- 15 Marks

Question

Uswa Ltd is engaged in manufacturing and sale of footwear. The company maintains one central factory and warehouse and sells its products through company-operated retail outlets as well as through distributors. Management is in the process of preparing the budget for the year 2018 on the basis of the following information:

- The marketing director has provided the following annual sales projections:

| Category | No. of Units | Retail Price Range (GH¢) |

|---|---|---|

| Men | 1,200,000 | 100 – 400 |

| Women | 500,000 | 85 – 250 |

- It has been estimated that 30% of the units would be sold through distributors who paid GH¢95 and GH¢70 per footwear for men and women respectively.

- The remaining 70% will be sold through company-operated retail outlets.

- The previous pattern of sales indicates that 60% of these units are sold at the minimum price; 10% units are sold at the maximum price and remaining 30% at a price of GH¢200 and GH¢120 per footwear for men and women respectively.

- The company incurs a variable cost of GH¢45 per footwear regardless of whether sales are through company-operated retail outlet or distributors.

- The company operates 22 outlets all over the country. The fixed costs per outlet are GH¢12,000 per month and include rent, electricity, maintenance, etc.

- Fixed costs for the factory and head office are GH¢4.5 million and GH¢1.5 million per month respectively.

Required:

i) Prepare a budgeted profit and loss account for the year 2018 for Uswa Ltd. (13 marks)

ii) Explain the term “budget manual.” (2 marks)

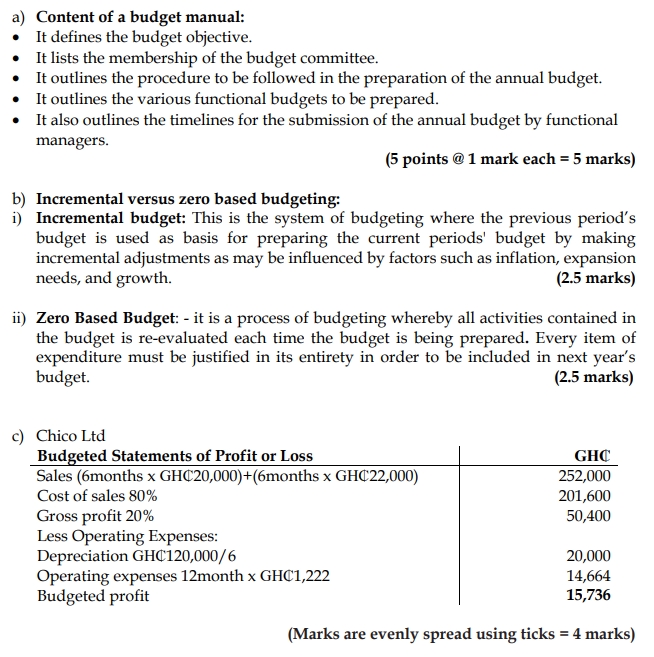

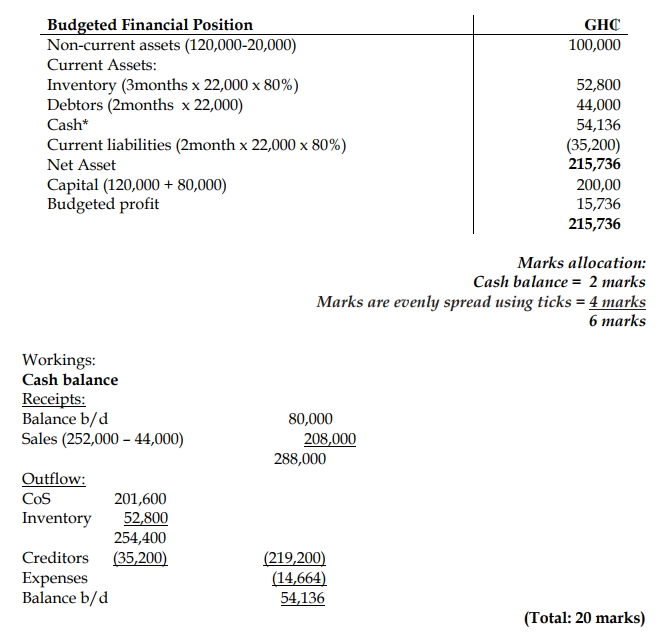

Answer

i) Budgeted Profit and Loss Account for the Year Ending 2018

| Item | Amount (GH¢) |

|---|---|

| Revenue | |

| Distributor: | |

| Men – (30% x 1,200,000) x GH¢95 | 34,200,000 |

| Women – (30% x 500,000) x GH¢70 | 10,500,000 |

| Outlets: | |

| Men | |

| Minimum Price – 60% x 840,000 x GH¢100 | 50,400,000 |

| Maximum Price – 10% x 840,000 x GH¢400 | 33,600,000 |

| Average Price – 30% x 840,000 x GH¢200 | 50,400,000 |

| Women | |

| Minimum Price – 60% x 350,000 x GH¢85 | 17,850,000 |

| Maximum Price – 10% x 350,000 x GH¢250 | 8,750,000 |

| Average Price – 30% x 350,000 x GH¢120 | 12,680,000 |

| Total Revenue | 218,300,000 |

| Less: Cost | |

| Variable Cost GH¢45 (1,200,000 + 500,000) | 76,500,000 |

| Less: Factory Overheads 4,500,000 x 12 | 54,000,000 |

| Gross Profit | 87,800,000 |

| Less: Administrative overhead 12 x 1,500,000 | 18,000,000 |

| Cost of retail outlets 12 x 22 x 12,000 | 3,168,000 |

| Net Profit | 66,632,000 |

ii) Budget Manual: The budget manual is a collection of instructions governing the responsibilities of persons and the procedures, forms, and records relating to the preparation and use of budgetary data.

- Tags: Budget Manual, Budgeting, Cost Accounting, Profit and Loss, Retail Operations

- Level: Level 2

- Topic: Budgetary control

- Series: NOV 2018

- Uploader: Joseph