- 9 Marks

Question

Anape Ltd is considering issuing a new 10-year bond in the domestic market. The interest rate on the bond is 20%. Interest will be paid semi-annually. The directors are considering the appropriate price at which the new bonds should be sold. The market required return is 25%.

Required:

- Compute the price investors would be willing to pay for each GH¢100 face value bond. (5 marks)

- Explain how changes in average interest rate affect the value of bonds. (4 marks)

(Total: 9 marks)

Answer

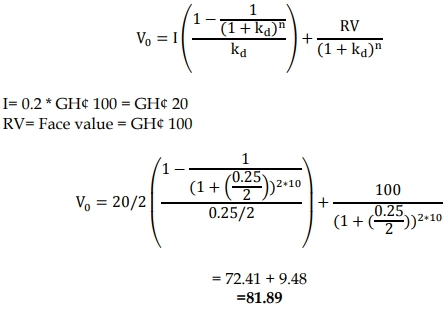

i) Price investors would be willing to pay

Face value= GH¢ 100

Coupon rate = 20%, paid semi-annually

Required return= 25%

ii) There is an inverse relationship between interest rates and price of bonds. As

interest rates rise, bond prices drop. Conversely, as interest rates decline, bond

prices rise. Interest rate movements reflect the value of money or safety of

investment at a given time. The movement of interest rates affects the price of

bonds because the coupon rate of interest, the money the issuer pays semi-annually to the owners of its bonds, remains fixed until the bond matures and

pays the GH¢1,000 principal. The fixed semi-annual interest payments and the

fixed repayment of principal at maturity are why bonds are called fixed income

investments.

- Tags: Bond pricing, Interest rates, Market value of bonds

- Level: Level 2

- Topic: Cost of capital

- Series: MAY 2019

- Uploader: Joseph