- 10 Marks

Question

Hajia Bintu has been in business from 1 September 2018, preparing accounts to 31 August each year. She ceased to operate the business on 31 May 2023. The agreed profits for the past years of operations are as follows:

| Year | Agreed Profits (GH¢) |

|---|---|

| Year to 30/8/2019 | 18,000,000 |

| Year to 30/8/2020 | 23,000,000 |

| Year to 30/8/2021 | 28,000,000 |

| Year to 30/8/2022 | 33,000,000 |

| Period to 31/5/2023 | 50,000,000 |

Required:

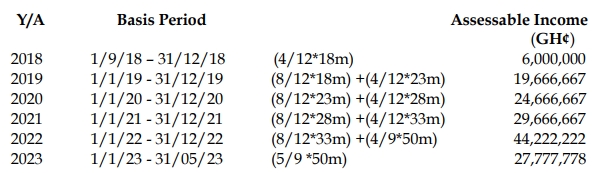

Calculate the assessable income for all relevant years.

Answer

Computation of Assessable Income for Hajia Bintu for all relevant years

- Tags: Assessable Income, Basis Period, Business Cessation, Tax computation

- Level: Level 2

- Topic: Income Tax Liabilities

- Series: MAR 2024

- Uploader: Theophilus