- 20 Marks

Question

Additional Information:

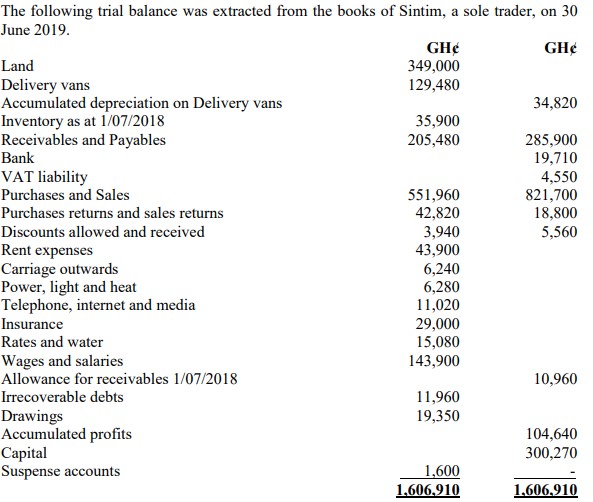

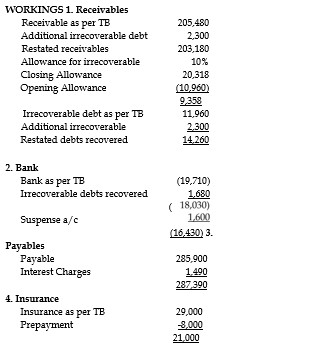

i) The inventory count on 30 June 2019 showed closing inventory valued at GHȼ34,380.

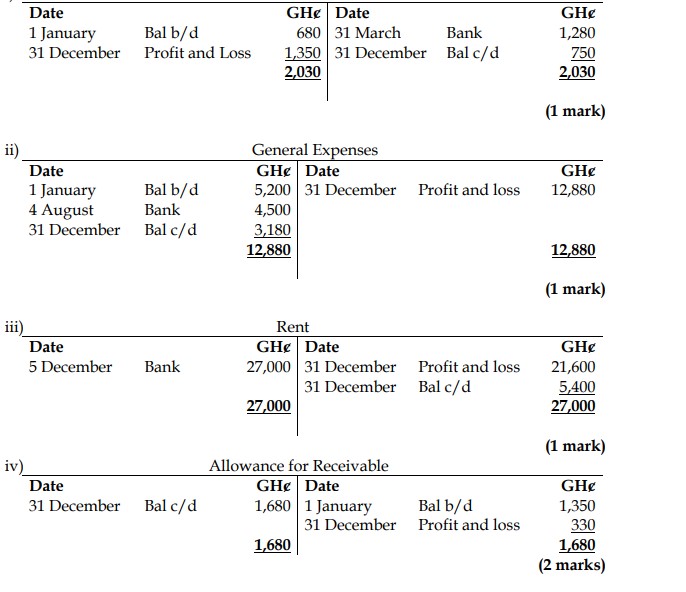

ii) A review of receivables as at 30 June 2019 showed that a further GHȼ2,300 was to be written off as an irrecoverable debt. Therefore, it was decided that the closing allowance for receivables was 10% of the outstanding receivables balance as at 30 June 2019.

iii) On 30 June 2019, Sintim received a cheque of GHȼ1,680 in relation to an irrecoverable debt previously written off.

iv) A supplier of Sintim has charged an interest of GHȼ1,490 on a payable balance that has been outstanding for over 200 days.

v) GHȼ16,000 of insurance in the trial balance above relates to 1 January 2019 to 31 December 2019.

vi) Allowance to be made for depreciation is as follows:

- Land: Not depreciated.

- Delivery van: 10% straight line basis.

vii) Upon investigation, it was revealed that the balance in the suspense account relates to a cash receipt from a customer of GHȼ800 that was credited to the bank account in error.

Required:

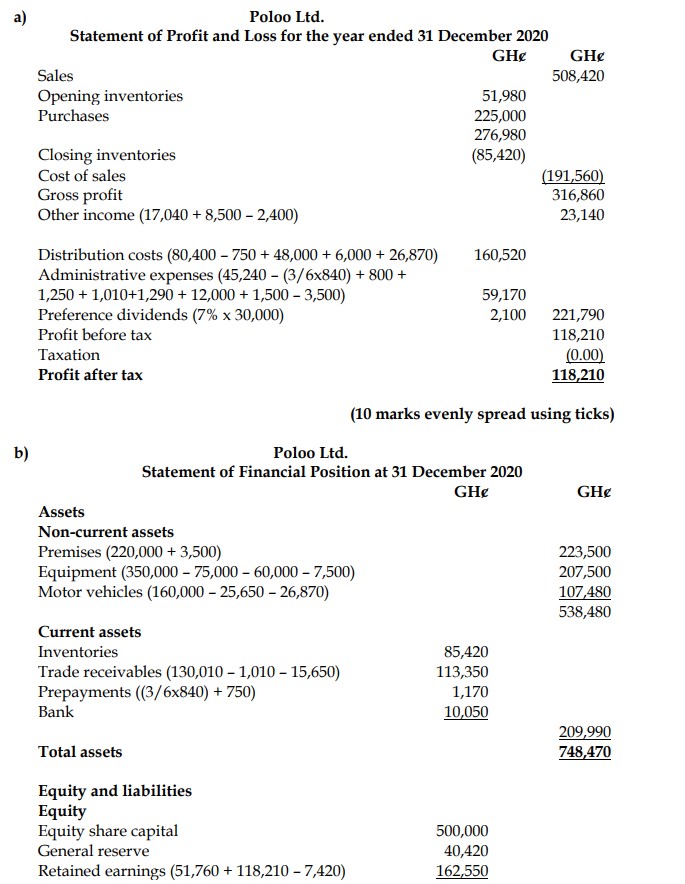

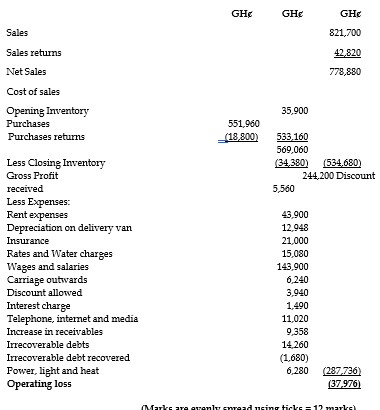

a) Prepare the statement of Profit or Loss for the year ended 30 June 2019.

(12 marks)

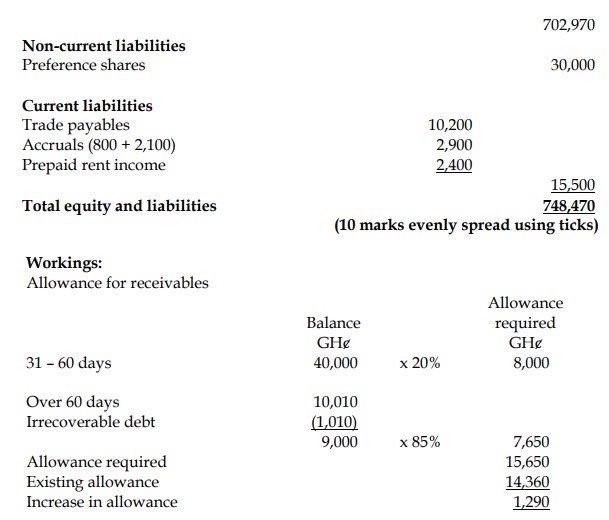

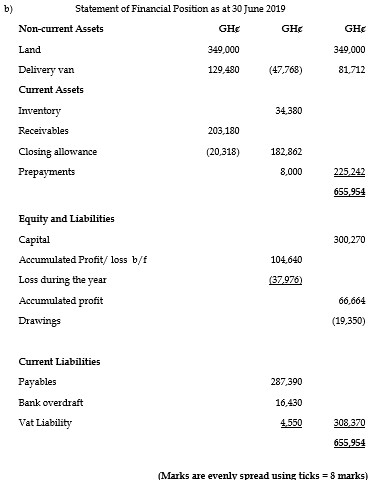

b) Prepare the statement of Financial Position as at that date.

(8 marks)

Answer

a) Sintim

Statement of Profit or Loss for the year ended 30 June 2019

b) Sintim

Statement of Financial Position as at 30 June 2019

- Uploader: Theophilus