- 20 Marks

Question

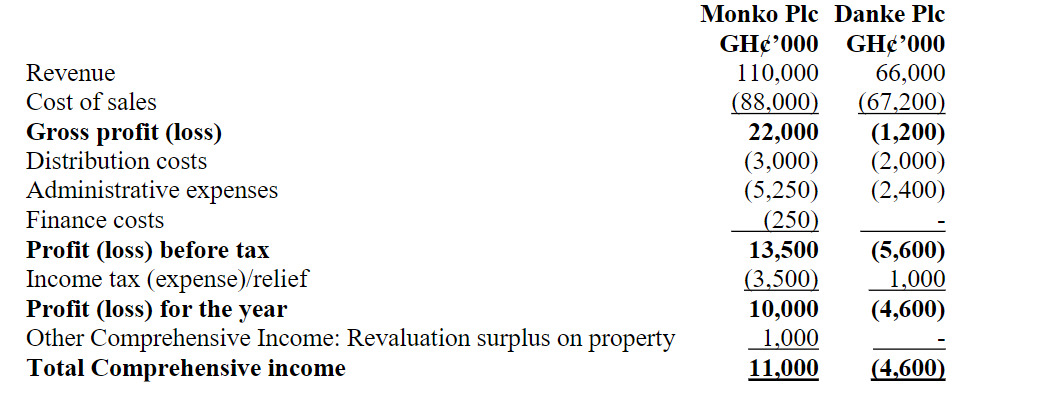

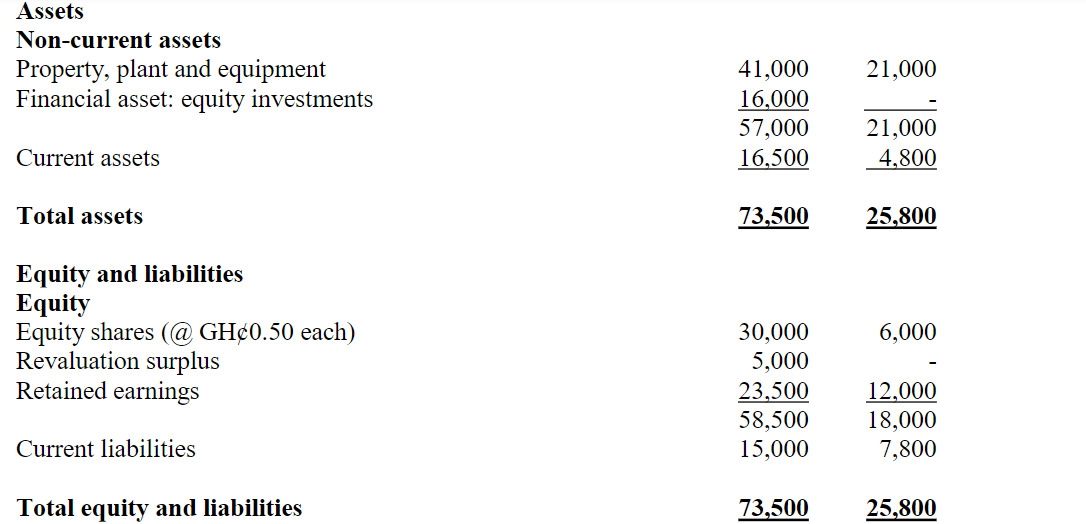

Below are the financial statements of Monko Plc and its investee company, Danke Plc for

the year ended 30 September 2023:

Statements of Profit or Loss and other Comprehensive Income for the year ended 30

September 2023

Additional information:

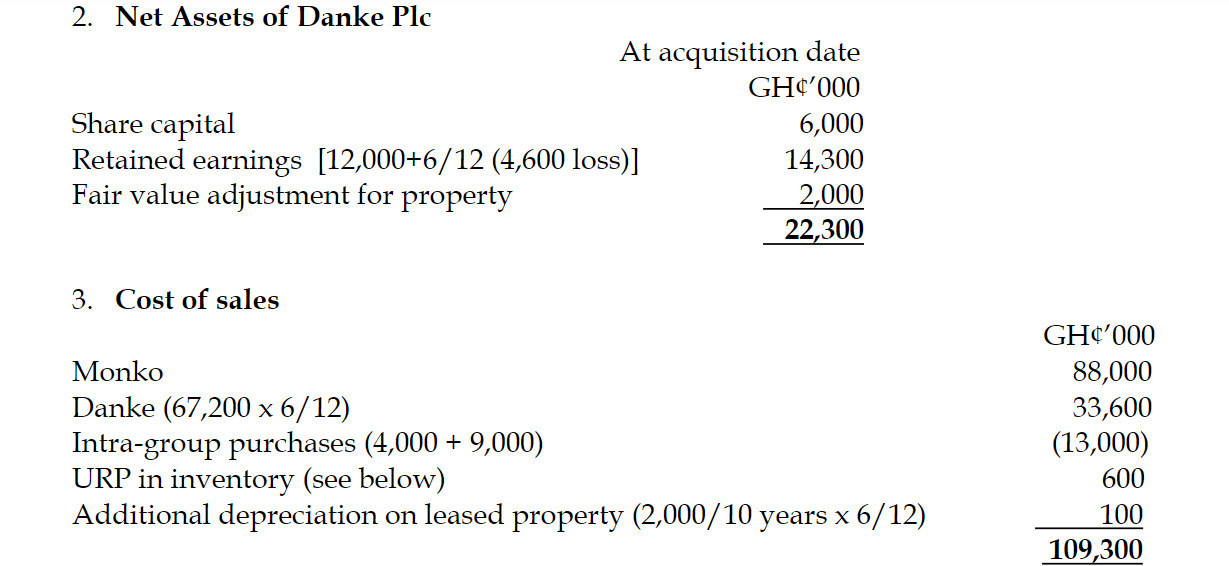

i) On 1 April 2023, Monko Plc acquired 75% of the equity shares of Danke Plc. Danke Plc had been experiencing difficult trading conditions and making significant losses. Taking into consideration Danke Plc’s difficulties, Monko Plc made an immediate cash payment of only GH¢1.50 per share. In addition, Monko Plc will pay a further amount in cash on 30 September 2024 if Danke Plc returns to profitability by that date. The value of this contingent consideration at the date of acquisition was estimated to be GH¢1,800,000 but in the light of continuing losses, it value was

estimated at only GH¢1,500,000 as at 30 September 2023. The contingent consideration has not been recorded by Monko Plc. At the date of acquisition, shares in Danke Plc had a listed market price of GH¢1.20 each.

ii) On 1 April 2023, the fair values of Danke Plc’s assets were equal to their carrying amounts with the exception of a leased property. This had a fair value of GH¢2,000,000 above its

carrying amount and a remaining lease term of 10 years at that date. Depreciation is charged to cost of sales.

iii) Monko Plc transferred raw materials at their cost of GH¢4,000,000 to Danke Plc in June 2023. Danke Plc processed all of these materials incurring additional direct costs of GH¢1,400,000 and sold them back to Monko Plc in August 2023 for GH¢9,000,000. At 30 September 2023, Monko Plc had GH¢1,500,000 of these goods still in inventory.

iv) Monko Plc has recorded its investment in Danke Plc at the cost of the immediate cash payment. Other equity investments (included in the financial assets-equity investments) are carried at fair value through profit or loss as at 1 October 2022. The other equity investments have fallen in value by GH¢200,000 during the year ended 30 September 2023.

v) Monko Plc’s policy is to value the non-controlling interest at fair value at the date of

acquisition. Danke Plc’s share price at that date can be deemed to be representative of the

fair value of the shares held by the non-controlling interest.

vi) All items in the above statements of profit or loss are deemed to accrue evenly over the year unless otherwise indicated.

Required:

a) Compute the Goodwill on acquisition of Danke Plc. (4 marks)

b) Prepare the Consolidated Statement of Profit or Loss and other Comprehensive Income for

Monko Plc Group for the year ended 30 September 2023. (16 marks)

Answer

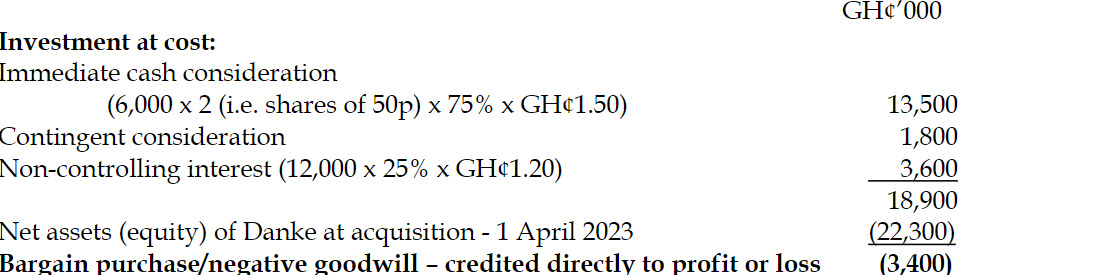

a) Computation of Goodwill on Acquisition of Danke Plc

Note: IFRS 3 Business Combinations says negative goodwill should be credited to the

acquirer, thus none of it relates to the non-controlling interests

(Marks are evenly spread using ticks = 4 marks)

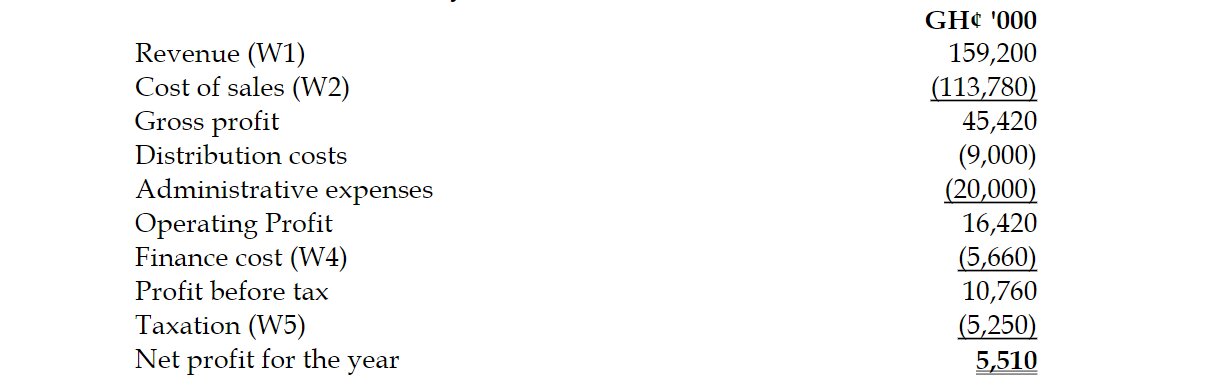

b) Monko Plc Group

Consolidated statement of profit or loss and other comprehensive income for the year ended 30th September 2023

Workings in GH¢’000

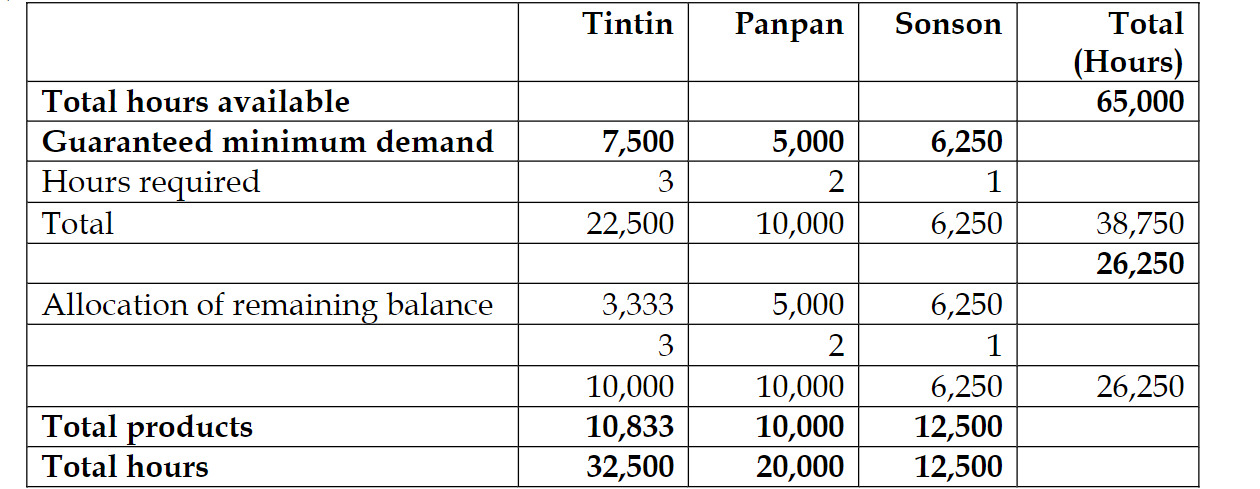

1. Group structure

Monko 75%

NCI 25%

Date of acquisition 1 April 2023

Pre-acquisition period 6 months

Post-acquisition period 6 months

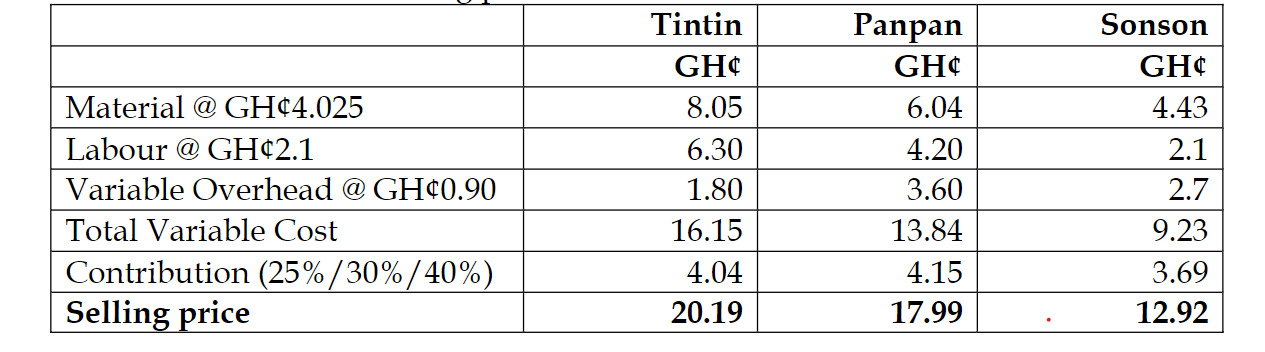

The profit on the sale of the goods back to Monko is GH¢3·6 million (9,000.000 – (4,000,000 + 1,400,000)). Therefore the unrealized profit (URP) in the inventory of GH¢1·5 million at 30 September 2022 is GH¢600,000 (3,600,000 x 1,500,000/9,000,000).

(Marks are evenly spread using ticks = 16 marks) (Total: 20 marks)

- Uploader: Cheoli