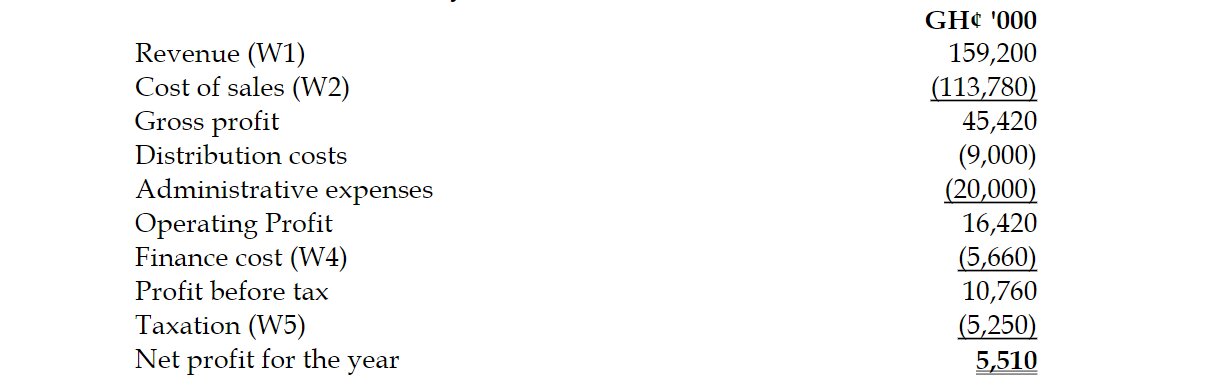

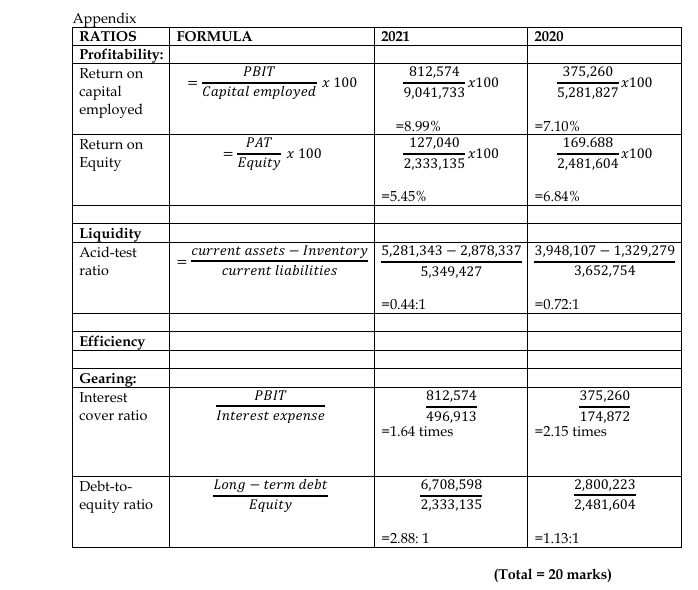

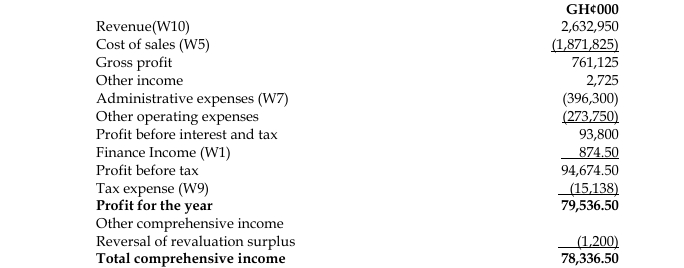

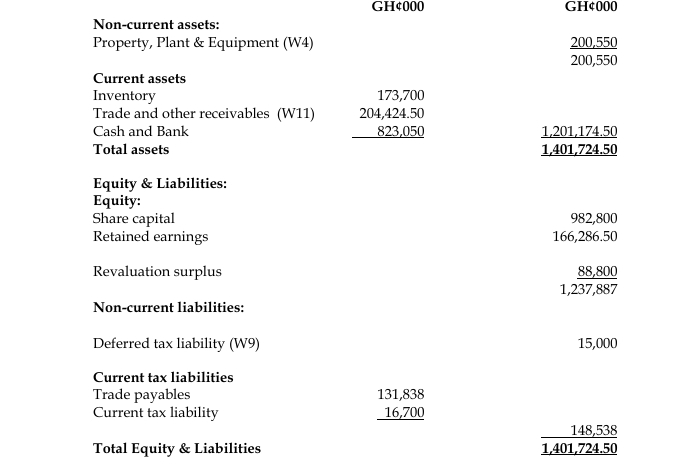

i) Beposo Ltd – Statement of Profit or Loss and Other Comprehensive Income for the year ended 31 December 2021

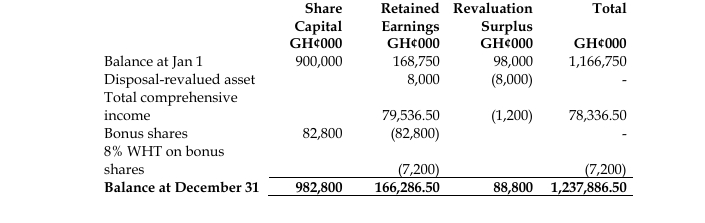

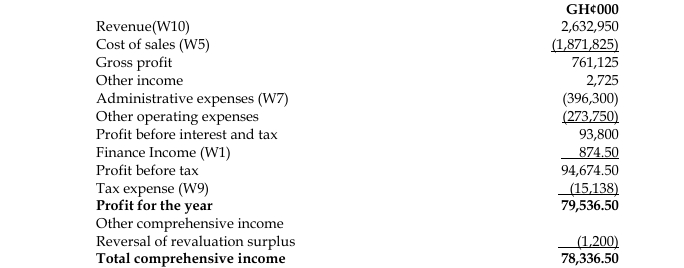

ii) Beposo Ltd – Statement of Changes in Equity for the year ended 31 December 2021

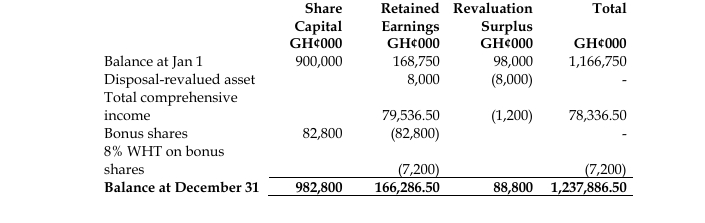

iii) Beposo Ltd – Statement of Financial Position as at 31 December 2021

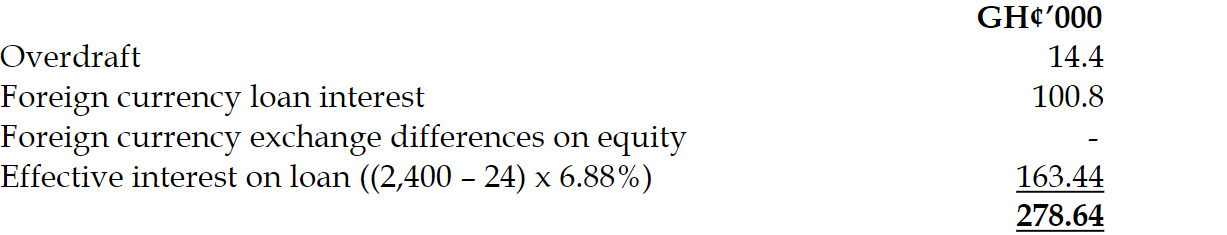

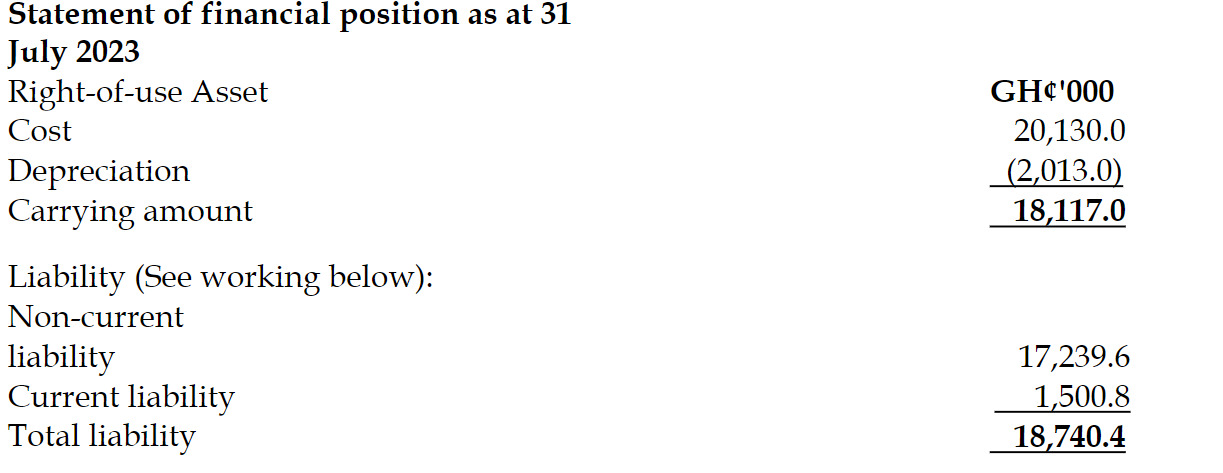

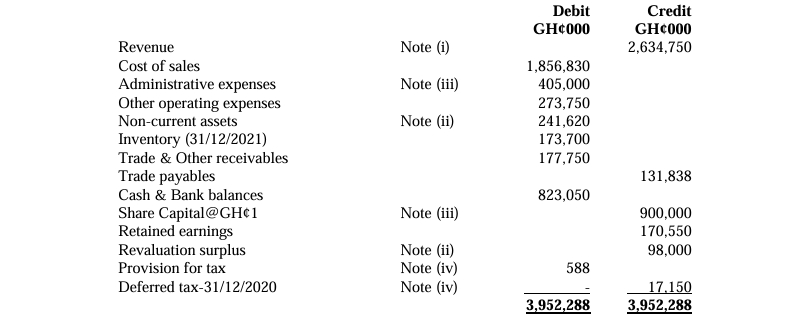

Workings:

1. Revenue with Significant Financing Component

Sales have been made on credit-terms beyond one year. Therefore, the time value of money becomes important, and a financing component is included in the revenue in accordance with IFRS 15, Revenue from Contracts with Customers. The financing component is separated from the revenue itself. The revenue is recorded at the cash price, and the interest or finance cost recognized using the effective interest rate implicit in the arrangement of 5.83%.

| Debit |

GH¢000 |

| Revenue |

1,800,000 |

| Trade receivables |

1,800,000 |

| Credit |

|

| Trade receivables |

874.50 |

| Finance income |

874.50 |

The financing component (interest) is reversed in revenue.

At the end of the year, interest unwound is GH¢874,500 (5.83% of GH¢15,000,000).

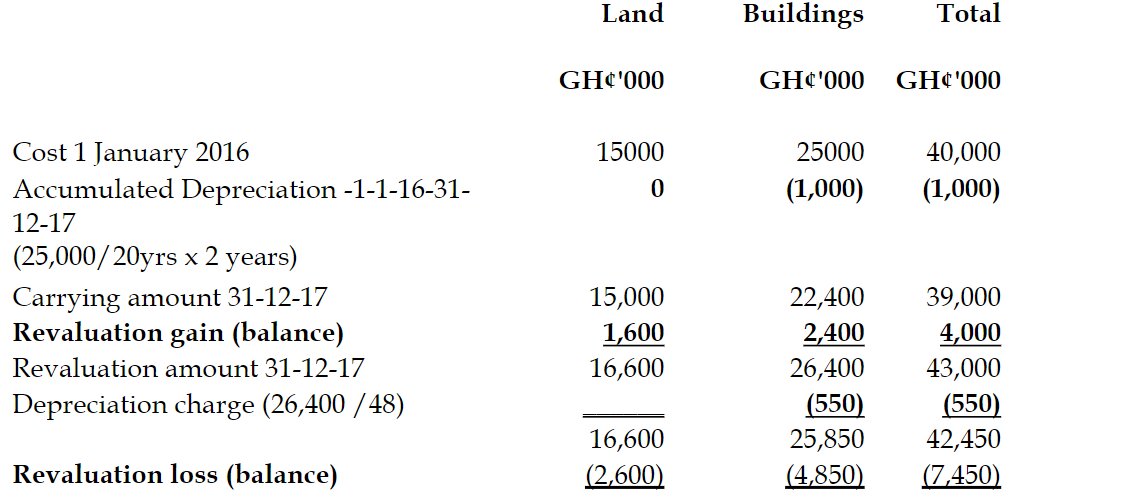

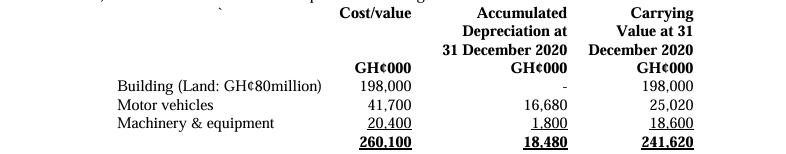

2. Gain/Loss on Disposal and Revaluation Loss on Building

The date of acquisition of the buildings is 1 January 2011.

The useful life of the asset = 50 years

Expired/used life as of 31st December 2020 = 10 years

Remaining useful life as of 31st December 2020 = 50 – 10 = 40 years

Disposal of building on 1 April 2021

Depreciation on disposed building = (GH¢25m – GH¢5m)/40 x 3/12 = GH¢125,000

Carrying value = GH¢25,000,000 – GH¢125,000 = GH¢24,875,000

Gain on disposed asset = GH¢27,600,000 – GH¢24,875,000 = GH¢2,725,000

The revaluation surplus of GH¢8,000,000 is held in respect of the disposed asset. This is realized by the entity as follows:

| Debit |

GH¢000 |

| Revaluation surplus a/c |

8,000 |

| Retained earnings |

8,000 |

Depreciation on remaining buildings:

(GH¢198m – GH¢80m – GH¢20m)/40 = GH¢2,450,000

Carrying value of remaining buildings at 31st December 2021:

Cost (198m – 25m) = 173,000,000

Depreciation = (2,450,000)

Carrying value: 170,550,000

Revaluation amount at 31st December 2021 is GH¢169,350,000.

Revaluation loss = GH¢169,350,000 – GH¢170,550,000 = GH¢1,200,000

Depreciation on other assets:

- Motor vehicle = GH¢41,700,000/5 = GH¢8,340,000

- Machinery & equipment = GH¢20,400,000/5 = GH¢4,080,000

3. Depreciation Calculation

| Description |

GH¢000 |

| Building – disposed |

125 |

| Building – existing |

2,450 |

| Motor vehicle |

8,340 |

| Machinery & equipment |

4,080 |

| Total depreciation |

14,995 |

4. Carrying Value of PPE as at 31 December 2021

| Description |

GH¢000 |

| Building |

169,350 |

| Motor vehicle (25,020 – 8,340) |

16,680 |

| Machinery & equipment (18,600 – 4,080) |

14,520 |

| Total |

200,550 |

5. Cost of Sales

| Description |

GH¢000 |

| Balance per Trial balance |

1,856,830 |

| Depreciation (W3) |

14,995 |

| Total cost of sales |

1,871,825 |

6. Bonus Share Issue

- Bonus shares = 1/10 x 900,000,000 x GH¢1 = GH¢90,000,000

- Withholding tax = 8% of GH¢90,000,000 = GH¢7,200,000

- Net amount issued to shareholders = GH¢90,000,000 – GH¢7,200,000 = GH¢82,800,000

Note: Proposed dividends are disclosed in the financial statements but not recognized since shareholders’ approval is required. This follows IAS 10, Events After the Reporting Period.

7. Administrative Expenses

| Description |

GH¢000 |

| Balance per trial balance |

405,000 |

| Grant repayment |

(1,500) |

| 8% WHT |

(7,200) |

| Total administrative expenses |

396,300 |

8. Other Income

| Description |

GH¢000 |

| Gain on disposal (W2) |

2,725 |

| Total other income |

2,725 |

9. Tax Expense

| Description |

GH¢000 |

| Current tax |

16,700 |

| Under-provision |

588 |

| Deferred tax: |

|

| – Balance at end |

15,000 |

| – Balance at start |

(17,150) |

| Total tax expense |

15,138 |

Deferred tax liability = 25% of GH¢60,000,000 = GH¢15,000,000

10. Revenue

| Description |

GH¢000 |

| Balance per trial balance |

2,634,750 |

| Interest-financing portion |

(1,800) |

| Total revenue |

2,632,950 |

11. Trade and Other Receivables

| Description |

GH¢000 |

| Balance brought forward |

177,750 |

| Financing component-interest |

(1,800) |

| Unwound interest |

874.50 |

| Proceeds receivable from disposed asset |

27,600 |

| Total trade & other receivables |

204,424.50 |

(80 ticks @ 0.25 marks per tick = 20 marks)