- 15 Marks

Question

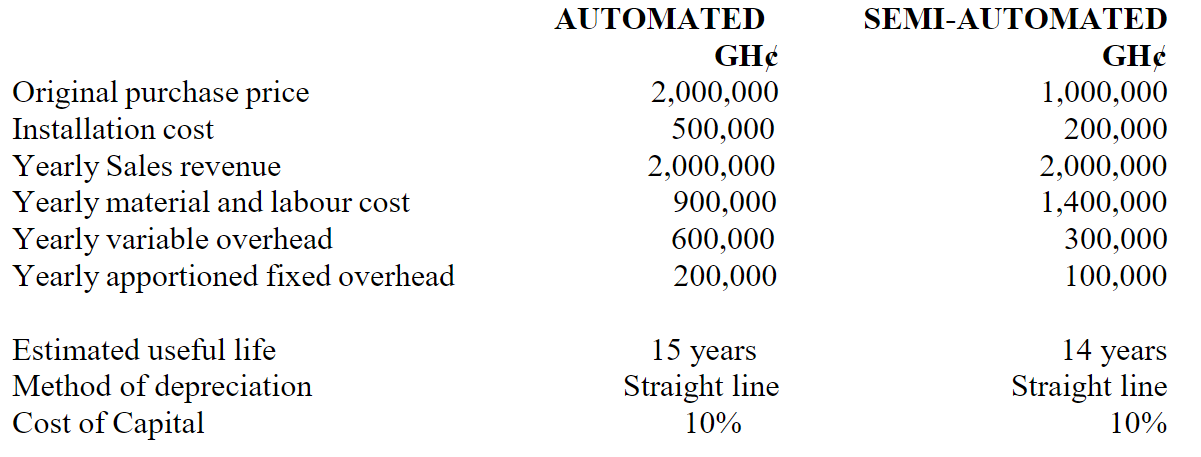

a) Pagsana Company plans to introduce a new product line for production of its local drink in Walewale. The company, therefore, decided to acquire either a semi-automated plant or an automated plant. The relevant data for the two proposed plants are as follows:

Required:

i) Select the appropriate plant on the basis of:

- Payback Period (4 marks)

- Net Present Value

(7 marks)

ii) Explain TWO (2) advantages of discounted cashflow method of investment appraisal. (4 marks)

Answer

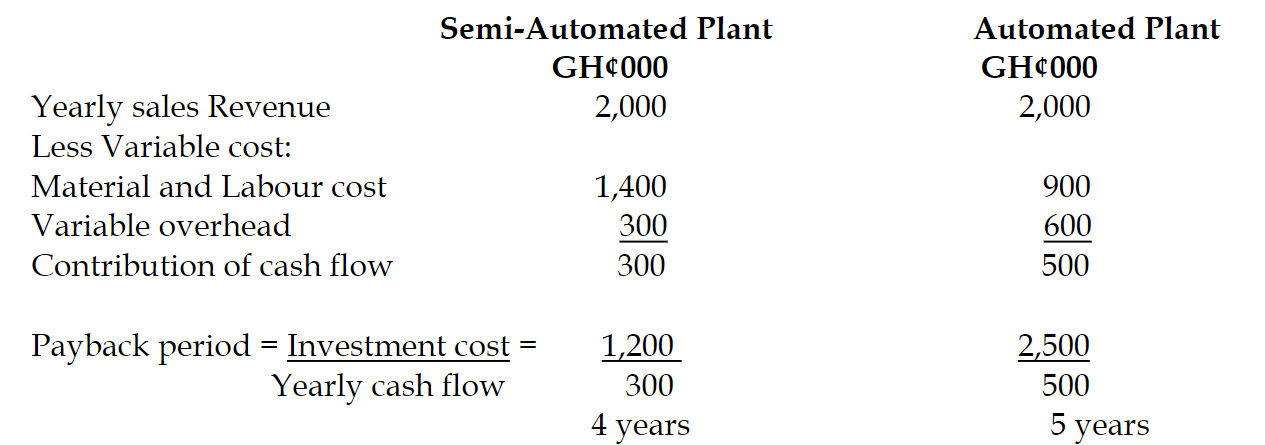

a)i) Pay Back Period is defined as the period, usually expressed in years, which it takes

the cash flows from a capital investment project to equal the cash flows generate

(3 marks)

Decision:

Semi-automated plant is considered more suitable because of PBP of 4 years as against

5 years for an automated plant.

(1 marks)

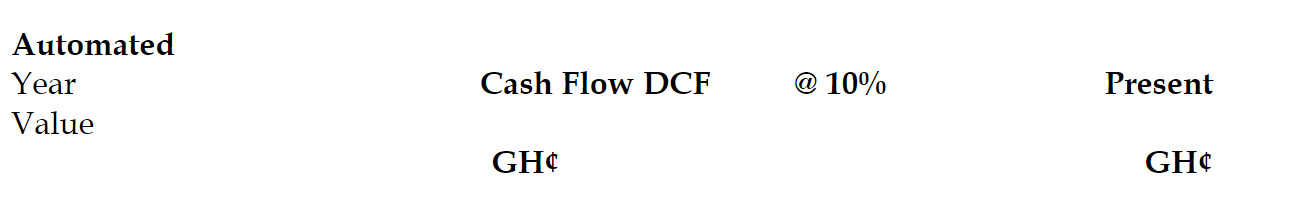

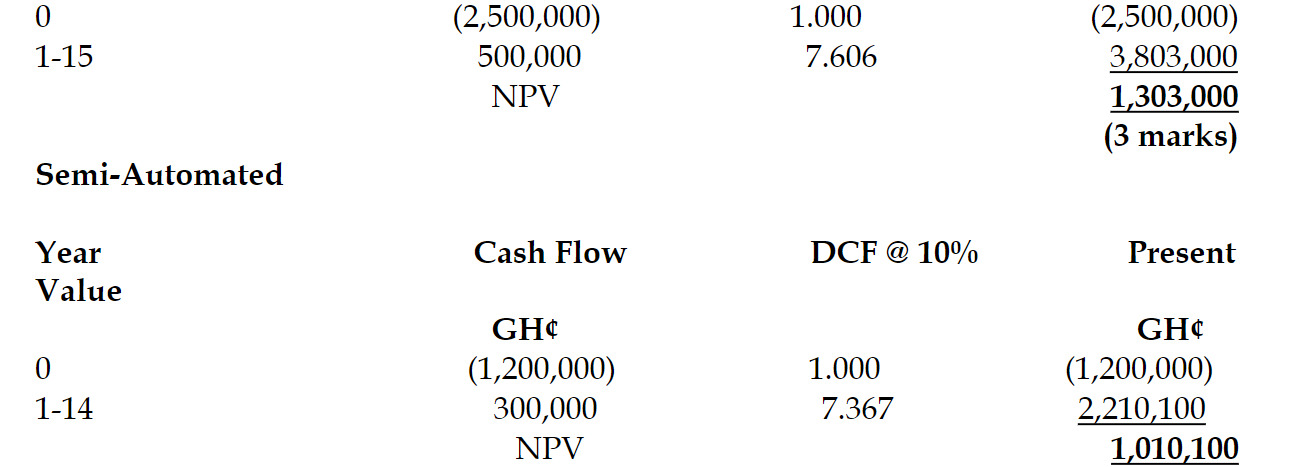

Using Discounted Cash Flow, the NPV of the Plants

(3 marks)

Decision

It is advisable to select automated plant that gives a higher NPV though the capital

requirement of the plants differs. (1 mark)

ii)Advantages of Discounted Cash Flow

- It uses the time value of money.

- It uses the cost of capital.

- Uses cash flow instead of accounting profit.

- Considers the entire life of the project.

(Any 2 points @ 2 marks each = 4 marks)

- Topic: Capital Budgeting, Discounted cash flow

- Series: NOV 2019

- Uploader: Cheoli