- 2 Marks

Question

c) The following data is relevant to Naab Ltd tax affairs for 2018 year of assessment:

Self-assessment returns submitted:

Tax paid on self-assessment: GH¢1,000,000

Chargeable income: GH¢4,000,000

Actual Returns submitted:

Chargeable Income: GH¢6,000,000

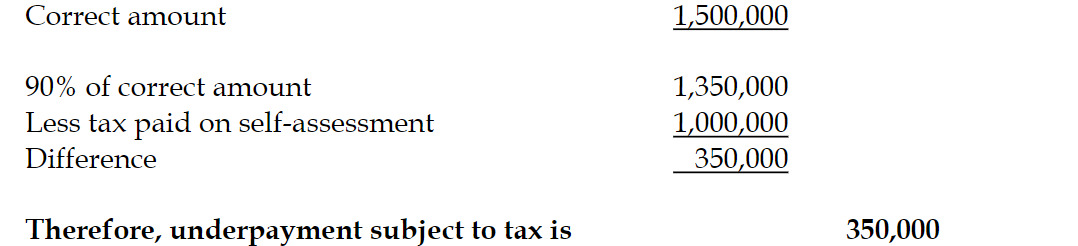

Correct amount – Tax payable: GH¢1,500,000

Required:

What is the amount of tax underpayment to be subject to interest computation?

(2 marks)

Answer

Computation of underpayment to be subjected to

Therefore, underpayment subject to tax is 350,000

(2 marks)

- Tags: Interest Computation, Self Assessment., Tax Liability, Tax Underpayment

- Level: Level 2

- Topic: Tax Administration

- Series: NOV 2019

- Uploader: Cheoli