- 15 Marks

Question

Dum and Sor were in partnership as retail traders, sharing profits and losses: Dum three quarters (3/4) and Sor one quarter (1/4). The partners were credited annually with interest at the rate of 6% per annum on their fixed capitals, but no interest was charged on their drawings. Sor was responsible for the buying department of the business, while Dum managed the head office. Sor was employed as the branch manager, and both Dum and Sor were each entitled to a commission of 10% of the net profits (after charging such commission) of the shop managed by him. All goods were purchased by the head office, and goods sent to the branch were invoiced at cost.

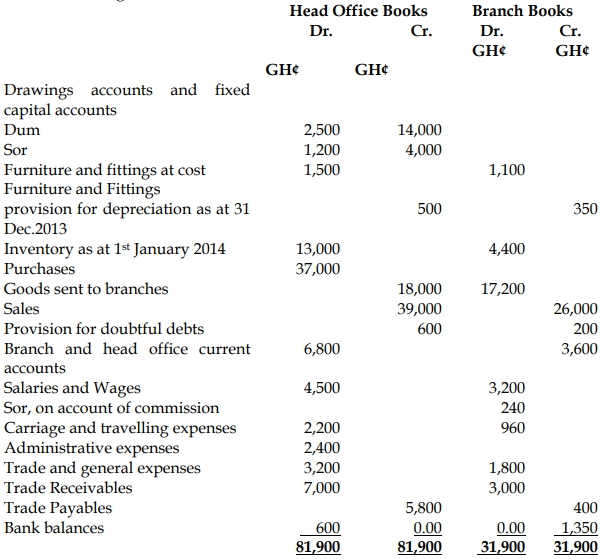

The following was the trial balance as at 31st December 2014:

Additional Information:

- Inventory on 31st December 2014 amounted to:

- Head office: GH¢14,440

- Branch: GH¢6,570

- Administrative expenses are to be apportioned between head office and the branch in proportion to sales.

- Depreciation is to be provided on furniture and fittings at 10% of cost.

- The provision for bad and doubtful debts is to be increased by GH¢50 in respect of head office receivables and decreased by GH¢20 in the case of the branch.

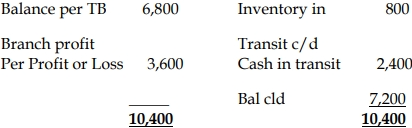

- On 31st December 2014, cash amounting to GH¢2,400 was in transit from the branch to head office and had been recorded in the branch books but not in those of the head office. Goods invoiced at GH¢800 were in transit from head office to the branch and had been recorded in the head office books but not in the branch books. Necessary adjustments are to be made in the head office books.

Required:

a) Prepare the statement of profit or loss and the appropriation account for the year ended 31st December 2014, showing the net profit of the head office and branch respectively.

b) Prepare the statement of financial position as at 31st December 2014.

c) Prepare the current accounts for head office and the branch.

Answer

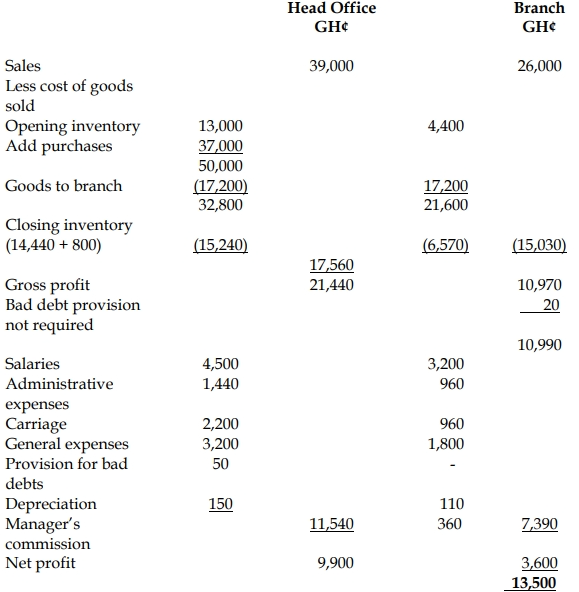

a) Dum and Sor

Statement of Profit or Loss for the year ended 31st December 2014

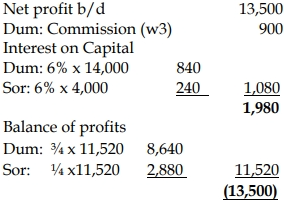

Appropriation of Profit:

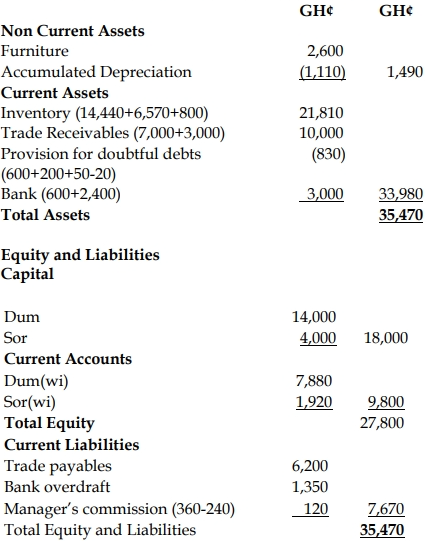

b) Dum and Sor

Statement of Financial Position as at 31st December 2014

c) Dum and Sor

Current Accounts

In the books of the Head Office:

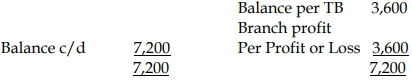

In the books of the Branch Current Accounts:

Workings:

- Current Accounts:

| Dum | Sor | |

|---|---|---|

| Drawings | (2,500) | (1,200) |

| Commission | 900 | – |

| Interest on capital | 840 | 240 |

| Share of profits | 8,640 | 2,880 |

| Balance c/d | 7,880 | 1,920 |

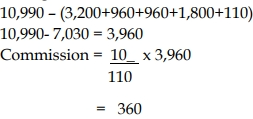

2. Manager’s Commission Calculation:

3. Dum’s Commission

![]()

- Topic: Preparation of Financial Statements

- Series: MAY 2016

- Uploader: Joseph