- 15 Marks

Question

Alex, Dennis, and Francis have been in partnership business for several years, sharing profits in the ratio 6:5:3, respectively. The statement of financial position of the partnership as at 31 March 2018 showed the following position:

| Statement of Financial Position as at 31 March 2018 | GH¢ | GH¢ |

|---|---|---|

| Capital Accounts: | ||

| Alex | 50,000 | |

| Dennis | 36,000 | |

| Francis | 17,400 | |

| Sundry Payables | 135,200 | |

| Total | 238,600 | |

| Tangible Non-current Assets | 44,800 | |

| Goodwill | 25,900 | |

| Sundry Receivables | 147,000 | |

| Bank Balance | 20,900 | |

| Total | 238,600 |

Additional Information:

On 31 March 2018, Alex retired from the partnership, and the remaining partners agreed to admit George as a partner under the following terms:

- Goodwill in the old partnership was to be revalued to two years’ purchase of the average profits over the last three years. The profits for the last three years were GH¢24,800, GH¢27,200, and GH¢28,010. Goodwill was to be written off in the new partnership.

- Alex was to take his car out of the partnership assets at an agreed value of GH¢2,000. The car had been included in the accounts as of 31 March 2018 at a written-down value of GH¢1,188.

- The new partnership, comprising Dennis, Francis, and George, was to share profits in the ratio 5:3:2, respectively, with an initial capital of GH¢50,000 subscribed in the profit-sharing ratio.

- Dennis, Francis, and George were each to pay Alex GH¢10,000 out of their personal resources in part repayment of his share of the partnership.

- Alex was to lend George any amount required to make up his capital in the firm from the monies due to him, and any further balance due to Alex was to be left in the new partnership as a loan, bearing interest at 20% per annum. Any adjustments required to the capital accounts of Dennis and Francis were to be paid into or withdrawn from the partnership bank account.

Required:

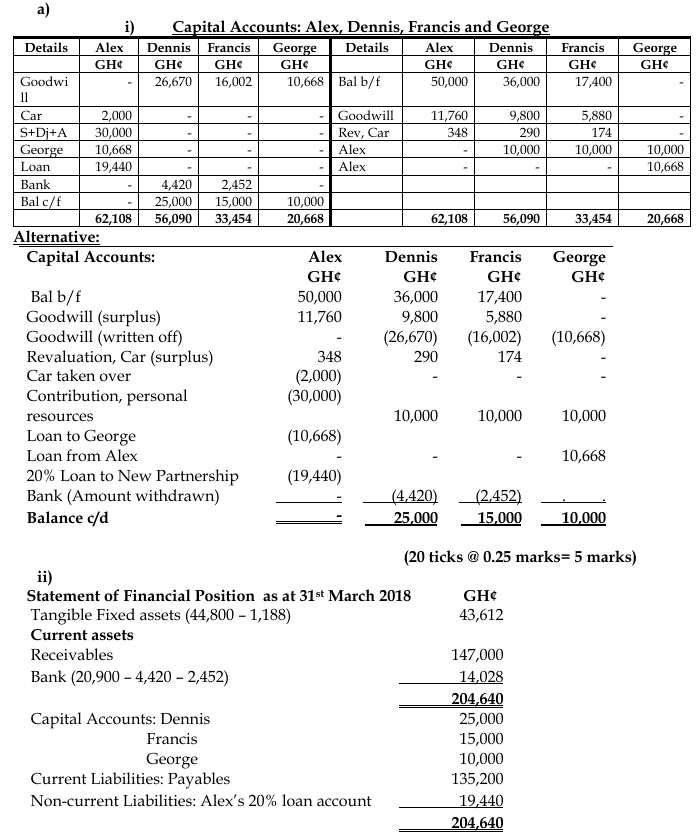

i. Prepare the partners’ capital accounts, in columnar form, reflecting the adjustments required on the change in partnership.

(5 marks)

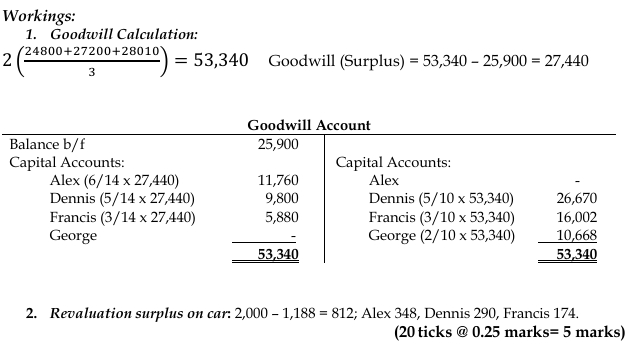

ii. Prepare the statement of financial position on completion.

(5 marks)

iii. For registration of partnership to be effected, there shall be sent to the Registrar a copy of the partnership agreement and a statement on a prescribed form signed by all the partners. Outline the main contents of the statement on the prescribed form.

(2 marks)

iv. In accordance with the Incorporated Private Partnership Act 1962 (Act 152), state THREE (3) grounds upon which the Registrar General’s Department may refuse to register a partnership business.

(3 marks)

Answer

iii. Main contents of the statement to the Registrar General’s Department for registration of the new partnership:

- The firm name of the partnership.

- The general nature of the business.

- The address and Post Office Box number of:

- The principal place of business of the partnership, and

- All other places in Ghana at which the business is carried on.

- The names, any former names, residential addresses, and business occupation of the partners.

- The date of commencement of the partnership, unless it commenced more than 12 months prior to the date of the statement.

- Particulars of any charges requiring registration under section 25 of Act 152, or a statement that there are no such charges.

(Any 4 items x ½ mark = 2 marks)

iv. Grounds upon which the Registrar General’s Department may refuse to register a partnership business:

- The partnership is not registerable under Act 152, for example, if it has more than 20 persons.

- Any of the business the partnership has been carrying on or is to carry on is unlawful.

- The name of the firm is misleading or undesirable.

- Any of the partners is an infant or of unsound mind, or within the preceding 5 years has been guilty of fraud or dishonesty in connection with any trade or business, or is an undischarged bankrupt.

- The statement is incomplete, illegible, inaccurate, irregular, or not on durable paper suitable for registration.

(Any 3 items x 1 mark = 3 marks)

- Tags: Capital Accounts, Financial Position, Goodwill, Partnership

- Level: Level 2

- Topic: Preparation of Financial Statements

- Series: NOV 2018

- Uploader: Dotse