- 20 Marks

Question

(a) CL Ltd is a wholesaler and retailer of office furniture. Extracts from the company’s financial statements are set out below:

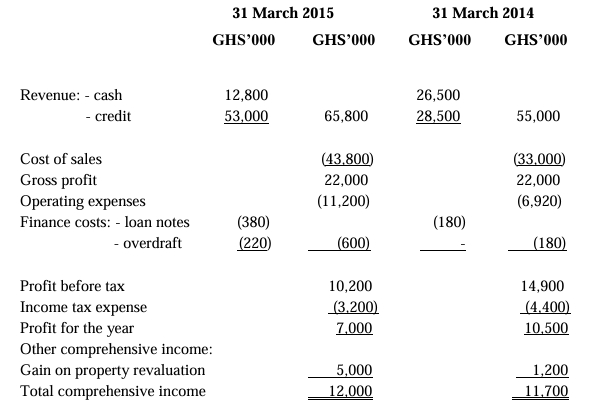

STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME

FOR THE YEAR ENDED:

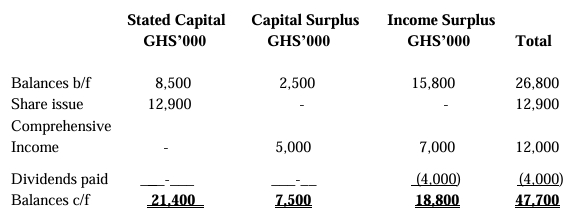

STATEMENT OF CHANGES IN EQUITY

FOR THE YEAR ENDED 31 MARCH 2015:

| Description | Stated Capital | Capital Surplus | Income Surplus | Total |

|---|---|---|---|---|

| Balances b/f | 8,500 | 2,500 | 15,800 | 26,800 |

| Share issue | 12,900 | – | – | 12,900 |

| Comprehensive income | – | 5,000 | 7,000 | 12,000 |

| Dividends paid | – | – | (4,000) | (4,000) |

| Balances c/f | 21,400 | 7,500 | 18,800 | 47,700 |

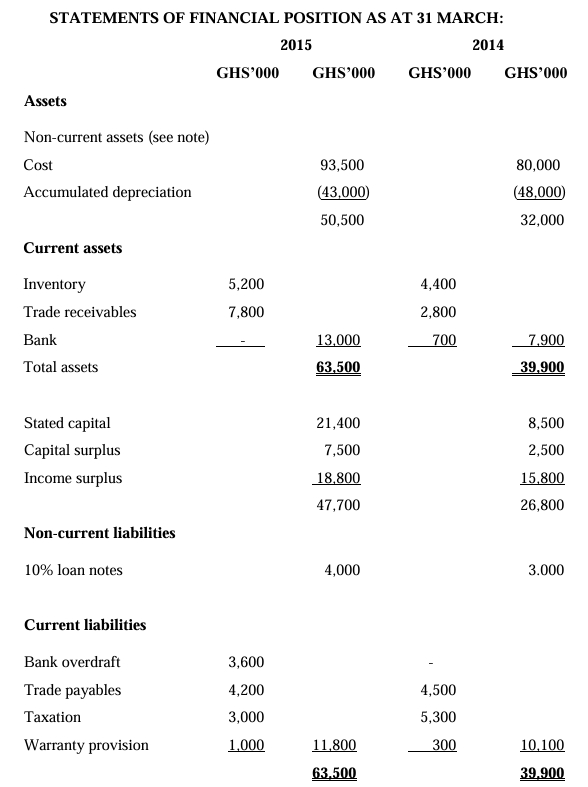

STATEMENT OF FINANCIAL POSITION

AS AT 31 MARCH:

Note:

Non-current assets

During the year, the company redesigned its display areas in all of its outlets. The previous displays had cost GHS10 million and had been written down by GHS9 million. There was an unexpected cost of GHS500,000 for the removal and disposal of the old display areas. Also, during the year, the company revalued the carrying amount of its property upwards by GHS5 million, and the accumulated depreciation on these properties of GHS2 million was reset to zero.

All depreciation is charged to operating expenses.

Required:

Prepare a statement of cash flows for CL Ltd for the year ended 31 March 2015 in accordance with IAS 7 – Statement of Cash Flows. (15 marks)

(b) The directors of CL Ltd are concerned at the deterioration in its bank balance and are surprised that the amount of gross profit has not increased for the year ended 31 March 2015. At the beginning of the current accounting period (i.e. on 1 April 2014), the company changed to importing its purchases from a foreign supplier because the trade prices quoted by the new supplier were consistently 10% below those of its previous supplier. However, the new supplier offered a shorter period of credit than the previous supplier (all purchases are on credit). In order to encourage higher sales, CL Ltd increased its credit period to its customers, and some of the cost savings (on trade purchases) were passed on to customers by reducing selling prices on both cash and credit sales by 5% across all products.

Required:

(i) Calculate the gross profit margin that you would have expected CL Ltd to achieve for the year ended 31 March 2015 based on the selling and purchase price changes described by the directors. (2 marks)

(ii) Comment on the directors’ surprise at the unchanged gross profit and suggest what other factors may have affected gross profit for the year ended 31 March 2015.

(3 marks)

(Total: 20 marks)

Answer

(a) CL Ltd

STATEMENT OF CASH FLOWS FOR THE YEAR ENDED 31 MARCH 2015

| Description | GHS ‘000 |

|---|---|

| Cash flows from operating activities | |

| Profit before tax | 10,200 |

| Depreciation (W2) | 6,000 |

| Loss on disposal of displays (W3) | 1,500 |

| Interest expense | 600 |

| Operating cash flow before working capital changes | 18,300 |

| Increase in warranty provision (1,000 – 300) | 700 |

| Increase in inventories (5,200 – 4,400) | (800) |

| Increase in receivables (7,800 – 2,800) | (5,000) |

| Decrease in trade payables (4,500 – 4,200) | (300) |

| Cash generated from operations | 12,900 |

| Interest paid | (600) |

| Income tax paid (W4) | (5,500) |

| Net cash from operating activities | 6,800 |

| Cash flows from investing activities | |

| Purchase of property, plant, and equipment (W1) | (20,500) |

| Cost of disposal of property, plant, and equipment | (500) |

| Net cash used in investing activities | (21,000) |

| Cash flows from financing activities | |

| Share issue | 12,900 |

| Loan note issue (4,000 – 3,000) | 1,000 |

| Dividends paid | (4,000) |

| Net cash from financing activities | 9,900 |

| Net decrease in cash and cash equivalents | (4,300) |

| Cash and cash equivalents at beginning of period | 700 |

| Cash and cash equivalents at end of period | (3,600) |

Workings

1) NON-CURRENT ASSETS – COST

| Description | GHS ‘000 | GHS ‘000 |

|---|---|---|

| Balance b/f | 80,000 | |

| Write-off old displays | 10,000 | |

| Revaluation (5,000 – 2,000) | 3,000 | |

| Purchases (balancing figure) | 20,500 | Balance c/f 93,500 |

| Total | 103,500 | 103,500 |

2) NON-CURRENT ASSETS – DEPRECIATION

| Description | GHS ‘000 | GHS ‘000 |

|---|---|---|

| Write-off on disposal | 9,000 | |

| Balance b/f | 48,000 | |

| Revaluation adjustment | 2,000 | |

| Balance c/f | 43,000 | |

| Charge in year (balancing figure) | 6,000 | |

| Total | 54,000 | 54,000 |

3) NON-CURRENT ASSETS – DISPOSAL

| Description | GHS ‘000 | GHS ‘000 |

|---|---|---|

| Cost of disposal | 10,000 | |

| Accumulated depreciation | 9,000 | |

| Cost of disposal | 500 | |

| Loss on disposal | 1,500 | |

| Total | 10,500 | 10,500 |

4) INCOME TAX PAYABLE

| Description | GHS ‘000 | GHS ‘000 |

|---|---|---|

| Tax paid (balancing figure) | 5,500 | |

| Balance b/f | 5,300 | |

| Balance c/f | 3,000 | |

| Charge for the year | 3,200 | |

| Total | 8,500 | 8,500 |

(b) (i) Gross Profit Margin Calculation

Taking the figures for the year ended 31 March 2014 and applying the 10% reduction in purchase costs and the 5% discount to customers, the directors would have expected the gross profit to be as follows:

| Description | GHS ‘000 |

|---|---|

| Revenue (55,000 x 95%) | 52,250 |

| Cost of sales (33,000 x 90%) | (29,700) |

| Gross profit | 22,550 |

| Gross profit margin (22,550 / 52,250 x 100) | 43.2% |

The actual gross profit percentage for the year ended 31 March 2015 is:

| Description | Calculation |

|---|---|

| Gross profit margin | (22,000 / 65,800 x 100) = 33.4% |

(ii) Comment on the Directors’ Surprise

The directors should not be surprised at the unchanged gross profit as cost of sales has increased by the same amount as revenue, wiping out any possible increase in gross profit. In fact, the actual gross profit margin has fallen from 40% in 2014 to 33.4% in 2015, so despite the 10% reduction in the cost of purchases, the company was trading less profitably.

Possible reasons for this could be:

- Shipping costs involved in importing goods may have to be borne by the recipient.

- Import duties or currency exchange losses, perhaps exacerbated by having to pay within a shorter period.

- Inventory losses due to uninsured damage or obsolescence.

- Selling a larger proportion of goods with a lower gross profit percentage, possibly due to sales or special offers.

- The foreign supplier may have increased his prices at some point during the year.

- There may have been changes in accounting policy, possibly shifting some expenses into cost of sales.

- Topic: Financial Statement Analysis, Preparation of Financial Statements

- Series: NOV 2015

- Uploader: Dotse