- 10 Marks

Question

Rosa Kurablah Ltd (Kurablah) plans to invest in ordinary shares for a period of fifteen years, after which she will sell out, buy a lifetime room and board membership in a retirement home, and retire. She feels that Senchi Ltd (Senchi) is currently, but temporarily, undervalued by the market. Kurablah expects Senchi’s current earnings and dividend to double in the next fifteen years. Senchi’s last dividend was GH¢3, and its stock currently sells for GH¢35 a share.

Required:

i) If Kurablah requires a 12 percent return on her investment, will Senchi be a good buy for her?

(3 marks)

ii) What is the maximum that Kurablah could pay for Senchi and still earn her required 12 percent?

(2 marks)

iii) What might be the cause of such a market undervaluation?

(3 marks)

iv) Given Kurablah’s assumptions, what market capitalization rate for Senchi does the current price imply?

Answer

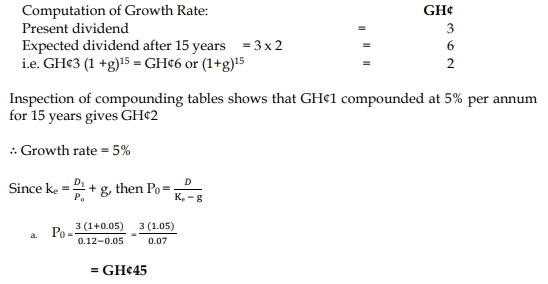

Dividend Growth Model – Will Senchi Be a Good Buy?

According to the Dividend Growth Model (DGM):

ii) Maximum Price Kurablah Could Pay

To achieve her required return of 12%, the maximum price Kurablah could pay for the stock is based on the DGM:

She could pay up to GH¢45 per share and still earn her required 12% return

iii) Causes of Market Undervaluation

- Market Perception: Investors may not recognize Senchi’s future growth potential, leading to undervaluation.

- Risk Factors: Investors could perceive higher risks in Senchi’s business, demanding a higher rate of return and resulting in a lower price.

- Temporary Market Conditions: Short-term market fluctuations or a general market recession could cause the stock to be undervalued temporarily.

(3 marks)

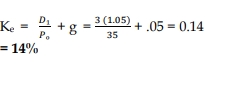

iv) Implied Market Capitalization Rate

The implied market capitalization rate is calculated as:

- Topic: Valuation and use of free cash flows

- Series: MAY 2019

- Uploader: Theophilus