- 8 Marks

Question

Suppose the South African government changes its policy on profit repatriation and legislates that profit cannot be repatriated until termination or exit.

i) If Rock can invest blocked funds in South Africa for a 12% annual rate of return, by how much would the project’s NPV differ from your results in sub-question (a) above?

(5 marks)

ii) Suggest THREE (3) ways through which Rock can deal with the risk of blocked funds.

(3 marks)

Answer

i) Evaluation of impact of restriction on profit repatriation on the NPV

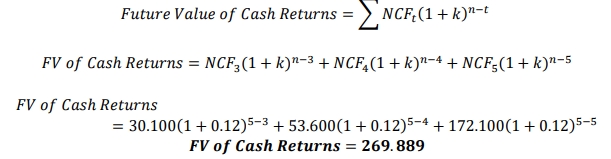

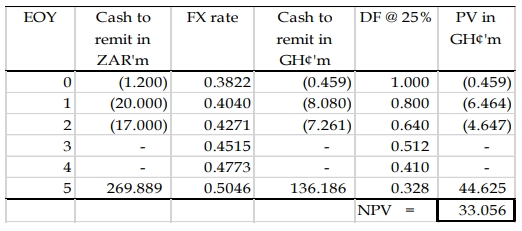

With a restriction on repatriation until exit, all cash returns from year 3 to the end of year 5 will be available to Rock only at the end of year 5 when it exits. As blocked funds can be invested at 12% in South Africa until the end of year 5, the amount that will be repatriated at the end of year 5 is the aggregate future value of the cash returns from year 3 to year 5.

Change in NPV: The NPV decreases by 3.7% compared to the original NPV of GH¢34.325 million.

ii) Suggestions for dealing with blocked funds

Rock Minerals Ltd can manage the risk of blocked funds by implementing any of the following strategies:

- Negotiate with the South African government for a stable profit repatriation policy to avoid restrictions.

- Sell goods or services to the subsidiary in South Africa and obtain payment for these services or goods to repatriate funds indirectly.

- License the subsidiary to use proprietary production processes protected by patents and receive royalties.

- Offer management services to the subsidiary and charge a fee for these services, enabling the transfer of funds.

- Increase loan financing rather than equity financing, allowing the subsidiary to repay loans with interest payments instead of relying on profit repatriation.

- Topic: International investment and financing decisions

- Series: NOV 2018

- Uploader: Theophilus