- 3 Marks

Question

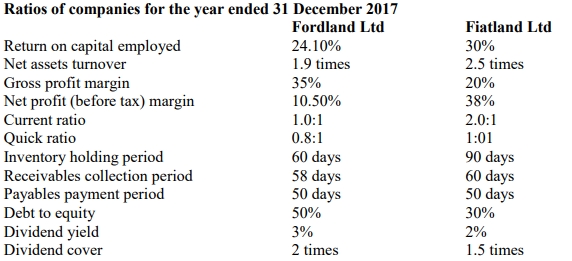

Fordland Ltd and Fiatland Ltd are two companies in the garment industry. The following are financial ratios computed by the Research Department of ICAG as part of analyzing companies’ performance industry by industry.

Required:

Explain THREE problems that are inherent when ratios are used to compare the performance of two companies, even in the same industry.

Answer

Three problems that arise when using ratios to compare the performance of two companies:

- Different Accounting Policies and Practices:

Even within the same industry, companies may apply different accounting policies (e.g., depreciation methods, inventory valuation techniques like FIFO vs LIFO). These variations can significantly affect financial ratios and make comparison less meaningful. For instance, one company may capitalize certain expenses while another may expense them, distorting profit margins and other ratios. - Impact of Inflation:

Inflation can distort financial statements and ratios, especially for companies with significant non-current assets. Companies operating in economies with different inflation rates may show inflated profits or asset values due to historical cost accounting, making it difficult to compare ratios like return on assets or return on equity accurately. - Seasonal Factors:

Seasonal fluctuations can lead to temporary changes in financial ratios. For example, companies with significant sales or production cycles may have varying levels of inventory or receivables at different times of the year. This can distort liquidity and efficiency ratios, making it challenging to compare companies that are in different stages of their operating cycle.

(3 points for 3 marks)

- Topic: Presentation of financial statements

- Series: MAY 2018

- Uploader: Theophilus