- 12 Marks

Question

Tinto Ltd produces handicrafts for both local and foreign markets. The company was incorporated several years ago. The shareholders of Tinto Ltd would now like to realize their investment. In order to arrive at an estimate of what they believe the business is worth, they have identified a long-established quoted company, Dingo Ltd, which has a similar business but produces for the European market only.

Summarized financial statistics for the two companies for the most recent financial year are as follows:

| Tinto Ltd | Dingo Ltd | |

|---|---|---|

| Issued shares (million) | 8 | 20 |

| Net assets value (GH¢ ’million) | 14.4 | 30 |

| Earnings per share (GH¢) | 0.35 | 0.28 |

| Dividend per share (GH¢) | 0.20 | 0.24 |

| Debt: Equity ratio | 1:7 | 1:6.5 |

| Share price (as quoted on the stock market) – GH¢ | – | 1.60 |

| Expected rate of growth in earnings/dividends | 5% | 5% |

Additional Information:

- The net assets of Tinto Ltd are the net book values of tangible non-current assets, including working capital. However:

- A recent valuation of the buildings was GH¢1,500,000 above book value.

- An investment held, which is designated as Equity Financial Asset at Fair Value through Profit or Loss with a carrying value of GH¢1,000,000, is fair valued at GH¢1,100,000.

- Due to a dispute with one of their clients, an additional allowance for bad debts of GH¢750,000 could prudently be made.

- An item of plant with a carrying value of GH¢800,000 is assessed to have a value-in-use of GH¢760,000 and fair value less cost to sell of GH¢780,000.

- Growth rate should be assumed to be constant per annum. Tinto Ltd’s earnings growth rate estimate was provided by the marketing manager, based on expected growth in sales adjusted by normal profit margins. Dingo Ltd’s growth rates are gleaned from press reports.

- The dividend yield of Dingo Ltd approximates its cost of equity.

Required:

Compute a range of valuations for the business of Tinto Ltd, using the information available and stating any assumptions made. Use the following methods for the valuation:

i) Net assets method (5 marks)

ii) Price-earnings method (3 marks)

iii) Dividend growth method (4 marks)

(Note: Ignore tax implications.)

Answer

i) Net Assets Method

To value Tinto Ltd using the Net Assets Method, the adjustments to the net assets based on the information provided are as follows:

| Adjustments to Net Assets of Tinto Ltd | Amount (GH¢ million) |

|---|---|

| Net assets per financial statements | 14.40 |

| Revaluation surplus on buildings | +1.50 |

| Fair value adjustment on financial assets | +0.10 |

| Allowance for bad debts | -0.75 |

| Impairment of plant | -0.02 |

| Revised Net Assets | 15.23 |

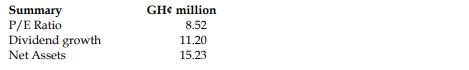

Thus, the value of the business using the Net Assets Method is GH¢15.23 million.

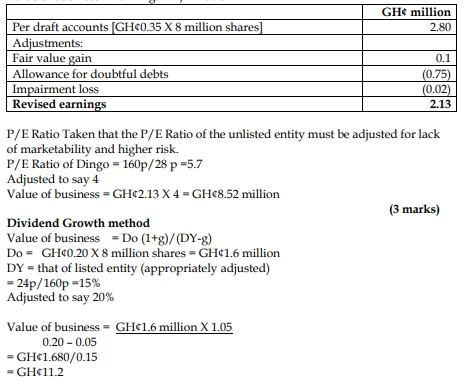

ii) Price-Earnings Method

To value Tinto Ltd using the Price-Earnings (P/E) Method, the earnings and the appropriate P/E ratio must be calculated and adjusted for risk and marketability.

- Tags: Business Valuation, Dividend Growth, Net Assets, Price/Earnings

- Level: Level 3

- Topic: Business valuations

- Series: AUG 2022

- Uploader: Theophilus