- 20 Marks

Question

Mahadi Ltd has operated profitably in Ghana for several years but is now facing financial difficulties after recording losses in its operations recently.

The company’s statement of financial position as at 30 September 2019 is given below:

| Mahadi Ltd Statement of Financial Position as at 30 September 2019 | GH¢ |

|---|---|

| Non-current Assets | |

| Freehold property | 68,000 |

| Equipment | 468,000 |

| Total Non-current Assets | 536,000 |

| Current Assets | |

| Inventories | 120,000 |

| Total Assets | 656,000 |

| Equity and Liabilities | GH¢ |

|---|---|

| Equity | |

| Stated capital (400,000 ordinary shares issued at 25 pesewas per share) | 100,000 |

| Capital surplus | 68,000 |

| Retained earnings | (40,000) |

| Total Equity | 128,000 |

| Non-current Liabilities | |

| 10% debenture stocks | 48,000 |

| Current Liabilities | |

| Sundry payables | 412,000 |

| Bank overdraft (from Northern Rock Bank) | 68,000 |

| Total Liabilities | 656,000 |

Additional Information:

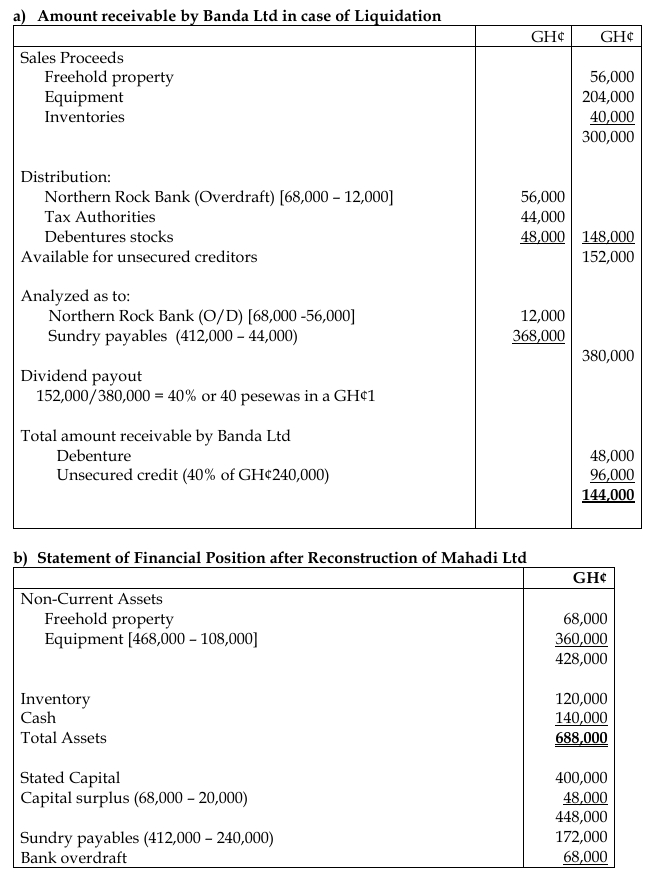

- Mahadi Ltd operates several retail outlets for snack bars, most of which are rented out. The company’s largest supplier, Banda Ltd, holds all of the debenture stocks and is also a trade creditor for GH¢240,000 included in sundry payables. The sundry payables also include GH¢44,000 owed to the Ghana Revenue Authority (GRA).

- The bank overdraft is secured by a fixed charge over the freehold property, and the debenture stock is secured by a floating charge over the company’s assets.

- On October 1, 2019, Mahadi Ltd has scheduled a meeting of stakeholders to consider the following two proposals:

- Proposal Alternative 1 (Liquidation): The management proposes immediate liquidation, which would result in the following amounts for realised assets:

Realised Assets GH¢ Freehold property 56,000 Equipment 204,000 Inventories 40,000 - Proposal Alternative 2 (Reconstruction): Banda Ltd proposes to allow the company to continue operating as a going concern with the following actions:

- Convert the debenture stock into 48,000 ordinary shares (issued at GH¢1.00 per share).

- Convert trade debt owed to Banda Ltd into 110 ordinary shares (issued at GH¢1.00 each) for every GH¢200 owed, and the balance of the debt would be written off.

- Existing shareholders would receive one ordinary share for every five held.

- Banda Ltd would subscribe for an additional 140,000 ordinary shares at GH¢1.00 each for cash to improve liquidity.

- The fair value of the freehold property and inventories approximates their carrying value.

- The management of Banda Ltd expects that after reconstruction, Mahadi Ltd would earn a regular net profit of GH¢54,000 per annum.

- Proposal Alternative 1 (Liquidation): The management proposes immediate liquidation, which would result in the following amounts for realised assets:

Answer

Workings:

- Shareholding in the Reconstructed Company:

| Shareholders | No. of Shares | GH¢ |

|---|---|---|

| Banda Ltd: | ||

| – Conversion of debentures | 48,000 | 48,000 |

| – Conversion of trade debt | 132,000 | 132,000 |

| – New shares subscription | 140,000 | 140,000 |

| Existing shareholders (1-for-5 exchange) | 80,000 | 80,000 |

| Total | 400,000 | 400,000 |

- Tags: Corporate Reconstruction, Financial Statements, Liquidation

- Level: Level 3

- Topic: Corporate reconstruction and reorganisation

- Series: NOV 2019

- Uploader: Dotse