- 5 Marks

Question

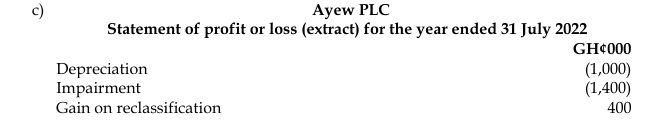

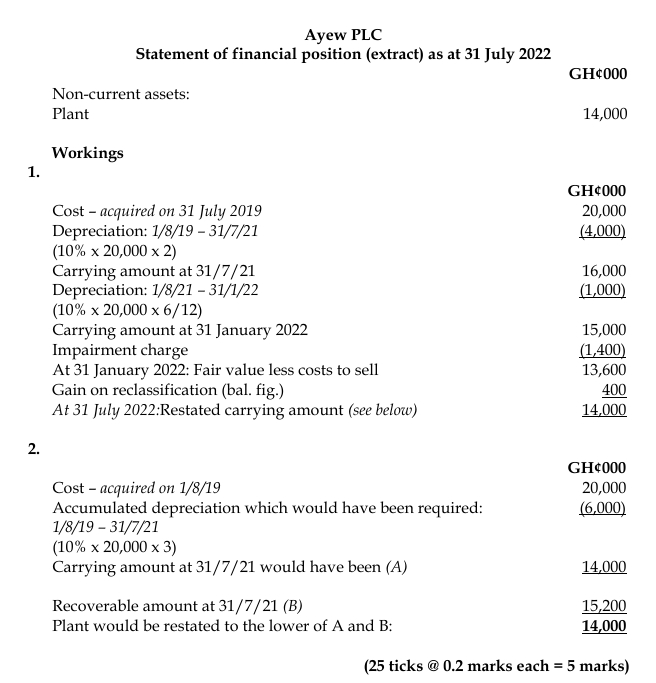

Ayew Plc (Ayew) decided to dispose of one of its major production plants, which had become surplus to requirement. At 31 January 2021, all criteria were met for the plant to be classified as held for sale. On 31 July 2022, there was material evidence that the original sale plan would change and hence, it was considered not appropriate to retain the plant as held-for-sale. The plant is carried under the cost model.

Details of the plant are as follows:

| GH¢’million | |

|---|---|

| Cost (acquired on 1 August 2019) | 20 |

| Depreciation rate (straight line to nil residual value) | 10% |

| At 31 January 2022: | |

| Fair value | 14 |

| Costs to sell | 0.4 |

| At 31 July 2022: | |

| Recoverable amount | 15.2 |

Required:

In line with IFRS 5: Non-Current Assets Held for Sale and Discontinued Operations, recommend how the above would be accounted for within the financial statements of Ayew for the year ended 31 July 2022.

(Total: 5 marks)

Answer

- Tags: Fair Value, Held for Sale, Impairment, Non-Current Asset, Plant, Reclassification

- Level: Level 3

- Uploader: Dotse