- 7 Marks

Question

Inaki Group (Inaki) has held a 90% interest in a subsidiary for over five years and prepares its consolidated financial statements to 31 March each year. The share consideration given for this investment was GH¢3,960 million and fair value increase in respect of non-depreciable land was GH¢200 million (this has not changed since acquisition). Due to the difficulties in determining reliable fair value of the investment in the subsidiary, Inaki measures the non-controlling interests at their proportion of the subsidiary’s net assets. The subsidiary’s net assets (excluding any fair value adjustment and goodwill) at acquisition and current reporting dates are provided below:

| Reporting | Acquisition | |

|---|---|---|

| Properties | GH¢2,300m | GH¢1,800m |

| Plant & equipment | GH¢1,500m | GH¢1,400m |

| Net current assets | GH¢680m | GH¢600m |

| Total | GH¢4,480m | GH¢3,800m |

Inaki has determined the recoverable amount of the subsidiary to be GH¢4,140 million at the reporting date. No impairment losses have previously been recognised for the goodwill. Net current assets above are stated below their recoverable amount.

Required:

From the above, determine how much impairment loss (if any) would be recognised by Inaki Group at the current reporting date and indicate the revised carrying amounts (if applicable) of the subsidiary in line with the applicable IFRS.

(Total: 7 marks)

Answer

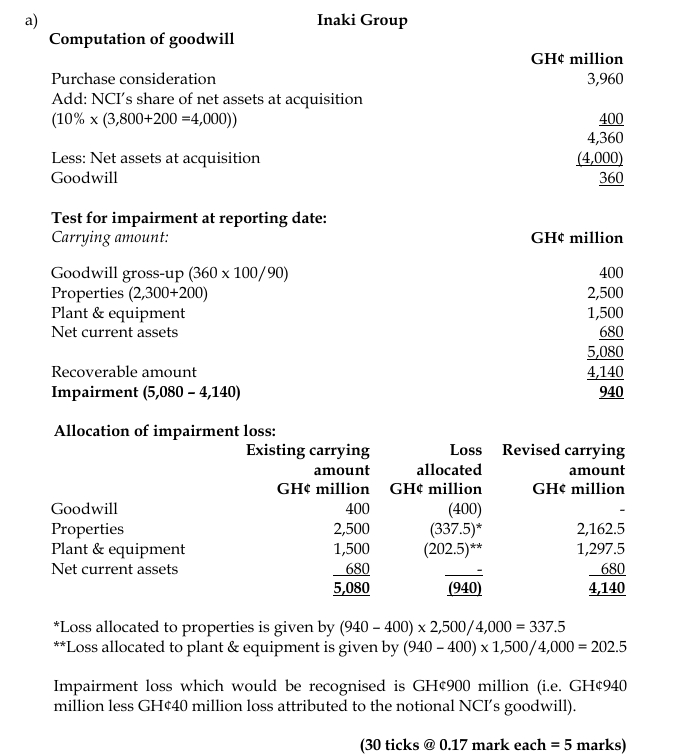

Computation of goodwill:

| GH¢ million | |

|---|---|

| Purchase consideration | 3,960 |

| Add: NCI’s share of net assets at acquisition (10% x (3,800+200 =4,000)) | 400 |

| Total | 4,360 |

| Less: Net assets at acquisition | (4,000) |

| Goodwill | 360 |

Test for impairment at reporting date:

| GH¢ million | |

|---|---|

| Goodwill gross-up (360 x 100/90) | 400 |

| Properties (2,300 + 200) | 2,500 |

| Plant & equipment | 1,500 |

| Net current assets | 680 |

| Total carrying amount | 5,080 |

| Recoverable amount | 4,140 |

| Impairment | (940) |

- Tags: Allocation of Loss, Goodwill, IAS 36, IFRS 3, Impairment, Non-Controlling Interest, Recoverable Amount

- Level: Level 3

- Topic: IAS 36: Impairment of assets

- Series: DEC 2022

- Uploader: Dotse