- 10 Marks

Question

ABG Ltd is a Free Zone Enterprise established in the year 2011. The company is part of Akafina Group of Companies with subsidiaries located in Accra, Kumasi, Ayanfuri, Tema, and Bodie. The following information is relevant to the operations of Akafina Group of Companies:

| Taxable Profit for the Year Ended 31 December 2022 | Location | Activity | GH¢ million |

|---|---|---|---|

| ABG Ltd | Accra | Manufacturing | 28 |

| Adooso Ltd | Tema | Manufacturing | 13 |

| Brefa Ltd | Kumasi | Manufacturing | 14 |

| Crame Ltd | Bodie | Manufacturing | 22 |

| Didie Ltd | Ayanfuri | Manufacturing | 33 |

| Frankaa Ltd | Accra | Manufacturing | 14 |

| Greda Ltd (established since 2010) | Agriculture | 20 |

Required:

Compute the tax payable by each company and explain the type of tax incentives they may enjoy.

Answer

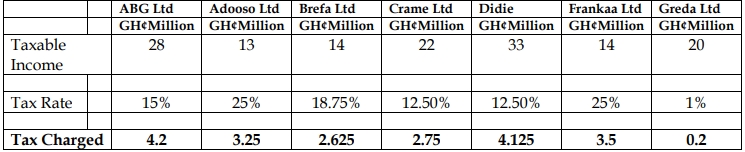

Computation of Tax Payable by Akafina Group of Companies (Year of Assessment 2022):

Explanation of Tax Incentives:

- ABG Ltd:

As a Free Zone Enterprise established in 2011, ABG Ltd enjoyed a 10-year tax holiday. Post the holiday period, the company now pays tax at a reduced rate of 15% on income earned from its export activities. - Adooso Ltd and Frankaa Ltd:

These companies are located in Accra and Tema, where there are no tax incentives. They pay the standard corporate tax rate of 25%. - Brefa Ltd:

Located in Kumasi, Brefa Ltd benefits from a 25% rebate on the standard corporate tax rate, reducing its rate to 18.75%. This incentive is aimed at encouraging businesses to operate in regional capitals other than Accra and Tema. - Crame Ltd and Didie Ltd:

Both companies are located in less developed areas (Bodie and Ayanfuri, respectively) and enjoy a 50% rebate on the standard corporate tax rate, reducing their rate to 12.5%. - Greda Ltd:

Greda Ltd, engaged in agriculture and established since 2010, benefits from a temporary tax concession, paying only 1% corporate tax on its profits to promote agriculture.

- Tags: Corporate Tax, Free Zone Enterprise, Group companies, Tax Incentives

- Level: Level 3

- Topic: Tax planning

- Series: JULY 2023

- Uploader: Theophilus