- 3 Marks

Question

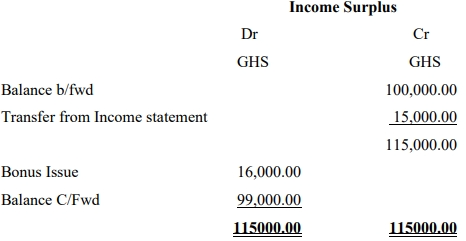

The following is a statement of retained earnings:

Required:

What is the tax implication, if any, on the above income statement?

Answer

Under section 94 of the Internal Revenue Act, 2000 (Act 592), a bonus issue to shareholders constitutes a capitalization of profits.

(1 mark)

The amount of GHS 16,000.00 is considered a dividend payment and should suffer a final withholding tax at the rate of 8%, under section 83 of the Internal Revenue Act 2000, Act 592, and Part IV of the First Schedule.

(2 marks)

- Tags: Bonus issue, Dividend tax, Retained Earnings, Withholding Tax

- Level: Level 3

- Topic: Business income - Corporate income tax

- Series: NOV 2015

- Uploader: Joseph