- 12 Marks

Question

On 1 January 2022, Frost Ltd based in the United States of America acquired 100% shares in Nzungu Ltd in the Gambia. Also, Nzungu Ltd acquired 60% shares in Gyakye Ltd in Ghana.

Frost Ltd granted a loan equivalent of GH¢100 million to Nzungu Ltd. The loan was subsequently passed on to Gyakye Ltd in Ghana to strengthen its capital structure.

The interest equivalent on the loan from Frost Ltd to Nzungu Ltd was GH¢6,000,000. Gyakye Ltd ended up paying GH¢8,000,000 as interest to Nzungu Ltd. The difference in interest payment was a service charge for the role played in transferring the loan to Ghana by Nzunga.

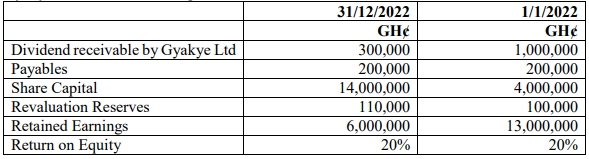

Gyakye Ltd has the following extracts from its Statement of Financial Position as at 2022:

Required:

Evaluate the tax implications of the following:

- The movement in the Share Capital.

- The loan interest paid.

- The movement in the retained earnings.

- The movement in the revaluation reserves.

- Thin capitalization implications from the above.

Answer

- The movement in the stated capital expenses the company to payment of stamp duty of 0.5%. Additional shares issued: Stamp duty @ 0.5% on the amount of the increase that is GH¢10,000,000. If it is as a result of transfer from retained earnings, two issues:

- Deemed dividend withholding tax at 8% on the amount transferred.

- Stamp Duty on the amount transferred @ 0.5%. (2 marks)

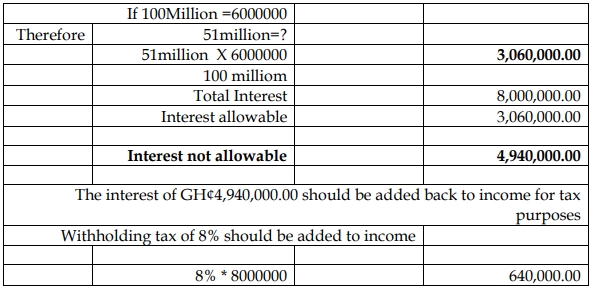

- The interest of GH¢8,000,000 paid shall be subject to a withholding tax at the rate of 8%. Additionally, the interest that shall be subject to the thin capitalisation rule shall be interest of GH¢6,000,000 and not the GH¢8,000,000 paid. The movement in the retained earnings implies a stamp duty of 0.5% on the amount transferred and also a deemed dividend withholding tax at 8%. Retained Earnings is treated as deemed dividend and taxed @ 8% on the difference (13,000,000-6,000,000) 8% * 7,000,000 = GH¢560,000.00 (2 marks)

- If the reduction in the loss is as a result of loss, that loss shall be carried forward. The movement in the revaluation reserves has no tax implication and therefore not taxable. If it was made a deductible expense, it would be reversed. (2 marks)

- The movement in the revaluation reserves has no tax implication except that the GRA must ensure that no asset revalued enjoys capital allowance on the revalued amount. (2 marks)

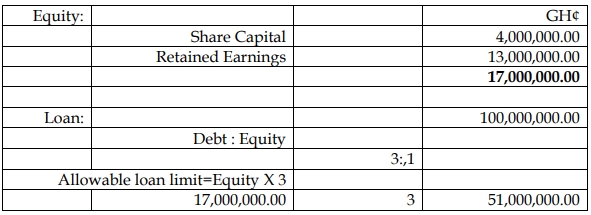

- Thin Capitalisation:

- Tags: Capital structure, Interest, International Taxation, Loan, Thin Capitalization

- Level: Level 3

- Topic: International taxation

- Series: JULY 2023

- Uploader: Theophilus