- 15 Marks

Question

b) Abigail Acheampong is in the process of preparing budgets for the period October to December 2017. The following information has been provided to assist in the budgeting process:

- Sales are 20% cash and 80% credit. Credit sales are collected over a three month period, 15% in the month of sale, 70% in the month following sale and 15% in the second month following sale. Bad debts of 5% are anticipated on all credit sales.

- Total sales revenue in August amounts to GH¢30,000 and September’s total sales revenue amounts to GH¢36,000.

- Cost of sales is expected to amount to 60% of sales revenue each month.

- The business maintains its closing inventory levels at 75% of the following month’s cost of sales. Inventory at the beginning of October is expected to amount to GH¢18,000.

- 50% of inventory purchased is paid in the month of purchase. The remaining 50% is paid for in the month following purchase. As at 30 September 2017, amount owed for purchases are GH¢11,700.

- A grant of GH¢20,000 is expected to be received in mid-October.

- A second hand van which cost GH¢8,000 three years ago is expected to be sold in December 2017 for GH¢3,000. At this time the expected net book value of the van is GH¢1,800.

- Equipment costing GH¢4,500 will be purchased and paid for in November 2017. The equipment will be depreciated on a straight line basis over three years.

- Operating expenses are paid as incurred. These have been estimated as follows: GH¢ October 12,800 November 18,900 December 14,600 The above figures include depreciation on existing assets of GH¢2,000 per month.

- The cash balance on 1 October is expected to amount to GH¢8,000

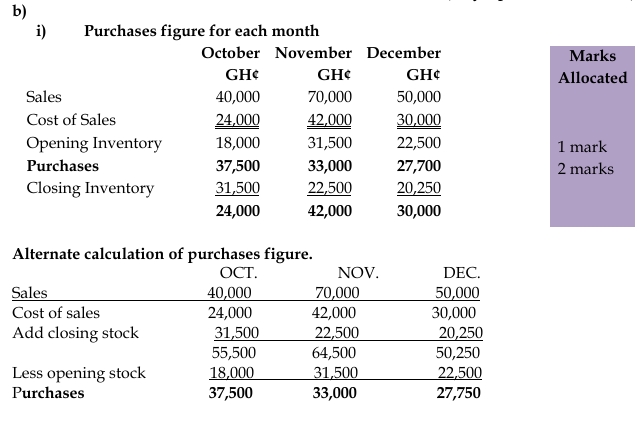

Required: i) Calculate the purchases figure for each month from October 2017 to December 2017.

(3 marks)

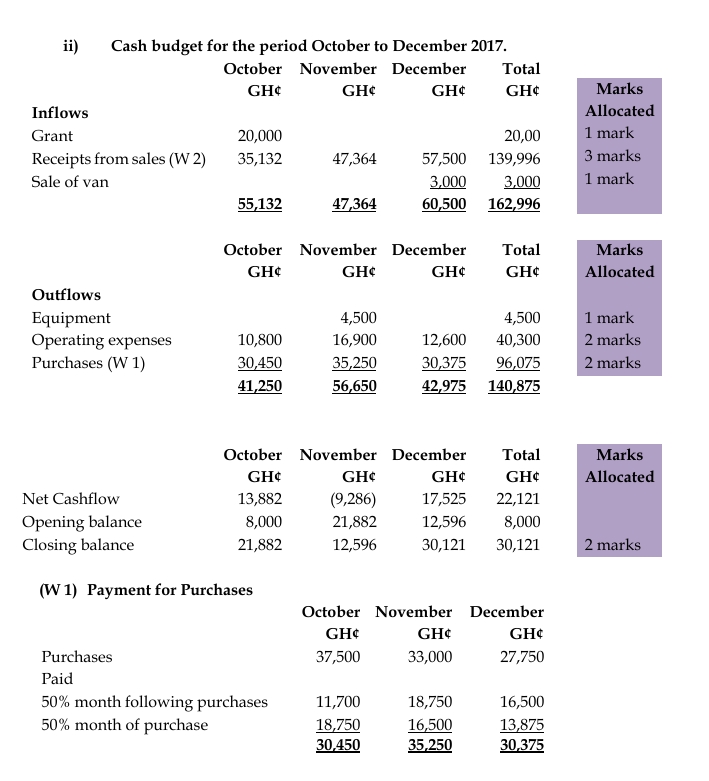

ii) Prepare a cash budget on a monthly basis and in total for the period October 2017 to December 2017. (12 marks)

Answer

- Topic: Cash Budgets and Master Budgets

- Series: NOV 2017

- Uploader: Dotse