- 20 Marks

Question

Below is the Trial Balance of the Consolidated Fund of Ghana for the year ended 31 December 2020.

| Item Description | DR (GH¢ million) | CR (GH¢ million) |

|---|---|---|

| Cash and Bank | 61,350 | |

| Established Post Salaries | 13,524 | |

| Non-Established Post Salaries | 4,016 | |

| Communications Service Tax | 5,144 | |

| PAYE | 6,940 | |

| Non-Tax Revenues | 2,312 | |

| Travel and Transport | 468 | |

| Administration Cost | 6,704 | |

| Conferences and Seminars | 2,510 | |

| Foreign Travel Cost | 1,490 | |

| Stationery Inventories | 20 | |

| Stationery Purchased | 220 | |

| Vehicles Income Tax | 2,316 | |

| Corporate Tax | 4,626 | |

| Grants | 1,150 | 2,516 |

| Customs and Excise Duties | 1,286 | |

| Subsidies for Consumption | 1,282 | |

| Subsidies for Production | 722 | |

| Value Added Tax | 7,716 | |

| Social Benefits | 760 | |

| State Protocol | 100 | |

| Allowance | 300 | |

| Domestic Debt Interest | 2,906 | |

| External Debt Interest | 3,482 | |

| Motor Vehicle | 4,800 | 1,920 |

| Equipment | 8,400 | 1,680 |

| Computers | 18,400 | 5,240 |

| Railway (Completed) | 5,000 | |

| Work in Progress | 400 | |

| Equity and Security Investment | 1,960 | |

| Loans and Advances | 1,120 | |

| Gold and Other Reserves | 1,620 | |

| Judgement Debt | 280 | |

| Treasury Bills | 22,240 | |

| Domestic Debt | 26,924 | |

| Payables | 34,844 | |

| External Debt | 45,726 | |

| Trust Fund and Deposits | 4,470 | |

| Other Expenditure | 1,800 | |

| Rent Receivable | 1,600 | |

| Accumulated Fund | 29,516 |

Total: 175,900, 175,900

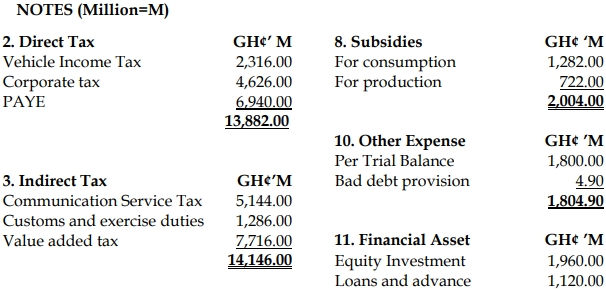

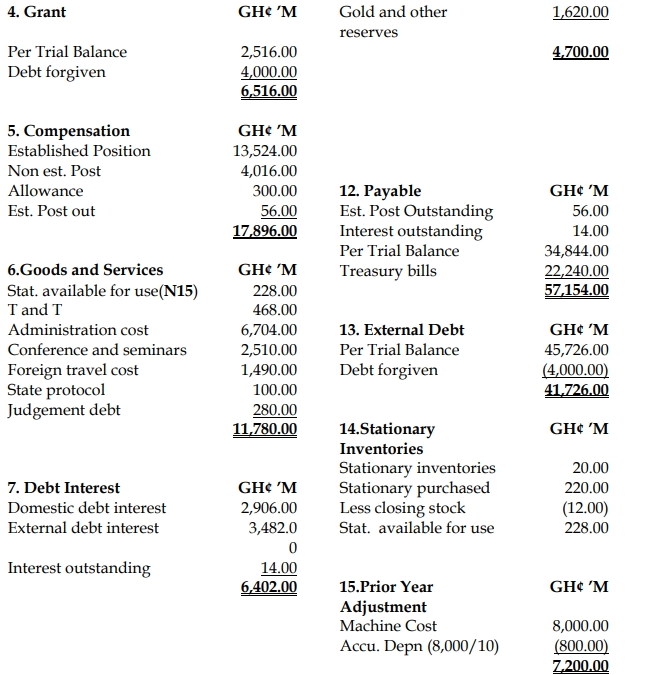

Additional information:

i) It is the policy of the Controller and Accountant General to use Accrual Basis of Accounting in preparing the Public Accounts of the Consolidated Fund financial statements in compliance with the Public Financial Management Act, 2016 (Act 921), Public Financial Management Regulation 2019 L.I 2378, and the International Public Sector Accounting Standards (IPSAS).

ii) Inventory in respect of stationery outstanding as at 31 December 2020 cost GH¢18 million and has a current Replacement Cost of GH¢12 million. Meanwhile, the Net Realisable value of the Inventories is estimated at GH¢14 million. No market exists for unused inventories.

iii) An Established Post Salary in arrears as a result of a salary increment in the fourth quarter of 2020 was GH¢56 million, and Public Debt Interest outstanding as at 31 December 2020 amounts to GH¢14 million.

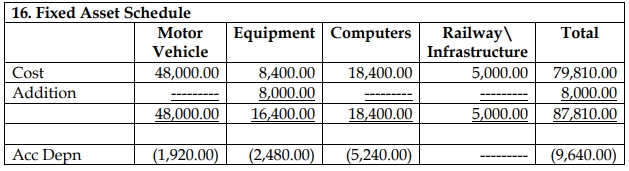

iv) Consumption of Fixed Capital is charged on a Straight-Line Basis for the year as follows:

| Asset | Useful life |

|---|---|

| Motor Vehicle | 5 years |

| Equipment | 10 years |

| Computers | 5 years |

| Railway | 20 years |

v) The Multilateral Partners have extended their Debt Forgiveness policy to the Government, which has resulted in the External Debt write-off amounting to GH¢4 billion in the year. However, this transaction has not been accounted for in the books.

vi) In the year 2019, GH¢8 billion was spent in acquiring Equipment to boost Government projects. However, these transactions were recognised in the accounts as Goods and Services Expenditure in the year 2019. This error has since not been rectified.

Required:

a) Prepare in a form suitable for publication and in accordance with the relevant Financial Laws and IPSAS:

- Statement of Financial Performance for the year ended 31 December 2020. (9 marks)

b) Statement of Financial Position as at 31 December 2020. (7 marks)

c) State and Explain FOUR (4) Conditions under which Revenue from The Sale of Goods shall be recognized in accordance with IPSAS 9: Revenue from Exchange Transactions. (4 marks)

Answer

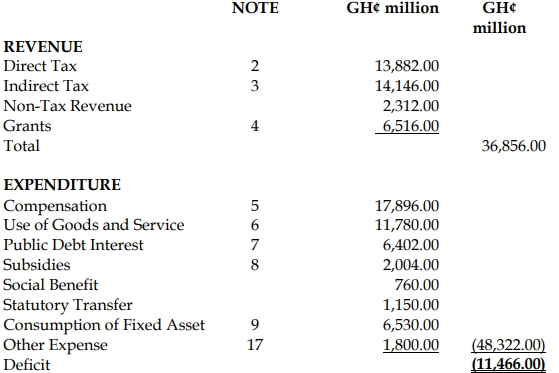

a)

CONSOLIDATED FUND OF GHANA

STATEMENT OF FINANCIAL PERFORMANCE FOR THE YEAR

ENDED 31/12/2020

Statement of Accumulated Fund for the year ended 31/12/2020

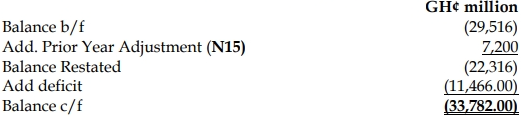

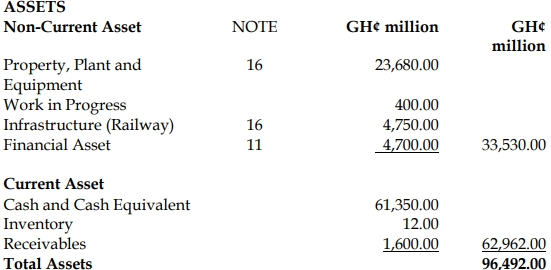

b)

CONSOLIDATED FUND

STATEMENT OF FINANCIAL POSITION AS AT 31/12/2020

c) Conditions for Revenue Recognition (IPSAS 9):

Revenue from the sale of goods shall be recognised when all the following conditions have been satisfied:

- The entity has transferred to the purchaser the significant risks and rewards of ownership of the goods.

- The entity retains neither continuing managerial involvement to the degree usually associated with ownership nor effective control over the goods sold.

- The amount of revenue can be measured reliably.

- The economic benefits or service potential associated with the transaction will probably flow to the entity.

- The costs incurred or to be incurred in respect of the transaction can be measured reliably.

- Uploader: Joseph