- 20 Marks

Question

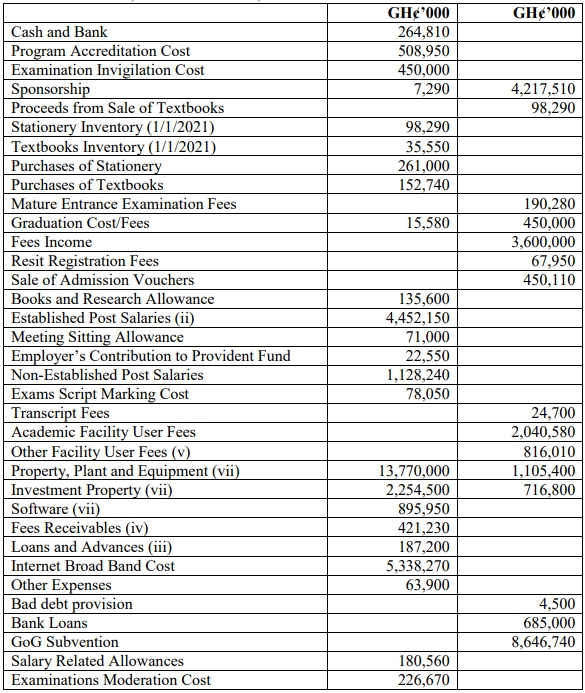

The following Trial Balance relates to Danke State University, a public tertiary educational institution in Ghana, as at 31 December 2021:

Additional Information:

- It is the policy of the University to prepare Financial Statements on an accrual basis in compliance with Public Financial Management Act, 2016 (Act 921), Public Financial Management Regulation 2019 (L.I 2378), and the International Public Sector Accounting Standards (IPSAS).

- Utility Bills outstanding during the year amounted to GH¢15,500,000 whilst that of Established Post Salaries amounted to GH¢120,000,000. These have been omitted from the trial balance.

- Loans and Advances represent Salary Loans given to some Staff of the University. These loans were granted at a concessionary interest rate of 2%. Provision is to be made for interest on Loans and Advances.

- The Fees Receivables represent outstanding school fees for 870 students. Out of this, 90 students were expelled from the school for poor academic performance. As a result, it is very unlikely the University would recover the amount of School Fees owed by the expelled students. This amount constitutes 5% of Fees Receivables. The University from experience also considers that it is very unlikely to recover all the outstanding fees and they intend to set a provision of unrecoverable debt against the remaining school fees at the rate of 7%.

- Included in the Other Facility User Fees is hostel fees amounting to GH¢1,050,000 paid in respect of the 2022/2023 Academic year.

- Inventory of Textbooks as at 31 December 2021 amounted to GH¢ 142,500,000 at cost and having a Net Realisable Value of GH¢165,000,000, but its Replacement Cost is GH¢78,000,000. In addition, stationery inventory as at 31 December 2021 amounted to GH¢17,000,000 and having a Replacement Cost of GH¢18,000,000 with an estimated Net Realisable Value of GH¢25,000,000.

- The University uses the Straight Line method of depreciation for Non-Current Assets. Details of Non-Current Assets and their respective useful lives are stated below:

| Non-Current Assets | Useful Life |

|---|---|

| Property, Plant, and Machinery | 20 years |

| Investment Property | 10 years |

| Software | 10 years |

Required: a) Prepare a Statement of Financial Performance for Danke State University for the year ended 31 December 2021. (8 marks)

b) Prepare a Statement of Financial Position for Danke State University as at 31 December 2021. (8 marks)

c) State FOUR (4) accounting policies applied in preparing the financial statement. (4 marks)

Answer

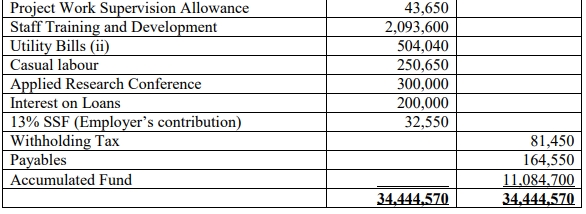

a) DANKE STATE UNIVERSITY

STATEMENT OF FINANCIAL PERFORMANCE FOR THE YEAR ENDED 31/12/2021

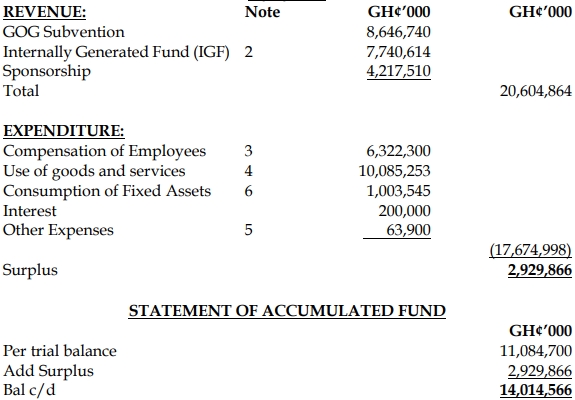

b) DANKE STATE UNIVERSITY

STATEMENT OF FINANCIAL POSITION AS AT 31/12/2021

c) Accounting policies applied in preparing the financial statements:

- General Statement: The university prepares its financial statements in compliance with Public Financial Management Act 2016 (Act 921) and its Regulation 2019, LI2378, and International Public Sector Accounting Standards (IPSAS).

- Basis of Accounting: The University uses Accrual Accounting Basis in the preparation of its Financial Statements.

- Valuation of Receivables: The University fees recoverable are stated at those amounts only reflecting good receivables. Provision for unrecoverable fees income is made at the rate of 7%.

- Depreciation of Non-Current Assets: The University uses the Straight-Line basis in computing its consumption of Fixed Assets, where the cost of the Fixed Assets is spread against its useful life. The basic Capital Assets and their Useful Life are as follows:

| Assets | Useful Life |

|---|---|

| Property, Plant, and Machinery | 20 years |

| Investment Property | 10 years |

| Software | 10 years |

- Inventory Valuation: In line with IPSAS 12, the University values stationery at the lower of cost and its replacement amount because it is held for consumption, but values its inventory of Textbook at the lower of cost and net realisable value since it is held for sale.

WORKINGS:

- Internally Generated Fund

| Item | GH¢’000 |

|—————————-|———–| | Proceeds from Sale of Textbooks | 98,290 | | Mature Entrance Exams Fee | 190,280 | | Graduation Fees | 450,000 | | Fees Income | 3,600,000 | | Resit Examination Fees | 67,950 | | Sales of Admission Vouchers| 450,110 | | Transcript Fees | 24,700 | | Academic Facility User Fees| 2,040,580 | | Other Facility User Fees | 816,010 | | Less Prepayment | 1,050 | | Other Income | | | Interest on Staff Loan (2% of 187,200) | 3,744 | | Total Internally Generated Fund | 7,740,614 | - Compensation of Employees

| Item | GH¢’000

Established Post Salaries | 4,452,150 |

| Outstanding Salaries | 120,000 |

| Employer’s Contribution to Provident Fund | 22,550 |

| Non-Established Post Salaries | 1,128,240 |

| Casual Labour | 250,650 |

| 13% SSF (Employer’s contribution) | 32,550 |

| Salary Related Allowance | 180,560 |

| Book and Research Allowance | 135,600 |

| Total Compensation of Employees | 6,322,300 | - Goods and Services

| Item | GH¢’000 | |——————————|———–|

| Program Accreditation Cost | 508,950 |

| Examination Invigilation Cost| 450,000 |

| Cost of Textbooks | 45,790 |

| Cost of Stationery | 342,290 |

| Graduation Cost | 15,580 |

| Meeting Sitting Allowance | 71,000 |

| Exams Scripts Marking Cost | 78,050 |

| Internet Broadband Cost | 5,338,270 |

| Examination Moderation Cost | 226,670 |

| Project Work Supervision Allowance | 43,650 |

| Staff Training and Development | 2,093,600 |

| Utility Bills | 504,040 |

| Outstanding Utility Bills | 15,500 |

| Applied Research Conference | 300,000 |

| Bad Debt – Expelled students | 21,062 |

| Provision for doubtful debt | 23,512 |

| Sponsorship | 7,290 |

| Total Goods and Services | 10,085,253 | - Other Expenses

| Item | GH¢’000 | |——————————|———–|

| Per Trial Balance | 63,900 |

| Bad Debt – Expelled students | 21,062 |

| Provision for doubtful debt | 23,512 |

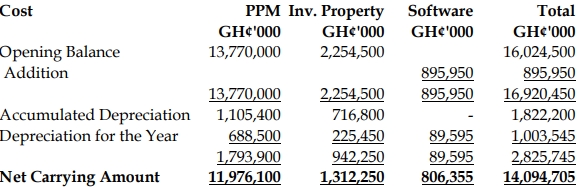

| Total Other Expenses | 108,473 | - Non-Current Asset Schedule

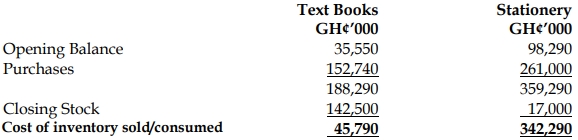

- Inventory

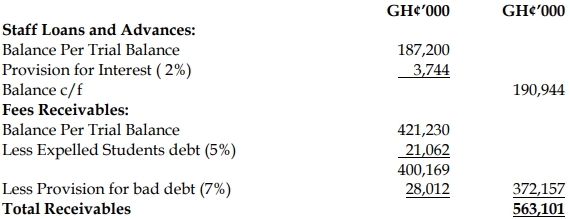

- Receivables

- Provision for Bad Debt

| Item | GH¢’000 |

| Balance b/f | 4,500 |

| Charge for the year | 23,512 |

| Total Provision for Bad Debt | 28,012 | - Payables

| Item | GH¢’000 |

| Balance Per TB | 164,550 |

| Outstanding Utilities | 15,500 |

| Outstanding Salaries | 120,000 |

| Fees Prepayments | 1,050 |

| Withholding Tax | 81,450 |

| Total Payables | 382,550 |

- Uploader: Theophilus