- 20 Marks

Question

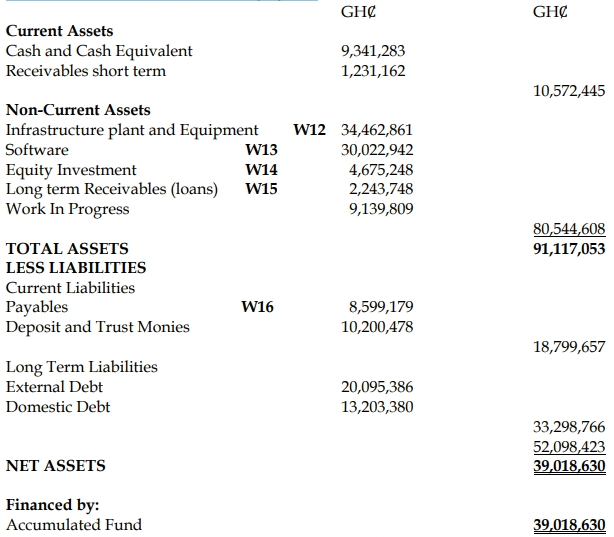

a) You are the head of the Budget department of the Ministry of Works. The Ministry intends to prepare the budget for the 2019 fiscal year and has intended to use the 2018 budget as a base. Below is the detail of the 2018 Budget:

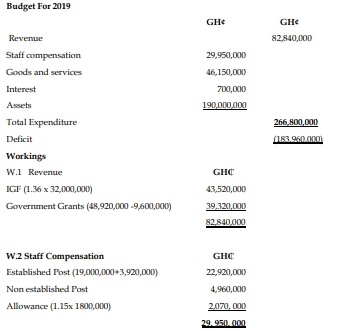

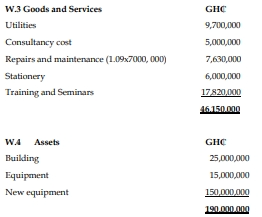

Assumptions for 2019 Budget: i) The Ministry has introduced new equipment, leading to a 36% increase in IGF, but government grants will be cut by GH¢9,600,000. ii) Established post salary will increase by GH¢3,920,000, non-established post salaries will increase to GH¢4,960,000, and allowances will increase by 15%. iii) Utility cost will decrease to GH¢9,700,000; repairs cost will increase by 9%; and training and seminar cost will increase to GH¢17,820,000. iv) The Ministry expects to acquire new equipment, increasing the equipment cost by GH¢150,000,000.

Required: Using the 2018 Budget as a base and assumptions made, prepare the Budget for the 2019 fiscal year. (10 marks)

b)

i) Identify and explain the type of Budget approach used by the Ministry in the Budget preparation. (2 marks)

ii) Explain THREE (3) merits and THREE (3) demerits of the Budget approach adopted in the preparation of the 2019 Budget. (3 marks)

iii) Explain an alternative approach you would have suggested to the Ministry for their subsequent budget preparation and explain THREE (3) reasons why that approach is appropriate under the circumstance. (5 marks)

Answer

a) Budget for 2019

b) i) The Ministry used the Incremental Budgeting approach in the preparation of the 2019 Budget. This approach involves using the previous year’s budget as a base and making adjustments for expected increases or decreases in revenues and expenditures.

(2 marks)

ii) Merits of Incremental Budgeting:

- Simplicity and Time-Efficiency: This method is straightforward and quick to apply, saving time in the budgeting process.

- Stability: It provides stability as it builds on existing budgets, which are familiar to all stakeholders.

- Ease of Justification: There is less need to justify the entire budget, as only the increments or decreases are usually scrutinized.

Demerits of Incremental Budgeting:

- Inefficiencies are Carried Forward: Inefficiencies in the previous budget may be perpetuated if they are not critically examined.

- Lack of Innovation: The approach discourages a fresh evaluation of activities and can stifle innovation as it assumes past activities are still relevant.

- Resource Allocation Issues: The approach may not align resources with strategic priorities, leading to the potential misallocation of funds.

(3 marks total – 1.5 marks for three merits and 1.5 marks for three demerits)

iii) An alternative approach that could be suggested is Zero-Based Budgeting (ZBB).

Reasons for ZBB:

- Resource Optimization: ZBB ensures that every department starts from a “zero base,” justifying all expenditures, leading to better resource optimization.

- Eliminates Waste: This approach forces a review of all expenditures, helping to eliminate unnecessary spending and promoting efficiency.

- Alignment with Strategic Goals: ZBB aligns budgeting with current strategic goals, ensuring resources are allocated to the most critical areas of need.

- Tags: Budget Preparation, Fiscal Year 2019, Incremental Budgeting, Public Sector

- Level: Level 2

- Topic: Public sector fiscal planning and budgeting

- Series: NOV 2018

- Uploader: Joseph