- 10 Marks

Question

Presented below is the Statement of Financial Performance of Okagya Municipal Assembly for the year ended 31 December 2020.

| GH¢’million | 2020 Actual | 2019 Actual | 2020 Budget |

|---|---|---|---|

| Revenues | |||

| Decentralized Transfer | 16,450 | 12,400 | 20,200 |

| IGF | 22,200 | 25,600 | 34,100 |

| Donation and Grants | 1,300 | 1,900 | 2,000 |

| Total Revenue | 39,950 | 39,900 | 56,300 |

| Expenditure | |||

| Compensation for employees | 29,800 | 24,300 | 25,900 |

| Use of goods and services | 10,300 | 9,860 | 18,000 |

| Consumption of fixed Asset | 240 | 220 | 0 |

| Interest | 19,660 | 14,550 | 16,780 |

| Grants | 510 | 430 | 1,920 |

| Other expenses | 1,600 | 1,430 | 2,450 |

| Total Expenditure | 62,110 | 50,790 | 65,050 |

| Net Operation Result | (22,160) | (10,890) | (8,750) |

Required:

i) Prepare a Common Size Statement of Financial Performance for the year ended 31 December 2020.

(6 marks)

ii) Based on the Common Size Statement of Financial Performance prepared in (i) above, write a report analyzing the financial performance of Okagya Municipal Assembly in line with the Recommended Practice Guide 2, Financial Statement Discussion and Analysis.

Answer

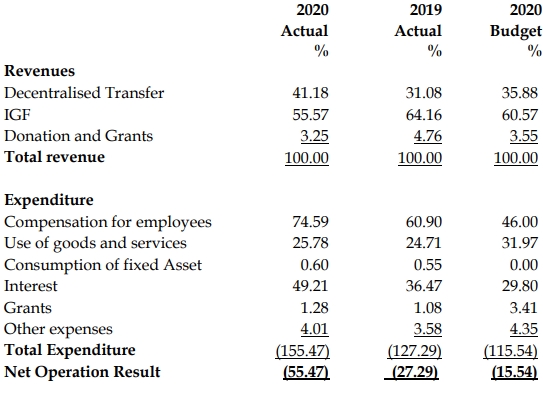

i) Common Size Statement of Financial Performance for the year ended 31 December 2020:

ii) Financial Performance Analysis Report:

Introduction:

This report analyzes the financial performance of Okagya Municipal Assembly for the year ended 31 December 2020. The analysis is based on the Common Size Statement of Financial Performance, focusing on the key revenue and expenditure items.

Revenue Analysis:

- Decentralized Transfer: The revenue from decentralized transfer constituted 41.18% of total revenue in 2020, an increase from 31.08% in 2019, but lower than the budgeted 35.88%.

- Internally Generated Funds (IGF): IGF contributed 55.57% to the total revenue in 2020, down from 64.16% in 2019, and below the budgeted 60.57%. This indicates a decrease in the Assembly’s ability to generate internal revenue.

- Donations and Grants: This source made up only 3.25% of total revenue, a reduction from 4.76% in 2019, and was close to the budgeted figure of 3.55%.

Expenditure Analysis:

- Compensation for Employees: This accounted for a significant 74.59% of total expenditure in 2020, up from 60.90% in 2019, and far exceeding the budgeted 46%. This suggests a heavy reliance on human resources and possibly an overspend on employee compensation.

- Use of Goods and Services: The cost of goods and services represented 25.78% of total expenditure, a slight increase from 24.71% in 2019, but below the budgeted 31.97%.

- Interest: Interest payments constituted 49.21% of total expenditure, a substantial increase from 36.47% in 2019, and higher than the budgeted 29.80%. This indicates an increased burden of debt on the Assembly’s finances.

Conclusion:

The financial performance of Okagya Municipal Assembly shows a heavy dependence on employee compensation and interest payments, which consume a large portion of the Assembly’s revenues. The reduction in IGF as a percentage of total revenue suggests challenges in internal revenue generation. The Assembly needs to improve its revenue generation strategies and control expenditure, particularly in employee compensation and debt servicing, to enhance its financial sustainability.

- Topic: Financial Statements Discussion and Analysis

- Series: NOV 2021

- Uploader: Theophilus