- 20 Marks

Question

Additional Information:

i) The Controller and Accountant General uses the modified accrual accounting concept in the preparation of its accounts.

ii) Established Post salaries of GH¢2,937,000 were outstanding as of 31/12/2018.

iii) Interest on domestic and external loans is provided for at 20% and 15%, respectively.

iv) The Central Government depreciates assets on a cost basis using the schedule below:

| Class of Assets | Number of Years |

|---|---|

| Building | 50 years |

| Plant, Machinery, Furniture, and Fittings | 20 years |

| Transport Equipment | 7 years |

| Computer Software and License | 5 years |

v) Provisions:

Specific provision for bad debt is made for loans receivables and investments as and when their non-recoverability is determined, and where a request is made for write-off to parliament. This provision is set at 3% and 5%, respectively.

Required:

a) Prepare the Statement of Financial Performance of the Consolidated Fund for the year ended 31/12/2018.

(10 marks)

b) Prepare the Statement of Financial Position for the Consolidated Fund as at 31/12/2018.

(7 marks)

c) State and explain THREE (3) Accounting Policies that usually accompany Consolidated Fund Financial Statements.

(3 marks)

Answer

a) Workings:

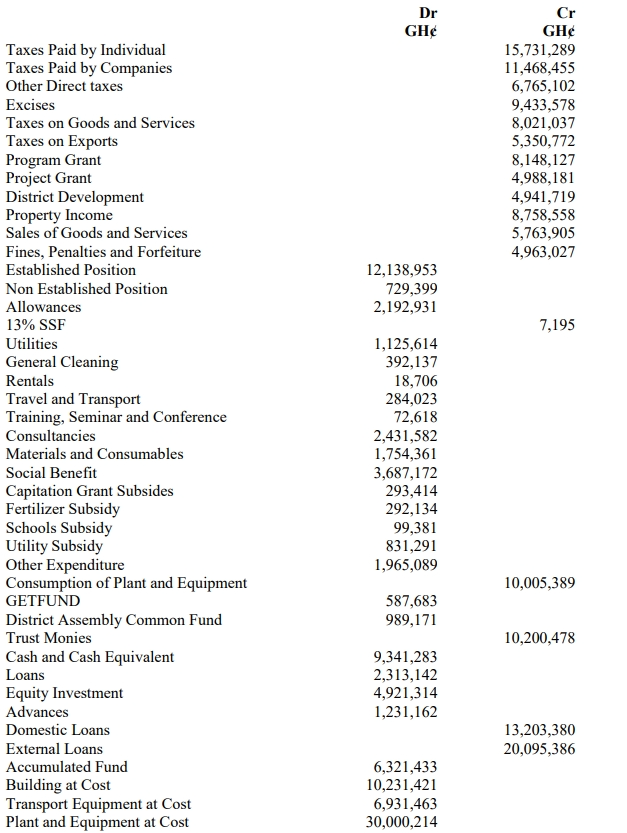

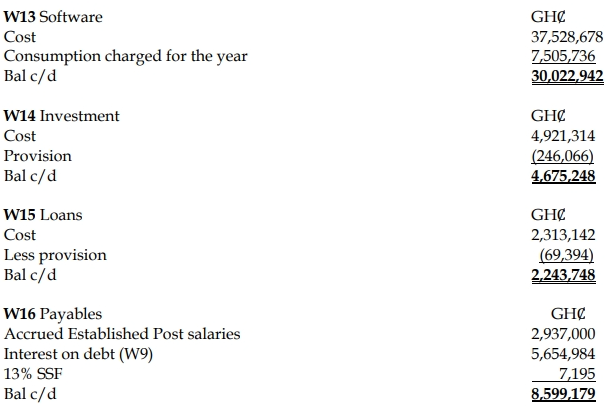

W1 Direct Taxes (GH¢):

- Taxes Paid by Individuals = 15,731,289

- Taxes Paid by Companies = 11,468,455

- Other Direct Taxes = 6,765,102

Total Direct Taxes = 33,964,846

W2 Indirect Taxes (GH¢):

- Excises = 9,433,578

- Taxes on Goods and Services = 8,021,037

- Taxes on Exports = 5,350,772

Total Indirect Taxes = 22,805,387

W3 Grants (GH¢):

- Program Grant = 8,148,127

- Project Grant = 4,988,181

- District Development = 4,941,719

Total Grants = 18,078,027

W4 Non-Tax Revenue (GH¢):

- Property Income = 8,758,558

- Sales of Goods and Services = 5,763,905

- Fines, Penalties, and Forfeiture = 4,963,027

Total Non-Tax Revenue = 19,485,490

W5 Compensation of Employees (GH¢):

- Established Position = 12,138,953

- Non-Established Position = 729,399

- Allowances = 2,192,931

- Add: Established Post Accrued Salaries = 2,937,000

Total Compensation of Employees = 17,998,283

W6 Goods and Services (GH¢):

- Utilities = 1,125,614

- General Cleaning = 392,137

- Rentals = 18,706

- Travel and Transport = 284,023

- Training, Seminar, and Conference = 72,618

- Consultancies = 2,431,582

- Materials and Consumables = 1,754,361

Total Goods and Services = 6,079,041

W7 Subsidies (GH¢):

- Capitation Grant Subsidies = 293,414

- Fertilizer Subsidy = 292,134

- School Subsidies = 99,381

- Utility Subsidy = 831,291

Total Subsidies = 1,516,220

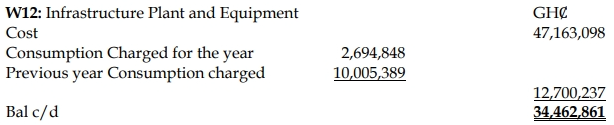

W8 Statutory Payment (GH¢):

- GETFUND = 587,683

- District Assembly Common Fund = 989,171

Total Statutory Payment = 1,576,854

W9 Interest on Debt (GH¢):

- Domestic Debt = (20% × 13,203,380) = 2,640,676

- External Debt = (15% × 20,095,386) = 3,014,308

Total Interest on Debt = 5,654,984

W10 Provision for Bad Debt (GH¢):

- Loans = (3% × 2,313,142) = 69,394

- Investment = (5% × 4,921,314) = 246,066

Total Provision for Bad Debt = 315,460

W11 Consumption of Assets (GH¢):

| Class of Asset | Cost (GH¢) | Years | Depreciation (GH¢) |

|---|---|---|---|

| Building | 10,231,421 | 50 | 204,628 |

| Plant, Machinery, Furniture | 30,000,214 | 20 | 1,500,011 |

| Transport Equipment | 6,931,463 | 7 | 990,209 |

| Computer Software and License | 37,528,678 | 5 | 7,505,736 |

| Total Consumption of Assets = 10,200,584 |

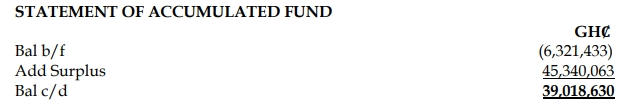

a) REPUBLIC OF GHANA

CONSOLIDATED FUND STATEMENT OF FINANCIAL PERFORMANCE FOR THE YEAR ENDED 31/12/2018

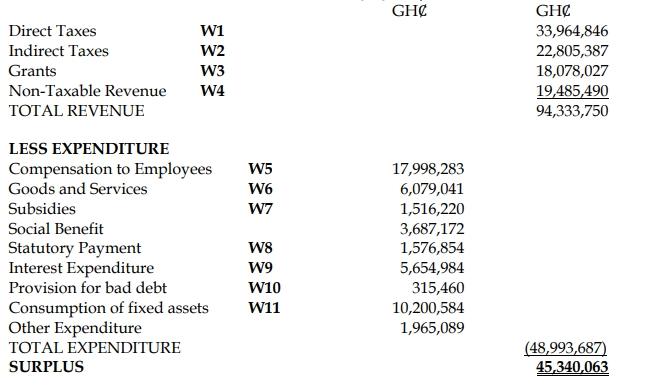

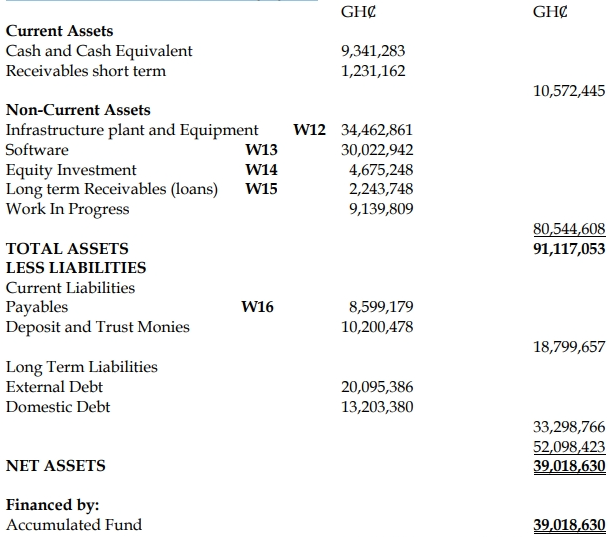

b) REPUBLIC OF GHANA

CONSOLIDATED FUND STATEMENT OF FINANCIAL POSITION AS AT 31/12/2018

c) Accounting Policies:

- Modified Accrual Accounting:

- The Consolidated Fund’s financial statements are prepared under the modified accrual accounting concept, which recognizes revenues when they become available and measurable, and expenditures when the obligation is incurred, except for interest on debt which is recognized on an accrual basis.

- Depreciation of Non-Current Assets:

- Non-current assets are depreciated using the straight-line method over their useful lives as follows:

- Building: 50 years

- Plant, Machinery, Furniture, and Fittings: 20 years

- Transport Equipment: 7 years

- Computer Software and License: 5 years

- Non-current assets are depreciated using the straight-line method over their useful lives as follows:

- Provision for Bad Debts:

- Provisions for bad debts are made for loans and investments based on an assessment of their recoverability. A provision of 3% is made for loans receivables and 5% for equity investments.

- Expenditure

- Uploader: Joseph