- 20 Marks

Question

The following are the balances extracted from the Consolidated Fund of Public Accounts for the year ended 31st December 2017:

| Description | Amount (GH¢ ‘000) |

|---|---|

| Consumption of fixed Capital | 208,878 |

| Miscellaneous Direct Taxes | 98,238 |

| Social Security Benefit in Kind | 66,120 |

| 13.5% SSF Contribution | 45,000 |

| Project Grant | 9,370 |

| Fines, Penalties and Forfeitures | 25,928 |

| Materials and Office Consumables | 117,526 |

| General Taxes on Goods & Services | 265,064 |

| Travel & Transport | 41,610 |

| Social Assistance Benefits | 68,678 |

| Established Post- salaries | 800,800 |

| Domestic Debt Interest | 40,200 |

| Gratuity | 20,000 |

| Training, Seminar and Conference Cost | 54,250 |

| External Debt Interest | 83,772 |

| Allowances to Employees | 56,000 |

| Repairs and Maintenance | 34,560 |

| Property Income | 25,000 |

| Cash & Bank Balances | 1,960,898 |

| Advances & Receivables | 60,164 |

| Taxes on Exports | 581,588 |

| Long Term Receivables | 2,836,616 |

| Non-Established Post-salaries | 400,104 |

| Payables | 1,211,044 |

| Accumulated Surpluses (1/1/2017) | (61,343,676) |

| Deposit and Other Trust Monies | 3,752,412 |

| Short-Term Borrowing | 11,299,822 |

| Taxes paid by individuals | 810,436 |

| Subsidy on Petroleum Products | 15,000 |

| Fertilizer Subsidies | 24,068 |

| Equity Investment | 3,619,752 |

| End of Service Benefit | 25,880 |

| Infrastructure, Plant & Equipment | 2,028,806 |

| Taxes paid by Companies & Enterprises | 135,784 |

| Work-In-Progress | 304,880 |

| Domestic Debt | 23,719,588 |

| External Debt | 32,283,148 |

| Employer Social Benefits in Cash | 30,500 |

| Other Expenses (note i) | 22,584 |

| Excise Duties | 92,900 |

Additional Notes:

i) Other Expenses:

During the year, the Government of Ghana benefited from free services provided by medical experts who were task forces of the British Government. The main objective of this task force was to help curb cholera in the country. The fair value of these services amounted to GH¢ 18,740,000. It is the policy of the Government to include goods and services received during the year in kind in its financial statements at fair values.

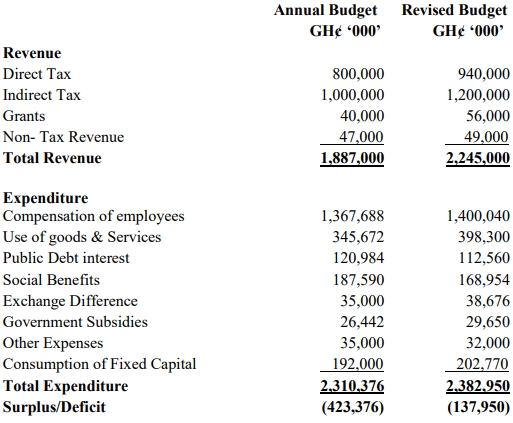

ii) The annual estimates for the year ending 2017 were as follows:

Required:

a) Prepare a Statement of Revenue and Expenditure of the Consolidated Fund for the year ended December 31, 2017, indicating the accompanying variances to the statement.

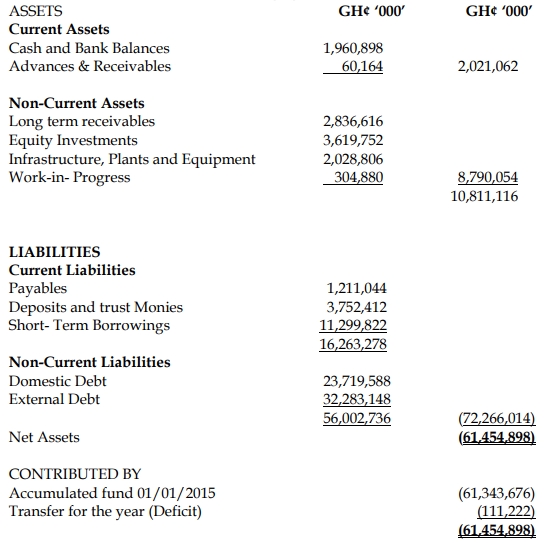

b) Prepare a Statement of Financial Position of the Consolidated Fund as of December 31, 2017.

Answer

a) Statement of Revenue and Expenditure for the Year Ended 31 December 2017

| Description | Actuals (GH¢ ‘000) | Revised Budget (GH¢ ‘000) | Variance (GH¢ ‘000) |

|---|---|---|---|

| Revenue: | |||

| Direct Tax | 1,044,458 | 940,000 | 104,458 |

| Indirect Tax | 939,552 | 1,200,000 | (260,448) |

| Grants | 28,110 | 56,000 | (27,890) |

| Non-Tax Revenue | 50,928 | 49,000 | 1,928 |

| Total Revenue | 2,063,048 | 2,245,000 | (181,952) |

| Expenditure: | |||

| Compensation of employees | 1,347,784 | 1,400,040 | 52,256 |

| Use of goods & Services | 247,946 | 398,300 | 150,354 |

| Public Debt Interest | 123,972 | 112,560 | (11,412) |

| Social Benefits | 165,298 | 168,954 | 3,656 |

| Exchange Difference | – | 38,676 | 38,676 |

| Government Subsidies | 39,068 | 29,650 | (9,418) |

| Other Expenses | 41,324 | 32,000 | (9,324) |

| Consumption of Fixed Capital | 208,878 | 202,770 | (6,108) |

| Total Expenditure | (2,174,270) | (2,382,950) | 208,680 |

| Excess of Expenditure over Revenue | (111,222) | (137,950) | 26,728 |

b) Statement of Financial Position as of 31 December 2017

Notes:

- Direct Taxes:

- Taxes paid by individuals: GH¢ 810,436

- Taxes paid by companies and enterprises: GH¢ 135,784

- Miscellaneous direct taxes: GH¢ 98,238

- Total Direct Taxes: GH¢ 1,044,458

- Indirect Taxes:

- Taxes on Goods & Services: GH¢ 265,064

- Excises: GH¢ 92,900

- Taxes on Exports: GH¢ 581,588

- Total Indirect Taxes: GH¢ 939,552

- Grants:

- Project Grant: GH¢ 9,370

- Service in Kind from British Gov’t: GH¢ 18,740

- Total Grants: GH¢ 28,110

- Non-Tax Revenue:

- Property Income: GH¢ 25,000

- Fees, Penalties, and Forfeitures: GH¢ 25,928

- Total Non-Tax Revenue: GH¢ 50,928

- Compensation of Employees:

- Allowances to Employees: GH¢ 56,000

- Non-Established Post: GH¢ 400,104

- Established Post: GH¢ 800,800

- National Pension Contribution:

- Gratuity: GH¢ 20,000

- 13.5% SSF Contribution: GH¢ 45,000

- End of Service Benefit: GH¢ 25,880

- Total Compensation of Employees: GH¢ 1,347,784

- Use of Goods & Services:

- Materials and Office Consumables: GH¢ 117,526

- Repairs and Maintenance: GH¢ 34,560

- Travel & Transport: GH¢ 41,610

- Training, Seminar, and Conference: GH¢ 54,250

- Total Use of Goods & Services: GH¢ 247,946

- Public Debt Interest:

- External Debt Interest: GH¢ 83,772

- Domestic Debt Interest: GH¢ 40,200

- Total Public Debt Interest: GH¢ 123,972

- Social Benefits:

- Social Security Benefit in Kind: GH¢ 66,120

- Employer Social Benefits in Cash: GH¢ 30,500

- Social Assistance Benefits: GH¢ 68,678

- Total Social Benefits: GH¢ 165,298

- Government Subsidies:

- Subsidy on Petroleum Products: GH¢ 15,000

- Fertilizer Subsidies: GH¢ 24,068

- Total Government Subsidies: GH¢ 39,068

- Other Expenses:

- As per Question: GH¢ 22,584

- Service in Kind – British Govt.: GH¢ 18,740

- Total Other Expenses: GH¢ 41,324

NB: Assets or services received free of charge or for nominal cost are recognized as Grants at the fair value of the assets or services that the Government would have otherwise paid for, where the fair value can be measured reliably. A corresponding expense is recognized for services received and in the case of assets, the receipts of assets are recognized in the Statement of Financial Position. In this case, a service in kind was received; hence the inclusion of GH¢ 18,740,000 in the Grants and Other Expenses accordingly.

- Uploader: Theophilus