- 20 Marks

Question

a) Wahala Ltd wants to employ more liberal credit standards to increase sales. The current annual sales figure is GH¢30 million. Currently, the firm has an average collection period of 30 days. Three alternative credit policies are on the table for evaluation and selection. The management team believes that the alternative credit policies will result in the following:

| Factor | Alternative Credit Policy A | Alternative Credit Policy B | Alternative Credit Policy C |

|---|---|---|---|

| Increase in sales from the current level | GH¢2.2 million | GH¢3.1 million | GH¢5.4 million |

| Average collection period for incremental sales (days) | 45 | 60 | 150 |

| Bad-debt losses on incremental sales | 1.50% | 3.50% | 8.50% |

The prices of its products average GH¢30.50 per unit and variable costs average GH¢21.35 per unit. The company’s pre-tax opportunity cost of funds is 35%.

Required:

i) Evaluate each of the three alternative liberal credit policies and advise the company on which credit policy it should pursue. (Assume a 360-day year). (12 marks)

ii) Suppose the company introduces a discount policy of 2/10 net 45. Compute the cost to a customer who forgoes the discount. (3 marks)

b) The treasury unit of a company performs various functions, including financial risk management.

Required:

Explain TWO (2) types of financial risks the treasury function manages. (5 marks)

Answer

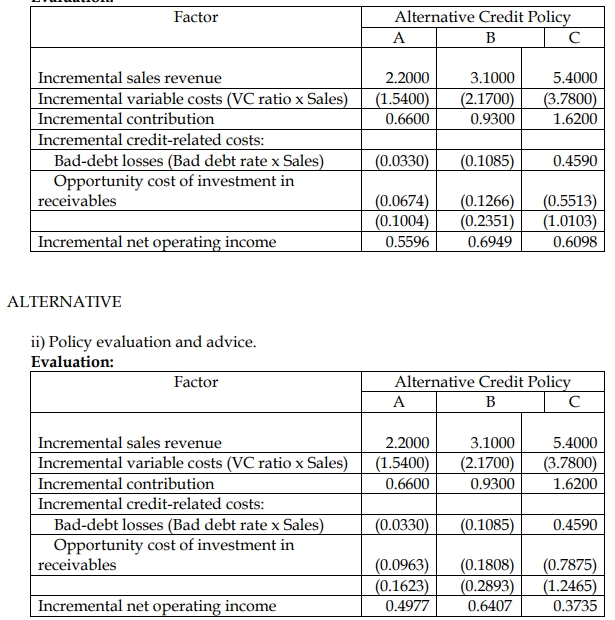

a) Evaluation of Credit Policies:

To evaluate the credit policies, we compute the incremental contribution, and the costs associated with each policy:

Recommendation:

- The policy with the highest net operating income should be pursued.

(12 marks)

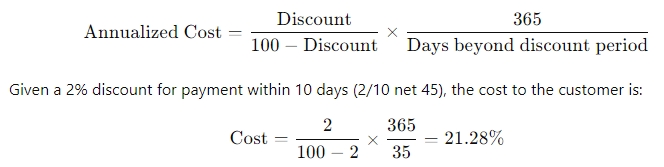

ii) Cost to Customer Forgoing Discount:

The cost of forgoing the discount is calculated using the formula:

b) Types of Financial Risks Managed by Treasury:

- Currency Risk:

- Arises from unexpected movements in exchange rates affecting companies with foreign currency exposures.

- Interest Rate Risk:

- Arises from unexpected changes in interest rates, impacting companies with outstanding interest-bearing loans or investments.

- Tags: Cost of Credit, Credit Policy, Treasury risk management

- Level: Level 2

- Topic: Management of receivables and payables, Working Capital Management

- Series: NOV 2023

- Uploader: Theophilus