- 20 Marks

Question

a) Understanding risk is key for a robust risk and control environment in modern business organisations.

Required:

In the light of the above, explain the following:

i) Systematic risk (2 marks)

ii) Business risk (2 marks)

iii) Financial risk (2 marks)

b) Quantum Investment Ltd in the past has been concentrating all its investments in one project that performed badly consistently over the past few years. They have therefore decided to adopt a diversification strategy by investing in projects A, B, and C. The table below presents the Net Present Value (NPV) of the projects under different states of the economy.

| State of Economy | Probability | Project A | Project B | Project C |

|---|---|---|---|---|

| Bad | 0.2 | GH¢10 million | GH¢12 million | GH¢15 million |

| Average/Normal | 0.5 | GH¢20 million | GH¢22 million | GH¢30 million |

| Good | 0.3 | GH¢35 million | GH¢40 million | GH¢45 million |

The company has GH¢200 million for investments in these three projects:

Project A = GH¢40 million

Project B = GH¢60 million

Project C = GH¢100 million

Required:

Compute the expected NPV for each of the three projects. (9 marks)

c) In capital structure decisions, there are two views of gearing and weighted average cost of capital (WACC): the traditional view and the Modigliani-Miller view.

Required:

Explain the two views with respect to gearing and WACC. (5 marks)

Answer

a) Explanation of Risks:

i) Systematic Risk:

Systematic risk is the risk inherent in the economy that affects all businesses. It cannot be diversified away and is often associated with macroeconomic factors such as interest rates, inflation, and economic cycles.

(2 marks)

ii) Business Risk:

Business risk is specific to the industry or the nature of the business a company is engaged in. It relates to the variability in earnings due to the nature of the operations. Some businesses, like technology companies, are inherently riskier than others, such as utilities.

(2 marks)

iii) Financial Risk:

Financial risk arises from the way a company finances its operations, particularly the use of debt. Companies with higher levels of debt (gearing) face higher financial risk, as they are more exposed to the risk of default if their earnings are insufficient to meet debt obligations.

(2 marks)

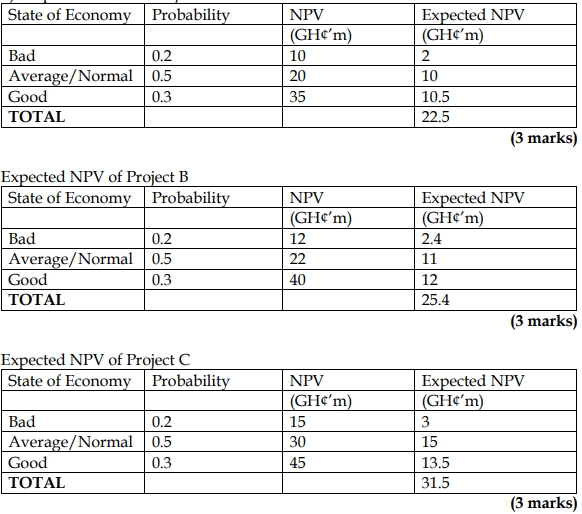

b) Expected NPV for Each Project:

c) Views on Gearing and WACC:

- Traditional View:

The traditional view suggests that there is an optimal level of gearing where the WACC is minimized, and the value of the company is maximized. As gearing increases, the cost of equity rises, but the benefit of cheaper debt outweighs this increase up to a certain point, after which further increases in gearing raise the WACC. - Modigliani-Miller View:

Modigliani and Miller proposed that, under certain assumptions (such as no taxes, no bankruptcy costs, and perfect markets), the WACC remains constant regardless of the level of gearing. They argued that the value of the firm is unaffected by how it is financed, although this theory has been adjusted in real-world applications to account for taxes and bankruptcy costs.(5 marks)

- Topic: Capital structure, DCF: Risk and uncertainty

- Series: NOV 2023

- Uploader: Kwame Aikins