- 20 Marks

Question

Amanfi Ltd manufactures cooking oil for the local markets in Ghana. The management of Amanfi Ltd believes that by merging with one of their input suppliers, Aseebu Ltd, the company will be able to control supply, thus giving the Amanfi Group a low-price advantage in the market. Aseebu Ltd is a key supplier of inputs to companies in the cooking oil industry. The financial statements of the two companies are shown below:

Income Statement for the past Five Years (Amanfi Ltd)

| Year (Million GH¢) | 2018 | 2019 | 2020 | 2021 | 2022 (current year) |

|---|---|---|---|---|---|

| Sales | 3,720 | 4,092 | 4,500 | 4,950 | 5,442 |

| Cost of Sales | (1,674) | (1,841) | (2,025) | (2,228) | (2,449) |

| Operating Profit | 2,046 | 2,251 | 2,475 | 2,722 | 2,993 |

| Finance Cost | (252) | (278) | (305) | (336) | (369) |

| Earnings Before Tax | 1,794 | 1,973 | 2,170 | 2,386 | 2,624 |

| Tax @ 30% | (538) | (592) | (651) | (716) | (787) |

| Earnings After Tax | 1,256 | 1,381 | 1,519 | 1,670 | 1,837 |

Income Statement for the past Five Years (Aseebu Ltd)

| Year (Million GH¢) | 2018 | 2019 | 2020 | 2021 | 2022 (current year) |

|---|---|---|---|---|---|

| Sales | 1,860 | 2,046 | 2,250 | 2,475 | 2,496 |

| Cost of Sales | (837) | (921) | (1,013) | (1,114) | (1,123) |

| Operating Profit | 1,023 | 1,125 | 1,237 | 1,361 | 1,373 |

| Finance Cost | (126) | (139) | (153) | (168) | (169) |

| Earnings Before Tax | 897 | 986 | 1,084 | 1,193 | 1,204 |

| Tax @ 30% | (269) | (296) | (325) | (358) | (361) |

| Earnings After Tax | 628 | 690 | 759 | 835 | 843 |

Additional Information:

Amanfi Ltd and Aseebu Ltd have beta of 1.6 and 1.1 respectively. The government treasury bill rate pays a yield of 8% and risk premium on the market is 17%. If the merger goes through, the combined company’s earnings after tax will grow at the same rate as Amanfi Ltd. The merger will lead to annual cost savings of GH¢850 million in perpetuity.

Required:

a) As a Finance Manager, calculate the value of the combined business based on the present value of expected earnings. (8 marks)

b) What is the maximum amount that Amanfi Ltd should pay for Aseebu Ltd? (4 marks)

c) What is the minimum bid that Aseebu Ltd shareholders should be prepared to accept? (4 marks)

d) Calculate the gain/loss from the merger. (2 marks)

e) Identify and explain the type of merger between Amanfi Ltd and Aseebu Ltd. (2 marks)

Answer

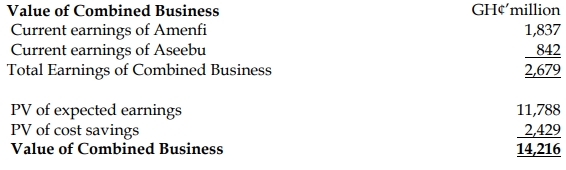

a) Calculation of the Value of the Combined Business Based on the Present Value of Expected Earnings

Value of Combined Business (GH¢’million):

(1 mark for each line up to 5, 1 mark each for the growth rate and 2 marks for cost of equity = 8 marks)

(1 mark for each line up to 5, 1 mark each for the growth rate and 2 marks for cost of equity = 8 marks)

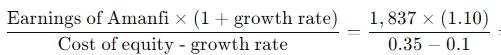

b) Maximum Amount that Amanfi Ltd Should Pay for Aseebu Ltd

Value of Amanfi =  = GH¢8,081 million

= GH¢8,081 million

(2 marks each for the maximum price and the value of Amanfi = 4 marks)

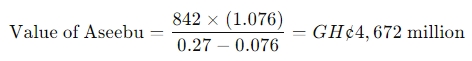

c) Minimum Bid that Aseebu Ltd Shareholders Should Be Prepared to Accept

(2 marks for the minimum price and 1 mark each for the growth rate and the cost of equity = 4 marks)

d) Gain/Loss from the Merger

Gain:

Value of Combined business − (Value of Amanfi + Value of Aseebu)

=14,216 − (8,081 + 4,672) = GH¢1,463 million

e) Type of Merger Between Amanfi Ltd and Aseebu Ltd

Backward Vertical Merger/Acquisition:

A merger between firms that operate at different stages of the same production chain, or between firms that produce complementary goods. This type of vertical merger between a supplier and a firm is known as a backward merger. (2 marks)

- Tags: Business Valuation, Cost savings, Earnings valuation, Mergers, Shareholder Value

- Level: Level 2

- Topic: Mergers and acquisitions

- Series: JULY 2023

- Uploader: Theophilus