- 20 Marks

Question

a) Sakyiama Poultry Farms is considering purchasing a new incubator that will improve its incubation efficiency to 90% as against the current 50%. The incubator, which is to be purchased immediately, will cost GH¢120,000. The incubator has a useful life of 4 years, after which it would be sold for scrap at GH¢10,000. The current contribution of GH¢3 per day-old chick will not change. The number of day-old chicks sold at 12,000 units per annum will increase by 80%. Fixed cost will be GH¢20,000 per annum. Sakyiama Farms has an after-tax cost of capital of 12.5% and pays tax in the year in which profit is made at a rate of 15% per annum. The farm is also entitled to capital allowance at 25% on a reducing balance.

i) Calculate the Net Present Value (NPV) and the viability of the investment. (7 marks)

ii) Calculate the Internal Rate of Return (IRR). (8 marks)

b) Two blue-chip companies – Abu Ltd and Ada Ltd are seeking to raise funds from venture capital to boost their production in order to satisfy demand for their solar-powered refrigeration and air-conditioning systems, which they developed through a joint venture. They have consulted you for advice.

Required:

Explain FIVE conditions that a venture capitalist will consider in accessing an application for funding. (5 marks)

Answer

a) Sakyiama Farms

i) Investment appraisal

| Years | 0 | 1 | 2 | 3 | 4 |

|---|---|---|---|---|---|

| Cost | 120,000.00 | 90,000.00 | 67,500.00 | 50,625.00 | 37,968.75 |

| Capital Allowance | 30,000.00 | 22,500.00 | 16,875.00 | 12,656.25 | |

| Tax Gain | 4,500.00 | 3,375.00 | 2,531.25 | 1,898.44 | |

| Additional Gain (37,968.75-10,000) x 15% | 398.44 | ||||

| Contribution (64,800 units/year) | 64,800.00 | 64,800.00 | 64,800.00 | 64,800.00 | |

| Fixed Cost | (20,000.00) | (20,000.00) | (20,000.00) | (20,000.00) | |

| Cash Flow Before Tax | 44,800.00 | 44,800.00 | 44,800.00 | 44,800.00 | |

| Tax (15%) | (6,720.00) | (6,720.00) | (6,720.00) | (6,720.00) | |

| Tax Gain | 4,500.00 | 3,375.00 | 2,531.25 | 1,898.44 | |

| Additional Gain | 398.44 | ||||

| Cost of Incubator (120,000.00) | |||||

| Scrap Value | 10,000.00 | ||||

| Net Cash Flow | (120,000.00) | 42,580.00 | 41,455.00 | 40,611.25 | 50,376.88 |

| Discount Factor (12.5%) | 1.000 | 0.889 | 0.790 | 0.702 | 0.624 |

| Present Value | (120,000.00) | 37,848.89 | 32,754.57 | 28,522.58 | 31,450.04 |

| Net Present Value | 10,576.07 |

Total for this part: 7 marks

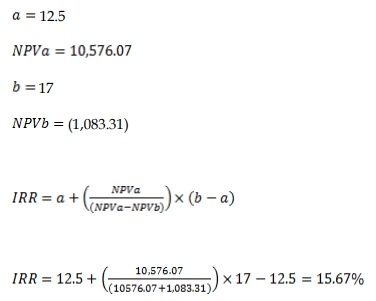

ii) IRR Calculation

| Years | 0 | 1 | 2 | 3 | 4 |

|---|---|---|---|---|---|

| Net Cash Flow | (120,000.00) | 42,580.00 | 41,455.00 | 40,611.25 | 50,376.88 |

| Discount Factor (17%) | 1.000 | 0.855 | 0.731 | 0.624 | 0.534 |

| Present Value | (120,000.00) | 36,393.16 | 30,283.44 | 25,356.47 | 26,883.62 |

| Net Present Value | (1,083.31) |

The IRR calculated using interpolation is approximately 15.67%.

Total for this part: 8 marks

b) Venture Capitalist Considerations

Venture capitalists will evaluate a funding application based on:

- Nature of the Company’s Products: The products should generate adequate and sustainable sales and profits.

- Expertise in Production: Technical efficiency and value-driven competencies must be demonstrated.

- Expertise in Management: Management should show commitment, skills, and experience in promoting the company’s objectives.

- Market and Competition: The company should have a competitive strategy to maintain and expand its market share.

- Future Profits: The company’s ability to generate realistic and sustainable future profits should be evident in its business plan.

- Board Membership: The company should have a board of directors that effectively represents stakeholders’ interests.

- Risk Borne by Existing Shareholders: The company’s owners should bear a significant portion of the risk.

- Topic: Cost of capital, Introduction to Investment Appraisal

- Series: NOV 2016

- Uploader: Joseph