- 20 Marks

Question

a) Explain THREE causes each of the following situations:

i) Overcapitalized (3 marks)

ii) Overtrading (3 marks)

b) SAP Petroleum Ltd is considering relaxing its credit policy to boost sales. The change will increase the average collection period from 30 days to 60 days. The review is expected to increase sales by 25%. The current annual sales are GH¢ 6,000,000. Selling price per litre is GH¢ 30, variable cost per litre is GH¢ 27, and additional stock level is GH¢250,000.

Required:

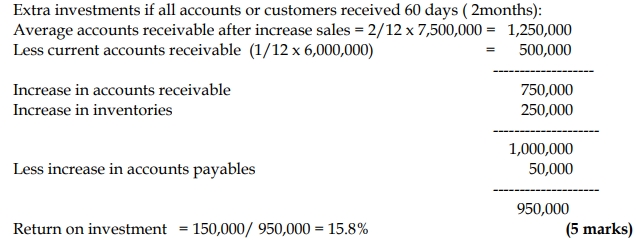

i) Advise on whether to extend the period to customers if all customers take the longer credit of 2 months. (5 marks)

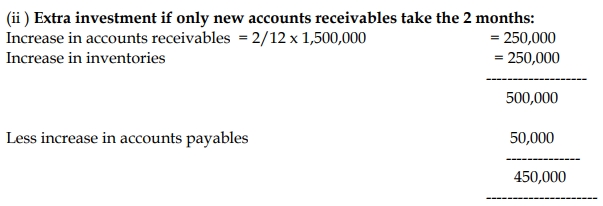

ii) Advise if existing customers do not change their payment terms and only new ones take the longer credit. (4 marks)

c) i) Explain the concepts of stock split and scrip issue and identify the main difference between the two. (3 marks)

ii) Explain why a company will embark on a scrip issue. (2 marks)

Answer

a)

i) Overcapitalization refers to a situation where a company has more or excess capital at its disposal than what is required for its normal and optimal operation or utilization. This may occur due to excessive equity or debt financing.

ii) Overtrading is when a company has insufficient cash or near-cash resources due to rapid growth. Indicators include high utilization of trade credit, large turnovers without a corresponding increase in cash, and liquidity challenges.

b)

i) Extra Profit:

Contribution Sales Ratio = (30-27)/30 = 10%

Increase in sales revenue: 25% x 6,000,000 = 1,500,000

Increase in contribution = 10% x 1,500,000 = 150,000

Return on investment = 150,000/ 450,000 = 33.33% (3 marks)

The policy is worthwhile if the existing customers stick to the 1 month and new

customers or accounts take the 2 months. The return on the latter is 33.33% which has

crossed the required rate of return of 28%.

Decision or advice

c)

i) A stock split divides existing shares into multiple shares. A scrip issue gives additional fully paid shares free of charge, similar to a bonus. The main difference is that stock splits simply increase the number of shares, whereas scrip issues involve giving additional shares. (3 marks)

ii) A company may embark on a scrip issue to improve float, liquidity, and traded volumes of the stock. It also signals the company’s confidence in its ability to service a larger equity base. (2 marks)

- Tags: Credit Policy, Overcapitalization, Overtrading, Scrip Issue, Stock Split

- Level: Level 2

- Topic: Working Capital Management

- Series: NOV 2016

- Uploader: Joseph