- 14 Marks

Question

Panpana Ltd is operating in the same industry as Finkyim Ltd, but Finkyim Ltd is experiencing leadership crisis leading to poor performance. Panpana Ltd, upon realizing this, is putting up a bid to take over Finkyim Ltd. It has been agreed that Panpana Ltd will pay 0.7 of its own shares for each of the shares in Finkyim Ltd. This acquisition has no economies of scale and operating synergy. The relevant financial data of the two companies are as follows:

| Panpana Ltd | Finkyim Ltd | |

|---|---|---|

| Net Sales | GH¢503,000 | GH¢178,000 |

| Profit After Tax | GH¢88,000 | GH¢18,000 |

| Number of Shares | 18,000 | 4,500 |

| Price per Share | GH¢50 | GH¢30 |

| Price-Earnings (P/E) Ratio | 10 | 8 |

Required:

i) Calculate the Earnings per Share (EPS) for the combined company. (3 marks)

ii) Calculate the Weighted Average P/E ratio for the combined company. (3 marks)

iii) Calculate the Market Value per Share for the combined company. (2 marks)

iv) Calculate the Total Market Capitalization for the combined company. (2 marks)

v) Calculate the Premium received by Finkyim Ltd. (4 marks)

Answer

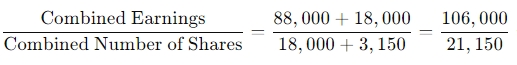

i) Earnings per Share (EPS):

Shares offered to Finkyim Ltd = 0.7 × 4,500 = 3,150 shares

Combined EPS =  = GH¢5.01

= GH¢5.01

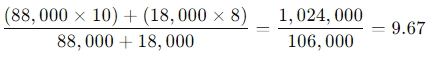

ii) Weighted Average P/E Ratio:

Weighted Average P/E Ratio =

iii) Market Value per Share:

Market Value per Share = EPS × P/E Ratio = 5.01 × 9.67 = GH¢48.45

iv) Total Market Capitalization:

Total Market Capitalization = Number of Shares × Market Value per Share = 21,150 × 48.45 = GH¢1,024,717

v) Premium Received by Finkyim Ltd:

Value before merger = 4,500 × 30 = GH¢135,000

Value after merger = (0.7 × 4,500) × 48.45 = GH¢152,618

Premium Received = 152,618 − 135,000 = GH¢17,618

- Tags: Acquisition premium, Earnings Per Share, Market Value, Mergers, Price-Earnings ratio

- Level: Level 2

- Topic: Mergers and acquisitions

- Series: MAR 2023

- Uploader: Theophilus