- 10 Marks

Question

An online university is setting up an endowment fund for the financing of scholarship grants. A total of GH¢200 million has been raised through fundraising events. This amount will be invested continuously for 5 years before disbursements will be made from the fund. The Trustees of the Endowment Fund have received a tentative investment strategy from the appointed Investment Manager.

Below is an extract from the tentative investment strategy:

“The seed money will be invested in fixed-income securities and negotiated short-term investments to secure the protection of the principal while earning stable returns over the 5-year gestation period. To achieve this objective, the seed money will be invested as follows: 60% in Government of Ghana 91-day Treasury Bills, 40% in 6-month fixed deposit accounts with top-class universal banks in Ghana. Over the 5-year gestation period, the maturity value of each round of investment will be rolled over as they mature.”

Being the only Trustee with expertise in finance, your fellow Trustees have asked you to do some simulations to inform them about the growth of the fund in the gestation period based on the tentative investment strategy.

Required:

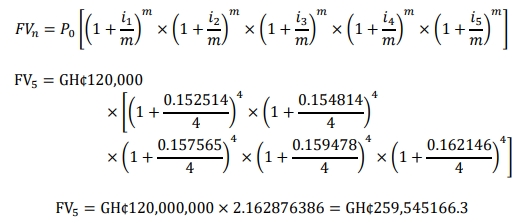

i) Suppose the annual nominal interest rate on the Government of Ghana 91-day Treasury bills will be 15.2514% in year 1, 15.4814% in year 2, 15.7565% in year 3, 15.9478% in year 4, and 16.2146% in year 5. Compute the terminal value of that component of the investment at the end of the fifth year. (5 marks)

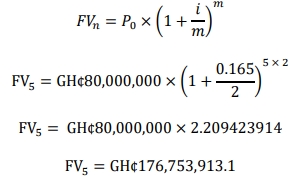

ii) Suppose the average nominal interest rate on the fixed deposits will be 16.5% over the next five years. Compute the terminal value of that component of the investment at the end of the fifth year. (3 marks)

iii) Considering the proposed strategy that the maturity value of each round of investment is rolled over as they mature, explain whether the interest that would accrue on the investment over the entire investment period would effectively be a simple interest. (2 marks)

Answer

i) The terminal value of the investment in the 91-day GoG Treasury bills:

Approximating the 91-day investment holding period to a quarter of a year, it can be concluded that the maturity value of the allocation to the 91-day GoG Treasury bills will be reinvested at the end of every quarter in each of the five years. Effectively, the allocated amount will be compounded quarterly over the next five years. The terminal value at the end of the fifth year may be calculated as under:

(Marks allocation: Amount allocated = 1; Computation of future value = 3; Final answer = 1)

ii) The terminal value of the investment in the 6-month fixed deposit:

The maturity value of the allocation to the fixed deposits will be reinvested at the end of every half in each of the five years. Effectively, the allocated amount will be compounded semi-annually over the next five years. The terminal value at the end of the fifth year may be calculated as under:

(Marks allocation: Computation of future value = 2 marks; Final answer = 1 mark)

iii) No. If the maturity value is reinvested, then it is both the principal and interest that are reinvested. Effectively, interest is earned on both principal and interest. In the case of simple interest, interest is earned only on the principal.

(Marks allocation: Conclusion = 1 mark; Explanation = 1 mark)

- Topic: Simple interest and compound interest

- Series: APR 2022

- Uploader: Theophilus