- 20 Marks

Question

a) In driving the profitability and liquidity position of an organization in the current local and global business environment, one area that has become the center of focus or attention to Management is how working capital is managed. Aggressive, moderate, and conservative policies to working capital management have implications on the profitability and liquidity positions of the organization.

Required:

In the light of the above, explain and demonstrate the impact of each of the policies below on profitability and liquidity:

i) Aggressive Working Capital Management (2 marks)

ii) Moderate Working Capital Management (2 marks)

iii) Conservative Working Capital Management (2 marks)

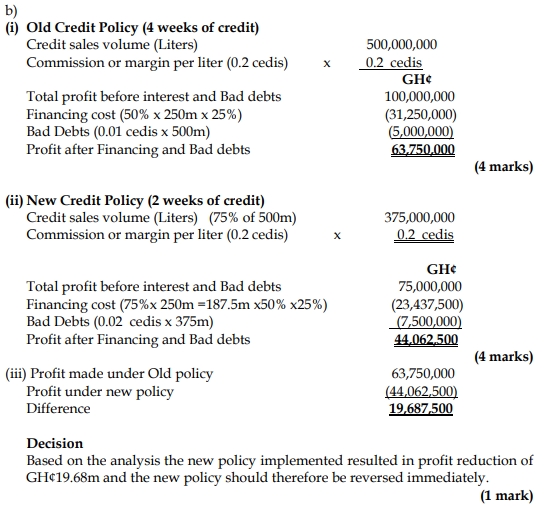

b) Taaba Oil Ghana Ltd is an Oil Marketing Company operating in the downstream sector of the Oil and Gas industry in Ghana. The company initially was offering 4 weeks credit to its retailers until it changed its strategy to reduce the credit period from 4 weeks to 2 weeks to manage down its financing cost and bad debt.

Under the 4 weeks credit regime, annual credit sales were 500 million liters. The profit made per liter before financing charges and bad debt was GH¢0.20. The total working capital was GH¢250 million, but 50% was funded through trade credit and the remaining 50% was through Bank Overdraft at an interest rate of 25% per annum. The cost of trade credit was already factored into the margin. Bad debt was GH¢0.01 per liter of the credit sales.

The change in policy from 4 weeks to 2 weeks was done immediately without prior advance discussion and notice period granted to retailers who were also selling on credit to their customers.

After operating the new credit policy, the volume of sales was negatively impacted as sales volume per annum dropped by 25% and bad debts increased by 100% due to pressure on the working capital of the retailers. As the new Finance Manager for Taaba Oil Ghana Ltd, you are tasked to review this policy.

Required:

i) Calculate the profit under the old policy. (4 marks)

ii) Calculate the profit under the new policy. (4 marks)

iii) Based on your calculations above, advise management whether to revert to the old policy or maintain the new policy. (1 mark)

c) Holding stock and sometimes over-stocking come at a great cost to a company. Notwithstanding these costs, it is sometimes necessary to hold stock or even overstock for the smooth running of the company.

Required:

i) Explain TWO (2) reasons for holding stock. (2 marks)

ii) State and explain THREE (3) costs associated with holding stocks. (3 marks)

Answer

a) Impact of Working Capital Management Policies:

i) Aggressive Working Capital Management:

This approach involves maintaining lower levels of current assets (such as cash, inventory, and receivables) relative to sales. The result is higher profitability due to lower holding costs, but it also increases the risk of liquidity problems, as the company may not have enough short-term assets to meet its obligations when they come due.

ii) Moderate Working Capital Management:

This approach strikes a balance between aggressive and conservative policies. It aims to maintain an optimal level of current assets relative to sales, which helps to moderate both profitability and liquidity risks. This policy seeks to achieve a balance that neither overstretches nor underutilizes the company’s working capital.

iii) Conservative Working Capital Management:

Under this policy, a company maintains higher levels of current assets relative to sales. This reduces the risk of liquidity problems but at the expense of profitability, as holding excess cash, inventory, or receivables increases carrying costs.

c) Reasons and Costs Associated with Holding Stock:

i) Reasons for Holding Stock:

- Catering to Unexpected Demand:

Holding stock ensures that the company can meet unexpected increases in demand without facing stockouts, which could result in lost sales. - Smooth Production Process:

Maintaining inventory levels helps ensure that the production process is not interrupted due to a lack of raw materials, which can lead to inefficiencies and increased costs.

ii) Costs Associated with Holding Stock:

- Storage Costs:

These include the costs of warehousing, such as rent, utilities, and security, as well as the cost of maintaining the physical condition of the inventory. - Obsolescence Costs:

There is a risk that inventory may become outdated or obsolete before it is sold, particularly for products with short life cycles. - Opportunity Costs:

Funds tied up in inventory could have been used elsewhere in the business, such as for investment opportunities or to reduce debt. The cost of capital represents the opportunity cost of holding inventory.

- Tags: Credit Policy, Inventory Costs, Liquidity, Profitability, Working Capital

- Level: Level 2

- Topic: Inventory Management, Working Capital Management

- Series: NOV 2019

- Uploader: Theophilus