- 15 Marks

Question

The Gomoa Chemical Limited has a capital budget for 2018 of GH¢1,000,000. The following capital investment proposals are submitted to the capital budget committee:

| PROJECT | PROFITABILITY INDEX | OUTLAY |

|---|---|---|

| 1 | 1.2 | 200,000 |

| 2 | 1.18 | 200,000 |

| 3 | 1.17 | 100,000 |

| 4 | 1.10 | 300,000 |

| 5 | 1.15 | 200,000 |

| 6 | 1.13 | 200,000 |

| 7 | 1.19 | 400,000 |

| 8 | 1.21 | 100,000 |

| 9 | 1.22 | 100,000 |

| 10 | 1.16 | 100,000 |

The company’s cost of capital is 5%. Projects 2 and 8 are mutually exclusive: Projects 1 and 5 are mutually dependent.

Required:

As the chairman of the budget committee, which projects should the committee choose? (15 marks)

Answer

To determine which projects should be selected, the following analysis can be performed:

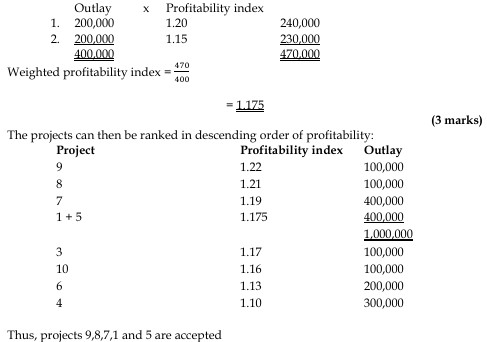

Identify Mutually Exclusive Projects:

- Projects 2 and 8 are mutually exclusive. We should select the one with the higher profitability index (PI).

- Project 8 has a PI of 1.21, while Project 2 has a PI of 1.18. Therefore, Project 8 should be selected.

Identify Mutually Dependent Projects:

- Projects 1 and 5 are mutually dependent, meaning both must be selected together or rejected together. The combined profitability index for these projects should be calculated:

- Combined Outlay = 200,000 + 200,000 = 400,000

- Combined Profitability Index = (1.2 × 200,000 + 1.15 × 200,000) / 400,000 = (240,000 + 230,000) / 400,000 = 470,000 / 400,000 = 1.175

Thus

- Tags: Capital Budgeting, Profitability Index, Project Selection

- Level: Level 2

- Topic: Capital rationing

- Series: NOV 2017

- Uploader: Theophilus