- 10 Marks

Question

The draft statement of financial position of Tinkong Ltd as at December 31, 2023, depicts the following:

| Description | GH¢ |

|---|---|

| Plant and Machinery – Cost | 4,954,824 |

| Less: Accumulated Depreciation | 1,917,016 |

| Net Book Value | 3,037,808 |

On reviewing the accounts of the business, its auditor found that the records have been correctly recorded except for the following events:

- On January 17, 2023, a contract was signed for the purchase of a machine for GH¢450,000 which is to be delivered on July 17, 2024. The company made an advance payment of GH¢180,000 on signing of the contract and the balance was to be paid on delivery of the machine. The advance payment was debited to the plant and machinery account.

- The cost of a new plant amounting to GH¢1,080,000 was acquired on January 21, 2023, and debited to the plant and machinery account. However, the cost of installation amounting to GH¢120,000 was debited to the repairs account.

Depreciation is charged on a reducing balance method at 10% per annum. Depreciation on new assets commences in the month in which the asset is acquired.

Required:

Prepare the following accounts indicating the closing balances as at December 31, 2023: i) Plant and Machinery

ii) Accumulated Depreciation – Plant and Machinery

Answer

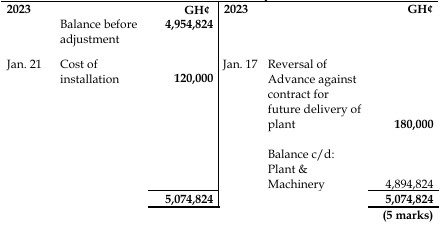

i) Plant and Machinery Account

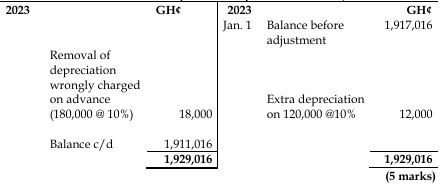

ii) Accumulated Depreciation – Plant and Machinery Account

- Topic: Non-current assets and depreciation

- Series: MAR 2024

- Uploader: Theophilus