- 10 Marks

Question

The following details were taken from the records of Pramso Ltd for the year ended 31 December 2022:

i) Tangible non-current assets (at cost) as at 1 January 2022 were:

| Description | Amount (GHȼ) |

|---|---|

| Land and buildings (Land GHȼ400,000) | 700,000 |

| Motor vehicles | 450,000 |

| Machinery | 310,000 |

ii) Accumulated depreciation as at 1 January 2022:

| Description | Amount (GHȼ) |

|---|---|

| Land and buildings | 85,000 |

| Motor vehicles | 210,000 |

| Machinery | 80,000 |

Pramso Ltd depreciates non-current assets as follows:

- Buildings – 4% per annum on cost.

- Motor Vehicles – 20% per annum using reducing balance method.

- Machinery – 15% per annum on cost. Depreciation is charged for each month of ownership for all the assets.

iii) On 1 July 2022, land was revalued by an expert to GHȼ520,000.

iv) A Motor Vehicle purchased on 1 January 2020 for GHȼ22,000 was sold for GHȼ6,000 on 1 April 2022.

v) Machinery purchased on 1 July 2020 for GHȼ70,000 was sold on 1 January 2022 for GHȼ24,000.

vi) During the year the following assets were bought:

- Machinery GHȼ24,000 on 1 July 2022.

- Motor vehicles GHȼ40,000 on 1 October 2022.

Required:

Prepare the Non-Current Assets account and Accumulated Depreciation account showing the depreciation charge for the year. (10 marks)

Answer

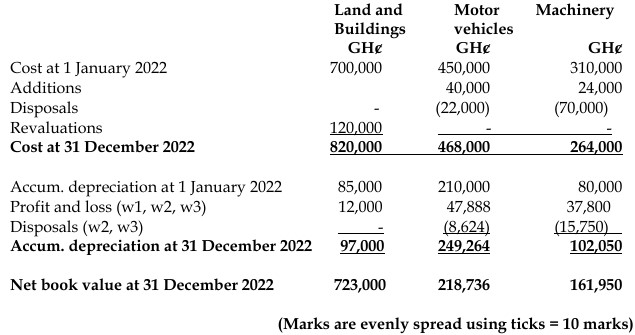

Pramso Ltd – Schedule of Non-Current Assets for the year ended 31 December 2022

1. Depreciation of buildings charged to profit and loss account:

(700,000 – 400,000) x 4% = 12,000

2. Accumulated depreciation of motor vehicle disposed of:

22,000 x 20% + (22,000 – 4,400) x 20% + (22,000 – 4,400 – 3,520) x 20% x 3/12 = 4,400 +

3,520 + 704 = 8,624.

3. Accumulated depreciation of machinery disposed of:

70,000 x 15% x 6/12 + 70,000 x 15% = 5,250 + 10,500 = 15,750.

4. Depreciation of motor vehicle charged to profit and loss account:

(428,000 – (210,000 – 7,920)) x 20% + (22,000 – 7,920) x 20% x 3/12 + 40,000 x 20% x

3/12 = 45,184 + 704 + 2,000 = 47,888.

5. Depreciation of machinery charged to profit and loss account:

(310,000 – 70,000) x 15% + 24,000 x 15% x 6/12 = 36,000 + 1,800 = 37,800

- Topic: Non-current assets and depreciation

- Series: NOV 2023

- Uploader: Theophilus