- 20 Marks

Question

a) Distinguish between capital expenditure and revenue expenditure. (5 marks)

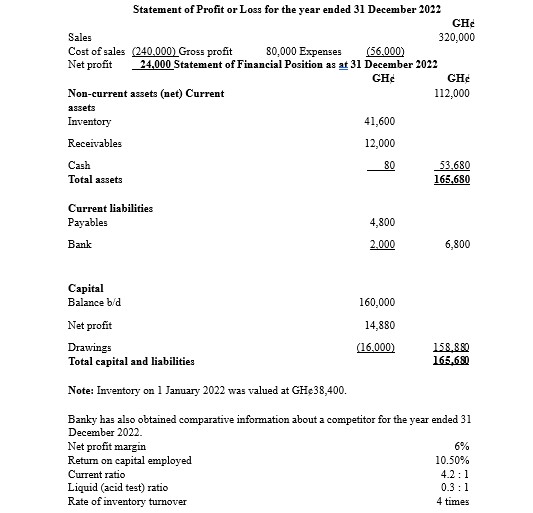

b) Banky is the owner of a business supplying goods to other traders. He has just received the financial statement for his business for the year ended 31 December 2022 from his accountant. Below are the summarized financial statements:

Required:

i) Calculate for Banky each of the following ratios for the year ended 31 December 2022 (where appropriate, calculations should be approximated to two decimal places):

- Net profit margin. (2 marks)

- Return on capital employed (using the closing year-end value for capital employed) (2 marks)

- Current ratio. (2 marks)

- Liquid (acid test) ratio. (2 marks)

- Rate of inventory turnover. (2 marks)

ii) Based on the ratios calculated in i) above, and all other information provided, assess the performance (profitability) of Banky’s business. (5 marks)

Answer

a) Distinction between Capital Expenditure and Revenue Expenditure:

Capital Expenditure:

- It is expenditure which results in the acquisition of non-current assets or an improvement in their earning capacity.

- Capital expenditure is not charged as an expense in the statement of profit or loss at one go but rather a depreciation or amortization charge will usually be made to write off the capital expenditure gradually over time.

- Capital expenditure on non-current assets is the recognition of a non-current asset (e.g., vehicles, land, and buildings) in the statement of financial position of the business.

Revenue Expenditure:

- It is expenditure which is incurred for either:

- The purpose of the trade/service of the business. This includes selling & distribution expenses, administration expenses, and finance charges.

- To maintain the existing earning capacity of non-current assets (such as repair expenses).

- To ensure the smooth running of the day-to-day activities of the company/business.

(5 marks)

b)

i) Computed ratios

Net Profit As A Percentage Of Sales (14,880/324,000) = 4.65%

Return On Capital Employed (24,000/158,880) = 15.11%

Current Ratio (53,680/6,800) = 7.89:1

Liquid (Acid Test) Ratio (12,080/6,800) = 1.78:1

Rate Of Inventory Turnover (240,000/41,600) = 6 times

(2 marks each = 10 marks)

ii) Assessment of Banky’s Business Performance:

- Net Profit Margin: The net profit margin of 4.65% is lower than the competitor’s 6%. This may indicate that Banky’s costs are higher or that he is not marking up his purchases as much as the competitor.

- Return on Capital Employed (ROCE): Banky’s ROCE of 15.11% is better than the competitor’s 10.50%, meaning that Banky is making more profit per cedi of investment in the company.

- Current Ratio: Banky’s current ratio of 7.89:1 is extremely high, indicating excessive liquidity, which might suggest inefficient use of resources. The competitor’s ratio is also high, but closer to the accepted standard.

- Acid Test Ratio: Banky’s acid test ratio of 1.78:1 is within acceptable limits, indicating good liquidity management, whereas the competitor’s ratio of 0.3:1 suggests potential liquidity issues.

- Inventory Turnover: Banky’s inventory turnover rate of 6 times is better than the competitor’s, indicating that Banky is selling inventory more frequently, which contributes positively to profitability.

(5 marks)

- Tags: Capital Expenditure, Financial Ratios, Liquidity, Profitability, Revenue Expenditure

- Level: Level 1

- Uploader: Theophilus