- 20 Marks

Question

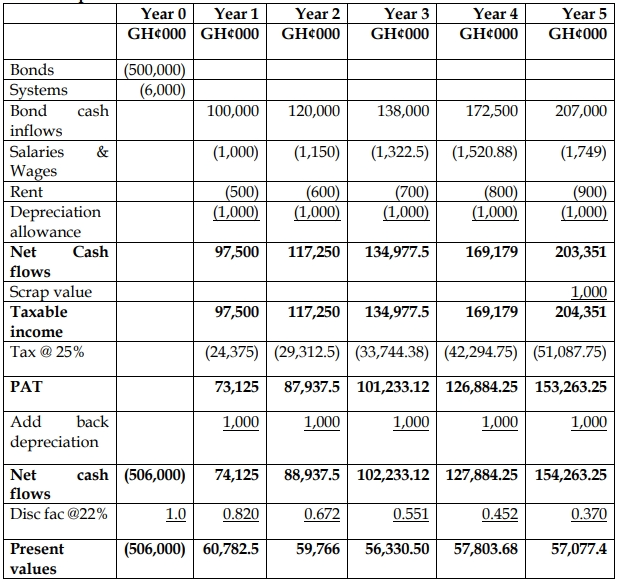

a) Toolo Ghana Ltd was recently formed as a special purpose vehicle (SPV) to provide a secondary market for investors involved in the domestic debt exchange programme who want to sell off their holdings for immediate cash.

The SPV was embarking on this special initiative as a one-off project; The company in year zero will acquire a total of GH¢500 million worth of bonds from investors and pay for all at the same time for cash.

Based on the projections, the expected cash inflows from the bonds are as follows:

- Year 1 = GH¢100 million

- Year 2 = Year 1 cash flows + 20% increase

- Year 3 = Year 2 cash flows + 15% increase

- Year 4 = Year 3 cash flows + 25% increase

- Year 5 = Year 4 cash flows + 20% increase

A special investment in systems and software, computers and other fixed assets is GH¢6 million in year zero and tax deductible depreciation is on a straight-line basis with a scrap value of GH¢1 million. Salaries and wages and other administrative expenses will be GH¢1 million in year 1 and grow at 15% per annum on the previous year’s figure. Rent is also determined at GH¢0.5 million in year 1 and growing by GH¢100,000 each year.

The internal cost of capital is 22% whilst corporate tax rate is 25%.

Required:

i) Calculate the Net Present Value (NPV) of this project and advise whether Toolo Ltd should embark on the project.

(12 marks)

ii) Explain TWO (2) reasons why NPV is preferred to payback period.

(3 marks)

b) Soso Ghana Ltd is considering investing in project Sankofa which has been appraised to have an expected return of 25% per annum. The project’s beta is 1.9 and the risk-free interest rate is 14% per annum, which is 9% below the average return on equity stocks on the market.

Required:

Calculate the required return on project Sankofa and advise Soso Ghana Ltd whether it should invest in the project.

(5 marks)

Answer

NPV = (506,000)+291,760 = (214239.9)

Decision: NPV is negative and the initiative should not be accepted.

ii) Reasons why NPV is preferred to payback period

- Considers time value of money

- considers only cash flows and not profit

- Considers cash flows after payback period

- Shows magnitude increase in shareholder value

b) Computation of RRR

Expected return = 25%

Return (r ) = rf + B(Rm – rf)

Rf = 14%

B=1.9

Rm = 14% +9% = 23%

r = 14% + 1.9 (23% -14%)

= 31.1%

Decision: Since the required return of 31.1% is higher than the expected return of

25% for project Sankofa, the project should be avoided.

- Tags: Capital Budgeting, Investment Decision, NPV Calculation, Payback Period

- Level: Level 2

- Topic: Introduction to Investment Appraisal

- Series: MAR 2024

- Uploader: Joseph