- 20 Marks

Question

Vemso Oil Ltd has been in business for the past ten years. The following trial balance was extracted from the books of Vemso Oil Ltd for the year ended 31 December 2021:

| Account | GH¢’000 | GH¢’000 |

|---|---|---|

| Bank | 46,200 | |

| Trade Payable | 25,000 | |

| Petty Cash | 4,000 | |

| Directors’ Current Account | 320,000 | |

| Computer and Accessories | 8,370 | |

| Computer and Accessories: Accumulated Depreciation | 3,348 | |

| Furniture and Fittings | 10,255 | |

| Furniture and Fittings: Accumulated Depreciation | 2,050 | |

| Land and Building | 214,000 | |

| Land and Building: Accumulated Depreciation | 8,560 | |

| Office Equipment | 12,250 | |

| Office Equipment: Accumulated Depreciation | 2,450 | |

| Plant and Machinery | 239,400 | |

| Plant and Machinery: Accumulated Depreciation | 47,880 | |

| Inventory | 1,900 | |

| Staff Loan | 5,088 | |

| Payroll Liabilities | 550 | |

| Taxation | 3,003 | |

| Retained Earnings | 49,282 | |

| Share Capital | 10,000 | |

| Sales | 574,145 | |

| Purchases | 355,000 | |

| Bank Service Charges | 1,300 | |

| Business Promotion | 1,500 | |

| Communication | 1,900 | |

| Insurance | 1,660 | |

| Licenses and Permits | 6,650 | |

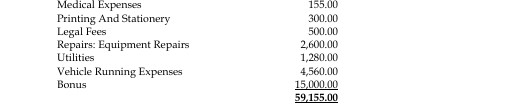

| Medical expenses | 155 | |

| Printing and Stationery | 300 | |

| Professional Fees: Legal Fees | 500 | |

| Repairs: Equipment Repairs | 2,600 | |

| Salaries | 23,050 | |

| Electricity | 780 | |

| Water | 280 | |

| Vehicle Running Expense | 4,560 | |

| Totals | 993,983 | 993,983 |

Additional information:

i) Closing inventory as at December 2021 amounts to GH¢48,500,000.

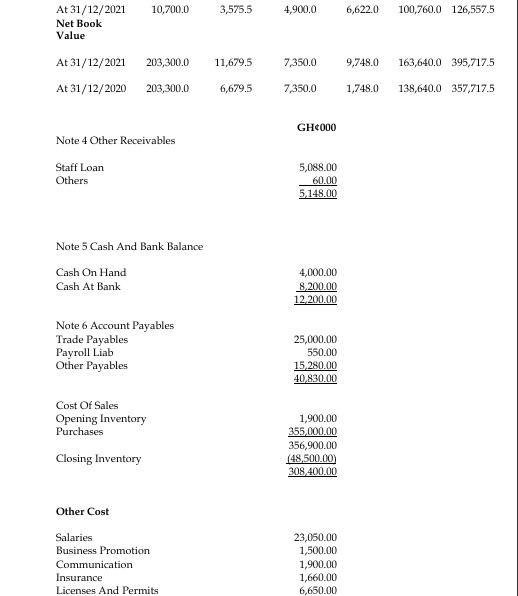

ii) The following assets were bought during the year 2021. However, this transaction was not recorded in the above trial balance:

- Computer and Accessories: GH¢8,000,000

- Fixtures and Fittings: GH¢5,000,000

- Plant and Machinery: GH¢25,000,000

iii) The following are the rates of depreciation being used by the company, however, depreciation for 2021 is yet to be charged: - Land and Building: 1%

- Computer and Accessories: 20%

- Furniture and Fittings: 10%

- Plant and Machinery: 20%

- Office Equipment: 20%

iv) Electricity stated in the trial balance includes January 2022 electricity bill, while that of water represents six months’ payment for the year 2021.

v) Staff bonus amounting to GH¢15,000,000 was agreed on 31 December 2021 for staff. However, it was paid after the year-end.

Required:

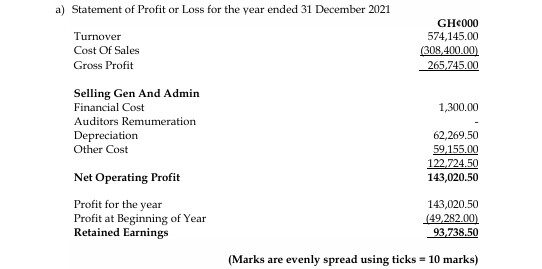

a) Prepare the Statement of Profit or Loss for the year ended 31 December 2021. (10 marks)

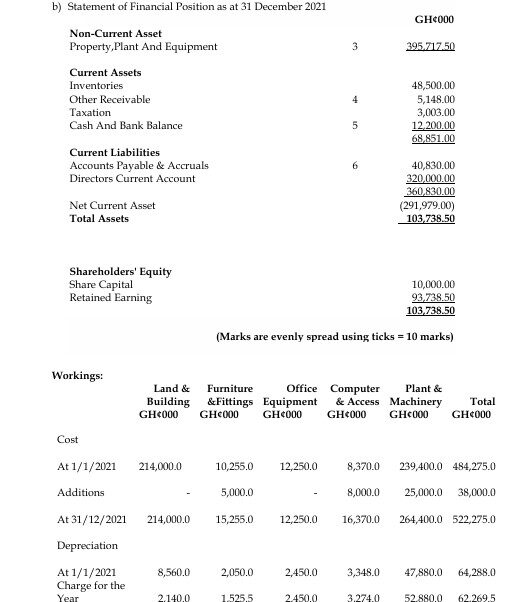

b) Prepare the Statement of Financial Position as at 31 December 2021. (10 marks)

Answer

- Uploader: Theophilus