- 15 Marks

Question

a) The directors of Clear Tel Ltd, a private telecommunication company, are considering a proposed resolution for converting the company to a public company and listing its equity stock on the stock exchange. The directors expect that the stock market listing can enhance Clear Tel’s ability to raise large amounts of capital from the public. However, they fear that stock market inefficiencies could have a negative effect on the price of Clear Tel’s equity stock.

Required:

Explain the THREE degrees of stock market efficiency, and how the price of Clear Tel is expected to move in each case.

(6 marks)

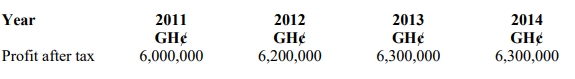

b) Restwell Ltd, a hotel leisure company, is currently considering taking over a smaller private limited company, Staygood Ltd. The board of Restwell is in the process of making a bid for Staygood, but first needs to place a value on the company. Restwell has gathered the following data:

The company’s earnings yield is 12%.

Required:

i) As a Finance Manager, calculate the value of the company based on the present value of expected earnings.

(6 marks)

ii) Explain THREE problems associated with using the P/E method for valuing firms.

(3 marks)

Answer

a) The Three Basic Forms of the EMH

The efficient market hypothesis assumes that markets are efficient. However, the

efficient market hypothesis (EMH) can be categorized into three basic levels:

Weak-Form EMH

The weak-form EMH implies that the market is efficient, reflecting all market

information. This hypothesis assumes that the rates of return on the market

should be independent; past rates of return have no effect on future rates. In this

event that the stock market has weak-form efficiency, the price of Clear Tel will

move in line with historical changes.

Semi-Strong EMH

The semi-strong form EMH implies that the market is efficient, reflecting all

publicly available information. This hypothesis assumes that stocks adjust

quickly to absorb new information. The semi-strong form EMH also incorporates

the weak-form hypothesis. Given the assumption that stock prices reflect all new

available information and Clear Tel purchase stocks after this information is

released, Clear Tel cannot benefit over and above the market by trading on new

information.

Strong-Form EMH

The strong-form EMH implies that the market is efficient: it reflects all

information both public and private, building and incorporating the weak-form

EMH and the semi-strong form EMH. Given the assumption that stock prices

reflect all information (public as well as private) Clear Tel would not be able to

profit above the average investor even if he was given new information.

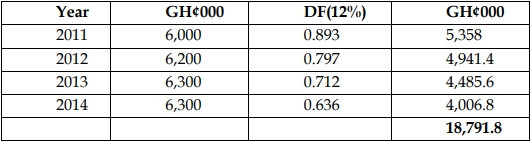

b) Restwell Ltd

The value of the company based on the present value of expected earnings is

GH¢18,791,800.

ii) Problems associated with P/E method for valuing firms

- Doesn’t account for growth- The price to earnings ratio doesn’t account for any

type of growth or the lack of growth. The fact that growth isn’t factored in means

that older more mature stocks are typically going to appear cheaper even if they

aren’t growing if you use the P/E ratio. For many investors growth is a variable

they do not want to exclude. - Backward looking- The P/E ratio is actually a backward looking indicator if you

use the company’s most recent full year earnings number. A backward looking

number can be of very little help to the investor during a period where economic

conditions have changed significantly in a short period of time. - Quality of earnings not considered- The last several months have been the

perfect example of how a company can really inflate their earnings to look better

than they really are. Many banks were able to do this for months, and because of

that investors that solely used the P/E ratio would have thought they were great

buys. In retrospect if the investor had been looking at other parts of the balance

sheet they may have seen inflated earnings as a real issue. - The Price doesn’t consider debt- Companies with major debt issues are

obviously higher risk investments, but the P in the P/E ratio only considers the

equity price and does nothing with the debt that the business has to continue

with operations. As we have found out over time, excess debt can be a real

problem, and the market price of a stock isn’t always a good gauge of fair value. - Uses profit which is not cash

- Tags: Business Valuation, Earnings Yield, Efficient Market Hypothesis, P/E Ratio, Stock Market

- Level: Level 2

- Topic: Business valuations

- Series: MAY 2019

- Uploader: Joseph