- 25 Marks

Question

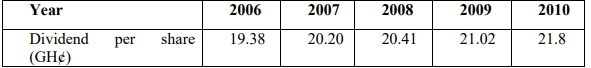

a) The Finance Director of Vista Hotel has heard that the market value of the company will increase if the weighted average cost of capital of the company is decreased. The company, which is listed on a stock exchange, has 100 million shares in issue and the current ex-div ordinary share price is GH¢2.50 per share. Vista Hotel also has in issue bonds with a book value of GH¢60 million and their current ex-interest market price is GH¢104 per GH¢100 bond. The current after-tax cost of debt of Vista Hotel is 7% and the tax rate is 30%. The recent dividends per share of the company are as follows:

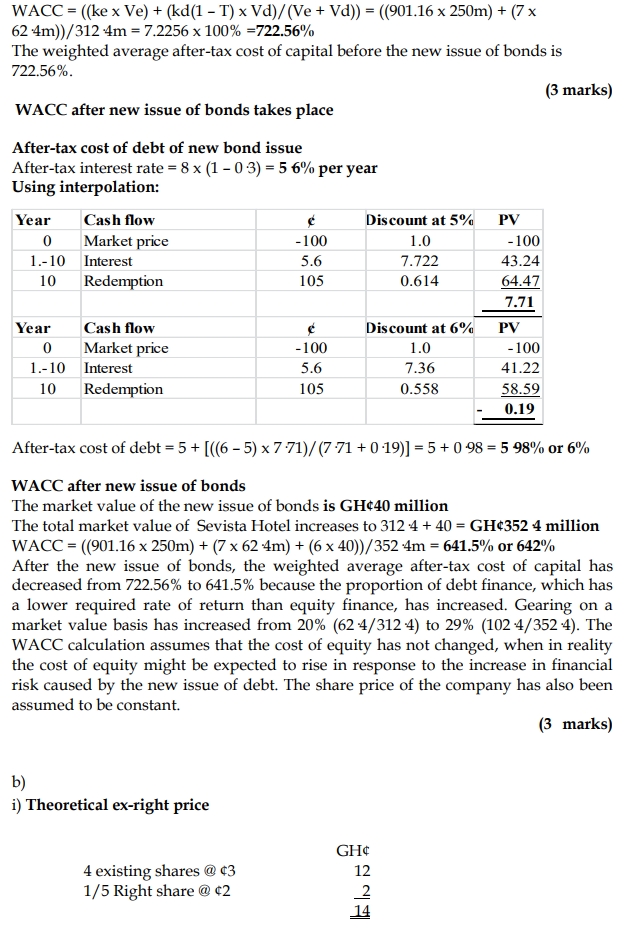

The Finance Director proposes to decrease the weighted average cost of capital of Vista Hotel and hence increase its market value by issuing GH¢40 million of bonds at their par value of GH¢100 per bond. These bonds would pay annual interest of 8% before tax and would be redeemed at a 5% premium to par after 10 years.

Required:

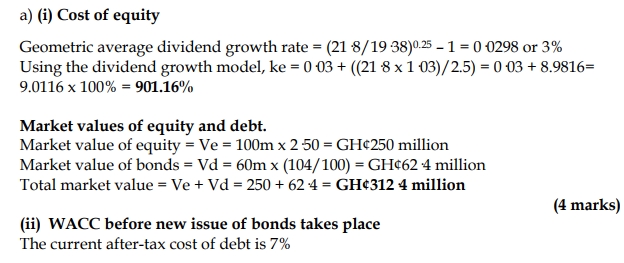

i) Determine the cost of equity capital of the company.

(4 marks)

ii) Calculate the weighted average cost of capital of Vista Hotel in the following circumstances:

- Before the new issue of bonds takes place;

(3 marks) - After the new issue of bonds takes place.

(3 marks)

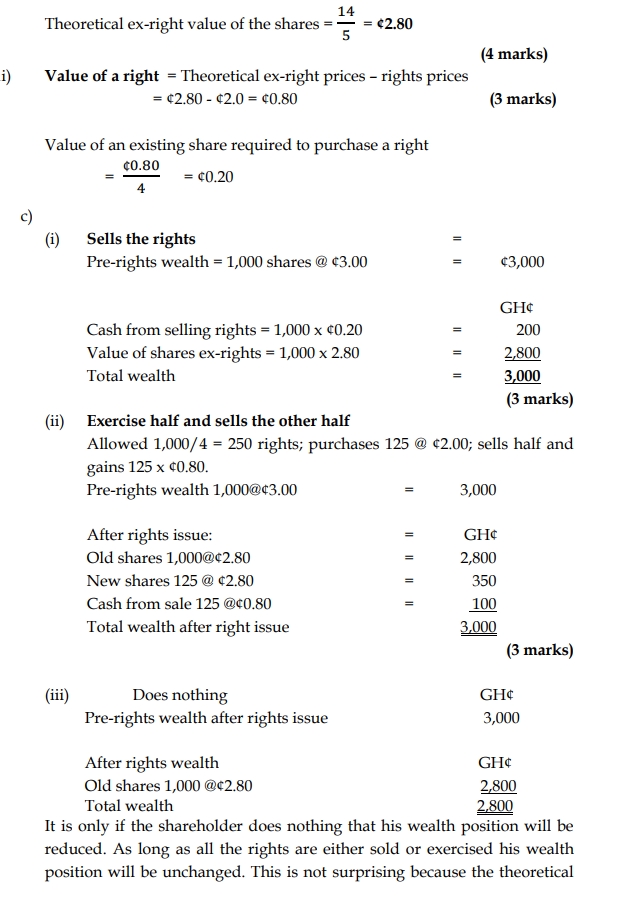

b) The Moorgate Company has issued 100,000 GH¢1 par equity shares which are at present selling for GH¢3.00 per share. It has also issued 50,000 warrants, each entitling the holder to buy one equity share. The warrants are protected against dilution. The company has plans to issue rights to purchase one new equity share at a price of GH¢2 per share for every four shares.

Required:

i) Calculate the theoretical ex-rights price of Moorgate’s equity shares.

(4 marks)

ii) Calculate the theoretical value of a Moorgate right, before the shares sell ex-rights.

(3 marks)

c) The chairman of the company receives a phone call from an angry shareholder who owns 1,000 shares. The shareholder argues that he will suffer a loss in his personal wealth due to this rights issue because the new shares are being offered at a price lower than the current market value.

The chairman assures him that his wealth will not be reduced because of the rights issue, as long as the shareholder takes appropriate action.

Required:

Prepare a statement showing the effects of the right issue on this particular shareholder’s wealth, assuming:

i) He sells all the rights.

(3 marks)

ii) He exercises one half of the rights and sells the other.

(3 marks)

iii) He does nothing.

(2 marks)

Answer

ex-rights price has been calculated as a weighted average of the old price

and the price of the right.

(2 marks)

- Topic: Cost of capital

- Series: MAY 2018

- Uploader: Joseph