- 15 Marks

Question

ASANTA Ghana Ltd is considering investing in the following projects which are considered mutually exclusive:

| PROJECT GO | PROJECT COME | |

|---|---|---|

| Annual cash inflows | GH¢1,000,000 | GH¢2,000,000 |

| Cost of Machine | GH¢2,500,000 | GH¢6,000,000 |

| Scrap value of Machine | GH¢250,000 | GH¢1,000,000 |

| Expected life of the Project | 5 years | 5 years |

ASANTA Ghana Ltd uses the straight line method of depreciation. However, tax-allowable depreciation is 30% on a straight-line basis. The cost of capital for the company is 20% per annum.

Required:

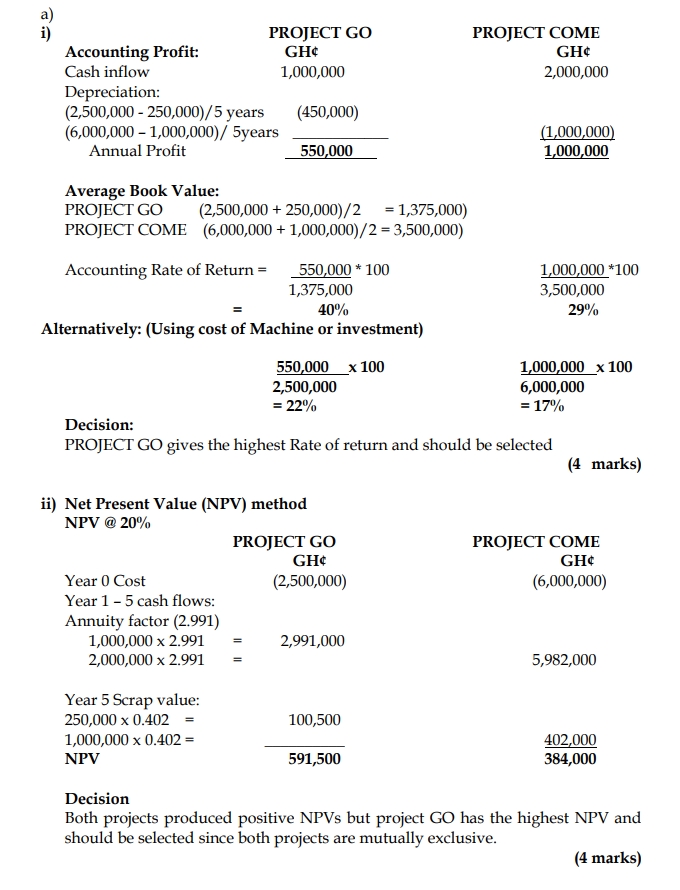

- Calculate the Accounting Rate of Return (ARR) for each project. (4 marks)

- Calculate the Net Present Value (NPV) for each project. (4 marks)

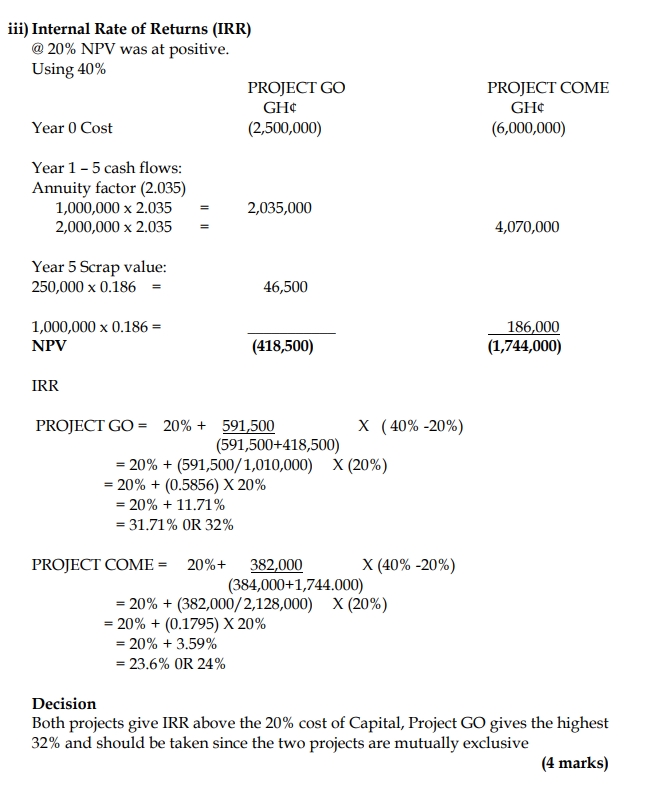

- Compute the Internal Rate of Return (IRR) for each project. (4 marks)

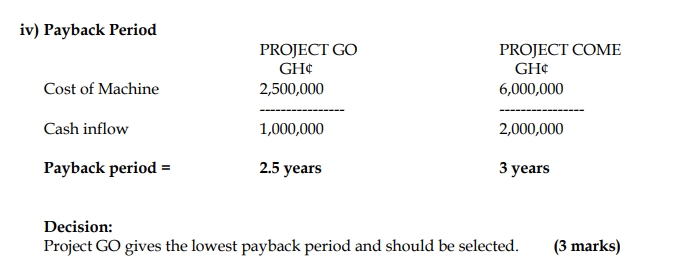

- Compute the Payback period for each project. (3 marks)

(Note: In each of the above, advise the Company on which of the projects to implement or undertake.)

Answer

- Topic: Introduction to Investment Appraisal

- Series: MAY 2019

- Uploader: Joseph