- 20 Marks

Question

a) On 15 October 2019, Mr. Ladzagla received his bank statement for the month ended 30 September 2019. The statement showed a balance of GH¢208,700 (overdraft) as at 30 September, while the cash book showed a balance of GH¢262,995 (credit) as at that date.

On examination of the cash book and the bank statement, the following were discovered:

i) Mr. Ladzagla exceeded his overdraft limit during the month of September. The bank had therefore charged him a penalty of GH¢1,250. This has not been effected in the cash book.

ii) A sum of GH¢6,250 had been credited to Ladzagla’s bank account in error by the bank.

iii) Bank charges of GH¢1,005 had not been recorded in the cash book.

iv) A cheque for GH¢6,150 had been returned by the bank as dishonoured. Due to the dishonoured cheque, the bank charged Ladzagla GH¢75. Both the dishonoured cheque and the fee charged have not been effected in the cash book.

v) Cash receipts of GH¢18,700 were posted as cash payment of GH¢23,650 in the cash book.

vi) On 21 September, Mr. Ladzagla lodged cash of GH¢3,250 to his personal bank account. This was lodged into the business bank account in error by the bank.

vii) Standing order and direct debits of GH¢5,575 had not been posted to the cash book.

viii) Payment of GH¢10,850 received from customers had been lodged in the bank account but is yet to be posted to the cash book.

ix) Lodgements of GH¢25,600 to bank on 30 September 2019 had not been credited by the bank.

x) The following cheques drawn on the bank accounts had not been presented to the bank for payment as at 30 September 2019:

| Cheque Number | Date cheque was written | Amount (GH¢) |

|---|---|---|

| No. 3528 | 11 September 2019 | 4,200 |

| No. 3535 | 28 September 2019 | 8,700 |

| No. 3557 | 30 September 2019 | 18,350 |

Required:

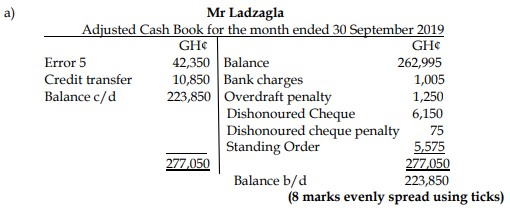

i) Prepare the adjusted cash book for the month of September 2019. (8 marks)

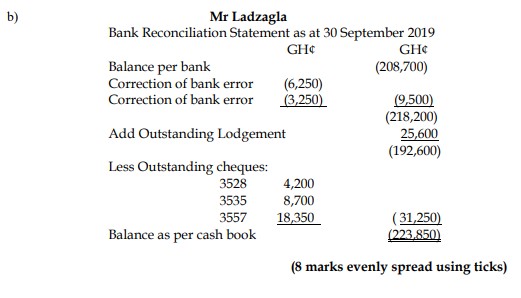

ii) Prepare a statement on 30 September 2019 reconciling the adjusted cash book with the bank statement balance. (8 marks)

iii) State TWO (2) reasons for preparing bank reconciliation on a regular basis. (4 marks)

Answer

c) Reasons for Preparing Bank Reconciliation on a Regular Basis

- Identification of Errors: Preparing bank reconciliations regularly helps in identifying errors made by the bank, the company, or both. For example, a business may have omitted to post receipts from receivables.

- Account for Unrecorded Transactions: Items such as bank interest, charges, standing orders, direct debits, and dishonoured cheques are often known by the bank but not identified by a business until it receives the bank statement and prepares the bank reconciliation.

(2 points well explained for 4 marks)

- Tags: Bank Reconciliation, Cash Book, Errors, Financial Statements

- Level: Level 1

- Topic: Bank reconciliations, Correction of errors

- Series: MAY 2020

- Uploader: Theophilus