- 20 Marks

Question

a) Write a short note to a client explaining the following issues:

i) Outline the differences between Cost and Management Accounting and Financial Accounting. (3 marks)

ii) Explain FOUR (4) roles of an Accountant in an organization. (4 marks)

iii) Outline SIX (6) key information provided by a Statement of Profit or Loss and Other Comprehensive Income and the Statement of Financial Position. (3 marks)

b) At 1 July 2017, the following information was extracted from the books of Tansah Ltd:

Non-current assets at cost:

| Reference | Description | Amount (GH¢) |

|---|---|---|

| M1 | Machinery | 25,000 |

| E1 & E2 | Equipment | 15,400 |

| MV1 | Motor Vehicle | 18,500 |

Provision for depreciation:

| Reference | Description | Amount (GH¢) |

|---|---|---|

| M1 | Machinery | 18,500 |

| E1 & E2 | Equipment | 8,600 |

| MV1 | Motor Vehicle | 6,500 |

During the financial year ended 30 June 2018, the following transactions took place:

Purchases:

| Date | Description | Reference | Amount (GH¢) |

|---|---|---|---|

| 1 April 2018 | Machinery M2 | M2 | 10,800 |

| 1 January 2018 | Equipment E3 | E3 | 6,800 |

Disposals:

| Reference | Description | Purchase Date | Disposal Date | Original Cost (GH¢) | Sale Proceeds (GH¢) |

|---|---|---|---|---|---|

| E2 | Equipment | 1 January 2015 | 31 March 2018 | 7,200 | 6,400 |

All transactions took place through the bank account.

Depreciation rates per annum:

- Machinery: 10% straight line on cost

- Equipment: 12.5% straight line on cost

- Motor Vehicle: 15% reducing balance

Depreciation for new assets commences in the month in which the asset is acquired.

Required:

For Tansah Ltd, prepare the following ledger accounts for the year ended 30 June 2018:

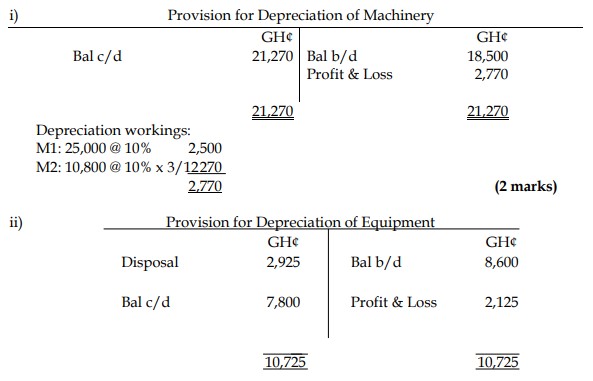

i) Provision for Depreciation of Machinery (2 marks)

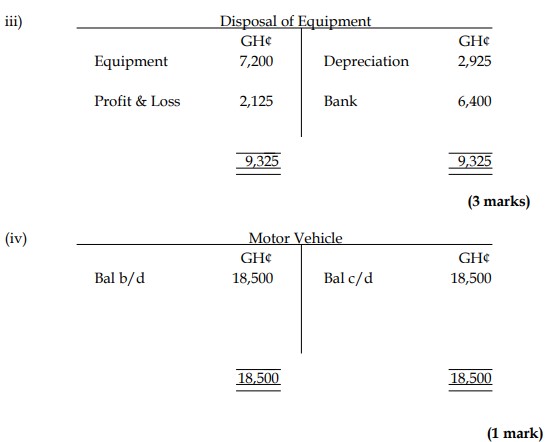

ii) Provision for Depreciation of Equipment (4 marks)

iii) Disposal of Equipment (3 marks)

iv) Motor vehicle (1 mark)

Answer

a) i) Cost and Management Accounting

This is the process of providing detailed information to management on current and

planned events. This information assists managers in their roles of planning,

controlling and making decisions. Usually management accounts are only available

to internal users of accounting information. Management accounting will contain

information such as department budgets, product profitability, information on

production costs etc.

Financial Accounting

This is the process of summarising financial information in order to prepare the

company’s financial statements. The financial statements of an organisation are the

Income Statement, Statement of Financial Position, Statement of Cash Flow and

Explanatory Notes. These statements are primarily of interest to external users of

accounting information. Financial statements are historical in nature in that they are

prepared on a semi-annual/annual basis and are concerned primarily with the

financial performance of the company in the income statement and the financial

position of the company reported in the statement of financial position. Therefore

from the perspective of management the information contained therein is not timely

being six months or a year out of date by the time it is reported. Financial accounting

is thus the manner in which an organisation communicates financial information,

namely performance, position and cash flow to the outside world. It represents a

report on the directors’ stewardship of the funds entrusted to them by the

shareholders. The financial statements are public documents they are easily

accessible. A copy of the financial statements must also be filed with the Registrar

General where they can be publicly accessed. Therefore they would not reveal

details about, for example, an individual products’ profitability. That information

would be contained in the management accounts of the business. (3 marks)

ii) The accountant’s role in the organisation can be analysed as follows:

Preparation and presentation of timely accurate financial/management accounts to

management to help management interpret the financial information.

Identification of areas of inefficiency and wastages of resources in the business.

Treasury functions: The accountant also plays the role of treasury functions in such

a way that they raise finance, cash management, etc.

Setting up an effective system of internal and accounting controls.

Preparation of feasibility reports: These reports assist management in assessing the

viability/profitability or otherwise proposed capital expenditure such as the

opening of a new factory or branch.

Investigation of the performance/operations of competing business organisations to

assist management in policy formulation.

Investigation of fraud within the organisation, this is a key role of the accountant in

preparation of an audit at year-end.

iii) Information provided by the Income Statement

The income statement is fundamentally a listing of all income and all expenses for

the year. Taking expenses from income gives the profit that the business earned for

the year. Therefore the income statement is year specific – just looking at the

accounting year or period in question.

By examining income statements year on year a business can gain information about

whether sales and expenses are increasing or decreasing and how they are moving

in relation to each other. For example in any year if sales were to fall while at the

same time expenses increase – the information would be captured in the income

statement and action could be taken.

Also the income statement divides the cost of producing/purchasing a good/service

from the cost of administration and selling expenses within the business. The

information can be useful when businesses are examining costs. (3 marks)

Information provided by the Statement of Financial Position

The statement of financial position is fundamentally a listing of all the assets of a

business and all the liabilities of a business. By subtracting these assets from

liabilities we arrive at the net worth of the business. The statement of financial

position is a snap shot pictures of a business at a point in time – usually the end of

the financial year. It is different to the income statement in this regard – the income

statement spans the full financial year.

(3 marks)

Depreciation workings:

- Disposal:

- E2: 7,200 @ 12.5% x 3 = 2,700

- E2: 7,200 @ 12.5% x 3/12 = 225

- Total Disposal Depreciation = 2,925

- Profit & Loss:

- E1: 8,200 @ 12.5% = 1,025

- E2: 7,200 @ 12.5% x 9/12 = 675

- E3: 6,800 @ 12.5% x 6/12 = 425

- Total Profit & Loss Depreciation = 2,125

- Tags: Depreciation, Disposal of assets, Financial Statements, Ledger Accounts

- Level: Level 1

- Uploader: Theophilus