- 20 Marks

Question

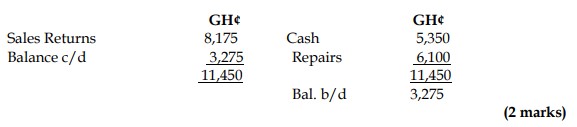

a) Nene Koba, a sole trader with a small business, extracted a trial balance as at 30 June 2018, which did not agree. The credits exceeded the debits by GH¢3,275, and the difference was entered in a suspense account.

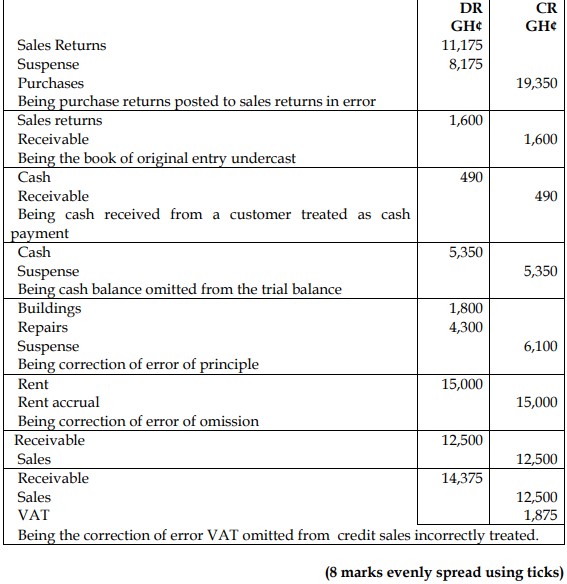

A detailed examination of the books was undertaken, and the following matters were uncovered:

- Purchases returns of GH¢19,350 were credited to sales returns as GH¢11,175, and the corresponding entry was correctly entered.

- An addition error was discovered in the sales returns day book, resulting in an understatement of GH¢1,600.

- An amount of GH¢245 cash received from a customer was debited to the customer’s account and credited to the cash account.

- The cash at hand balance of GH¢5,350 as at 30 June 2018 was omitted from the trial balance in error.

- Building repairs of GH¢4,300 were undertaken during the month ended 30 June 2018. The amount was paid by cheque, and GH¢1,800 was incorrectly credited to the building account.

- On 1 January 2017, rent for the year ended 31 December 2017 of GH¢22,500 was paid and accounted for correctly. Nene Koba’s landlord has indicated that rent for 2018 will increase to GH¢30,000, but no invoice has been received. Nene Koba, however, has not paid any rent for 2018 and has made no accounting entry for it because no invoice was received.

- A credit sale of GH¢12,500 (excluding tax) was recorded by debiting sales with GH¢12,500 and crediting receivable with GH¢12,500. The tax rate is 15%.

Required:

i) Prepare journal entries with appropriate narrations necessary to correct the above errors. (8 marks)

ii) Prepare the Suspense account. (2 marks)

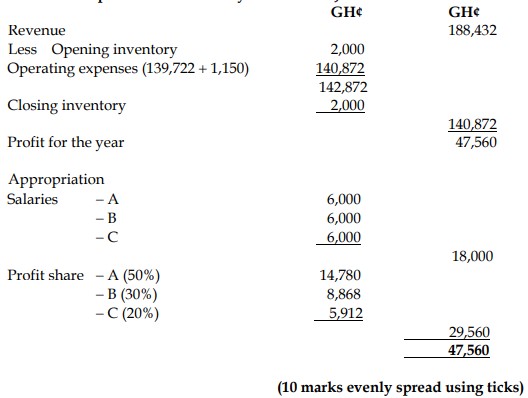

b) Ama, Baah, and Cain are in partnership, providing management services, sharing profits in the ratio 5:3:2 after charging annual salaries of GH¢6,000 each. Current accounts are not maintained. On 30 June 2019, Ama retired, and Doh was admitted into the partnership. Doh is entitled to 30% of the profits of the new partnership, with the balance being shared between Baah and Cain.

Required:

Prepare the Statement of Profit or Loss account and the Appropriation account for the year ended 30 June 2019. (10 marks)

Answer

a) Journal Entries to Correct Errors

b) Suspense Account

b) Statement of profit or loss for the year ended 30 June 2019

- Tags: Correction of Errors, Journal Entries, Sole Trader, Suspense account

- Level: Level 1

- Topic: Correction of errors

- Series: NOV 2019

- Uploader: Kwame Aikins