- 20 Marks

Question

a) The Conceptual Framework for Financial Reporting is a set of principles which underpin the foundation of financial accounting. The Conceptual Framework sets out the going concern concept as one of the important underlying assumptions for the preparation of financial statements.

Required:

Explain the going concern concept, illustrating your answer with suitable examples. (5 marks)

b) A trader who trades in computers commences business on 1 January 2018 and buys 100 computers, each costing GH¢3,500. During the year, he sells 80 machines at GH¢5,000 each.

Required:

How should the remaining machines be valued at the end of the year if:

i) He is forced to close down his business at the end of the year and the remaining machines will realize only GH¢2,000 each in a forced sale. (2 marks)

ii) He intends to continue the business into the next year. (2 marks)

c) One of the fundamental qualitative characteristics of useful financial information in the Conceptual Framework for Financial Reporting is ‘faithful representation’.

Required:

Explain what is meant by ‘faithful representation’. (5 marks)

d) Those charged with governance of a company are responsible for the preparation of the financial statements. The board of directors of a company are usually the top management in a Small and Medium Enterprise and are those who are charged with governance of the company. The responsibilities and duties of directors are usually laid down in law and are wide-ranging.

Required:

State THREE (3) responsibilities of directors towards the preparation of financial statements. (6 marks)

Answer

a) Going Concern Concept:

The financial statements are normally prepared on the assumption that an entity is a going concern and will continue in operation for the foreseeable future. Hence, it is assumed that the entity has neither the intention nor the need to liquidate or curtail materially the scale of its operations.

The main significance of the going concern concept is that the assets should not be valued at their ‘break-up’ value (the amount they would sell for if they were sold off piecemeal and the business were broken up). Example: If a company is known to be in financial difficulty and is unlikely to continue trading, then its assets should be valued at their liquidation value rather than their historical cost.

(5 marks)

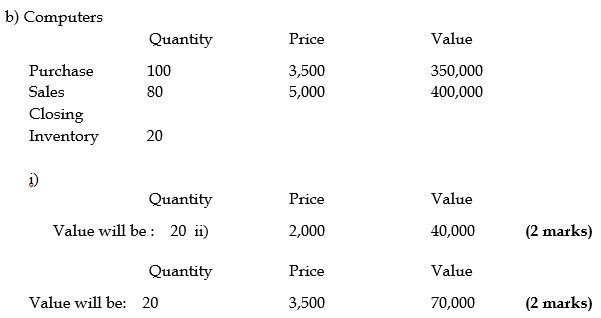

b) Inventory Valuation:

i) If the trader is forced to close down his business, the remaining machines should be valued at GH¢2,000 each, which is the realizable value in a forced sale. The value will be:

c) Faithful Representation:

Faithful representation means that financial reports should represent economic phenomena in words and numbers. To be useful, financial information must not only represent relevant phenomena but must faithfully represent the phenomena that it purports to represent.

For financial information to be considered faithfully representative, it must be complete, neutral, and free from error. A complete report includes all information necessary for the user to understand the financial information presented. Neutrality means that the information is presented without bias. Being free from error means that there are no errors or omissions in the description of the phenomena, and the process used to produce the information has been applied with no errors in the process.

(5 marks)

d) Responsibilities of Directors towards the Preparation of Financial Statements:

Directors are responsible for the preparation of the financial statements of the company. They are specifically responsible for:

- The preparation of the financial statements of the company in accordance with the applicable financial reporting framework (e.g., IFRSs).

- Ensuring that internal controls are in place to enable the preparation of financial statements that are free from material misstatement, whether due to error or fraud.

- The prevention and detection of fraud. (6 marks)

- Topic: Inventory, The IASB’s Conceptual Framework

- Series: NOV 2018

- Uploader: Theophilus