- 20 Marks

Question

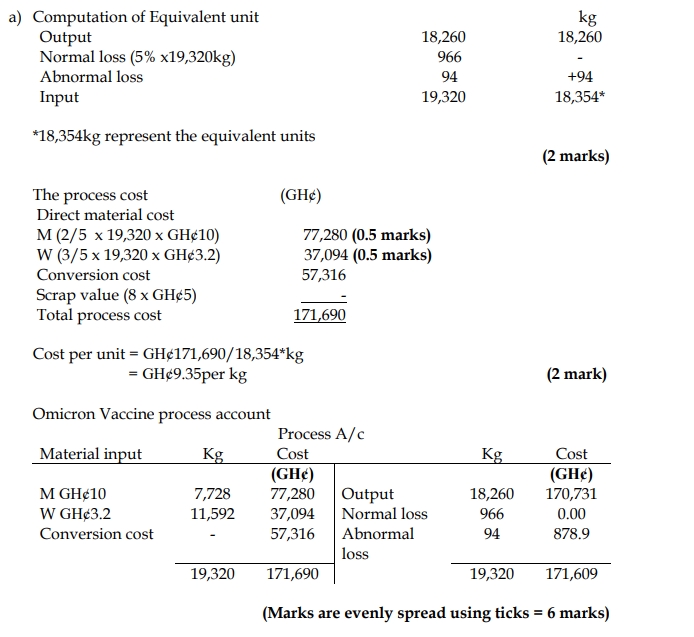

a) Adom Ltd manufactures Omicron vaccine for the treatment of COVID-19 in Africa. The manufacturing process uses two raw materials (M & W) which are mixed in the proportions (2:3). Materials are priced: M = GH¢10 per kg and W = GH¢3.2 per kg. Normal weight loss of 5% of material input is expected during the process, and material losses recorded in the manufacturing process have no saleable value. At the end of production, 18,260 kg of Omicron vaccine were manufactured from 19,320 kg of raw materials. Conversion costs in the period were GH¢57,316. There was no work in process at the beginning or end of the period.

Required:

Prepare the Process Account of the Omicron vaccine for the period. (10 marks)

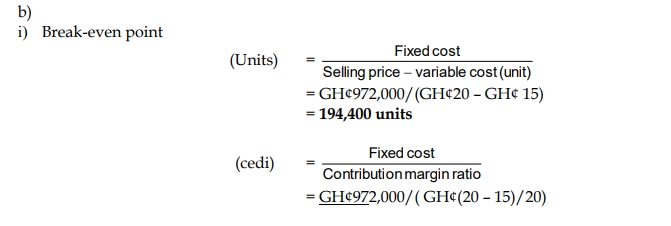

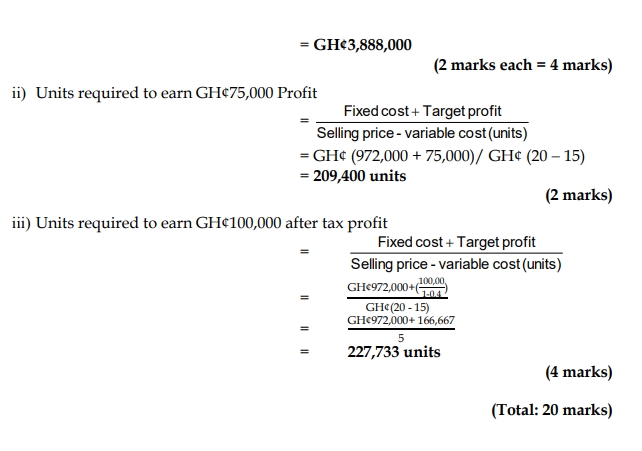

b) Manna Industries sold 150,000 units of its product at GH¢20 per unit. Variable costs are GH¢15 per unit (manufacturing cost of GH¢12 and selling expenses of GH¢3). Fixed costs are incurred uniformly throughout the year and amount to GH¢972,000, that is, manufacturing costs of GH¢600,000 and selling expenses of GH¢372,000.

Required:

i) Calculate the break-even point in units and Ghana cedis. (4 marks)

ii) Calculate the number of units that must be sold to earn an income of GH¢75,000 before income tax. (2 marks)

iii) Calculate the number of units that must be sold to earn an after-tax profit of GH¢100,000 if the income tax rate is 40%. (4 marks)

Answer

- Tags: After-tax Profit, Break-even Analysis, Process Costing, Target Profit

- Level: Level 1

- Topic: Cost-Volume-Profit (CVP) Analysis, Process Costing

- Series: JULY 2023

- Uploader: Joseph